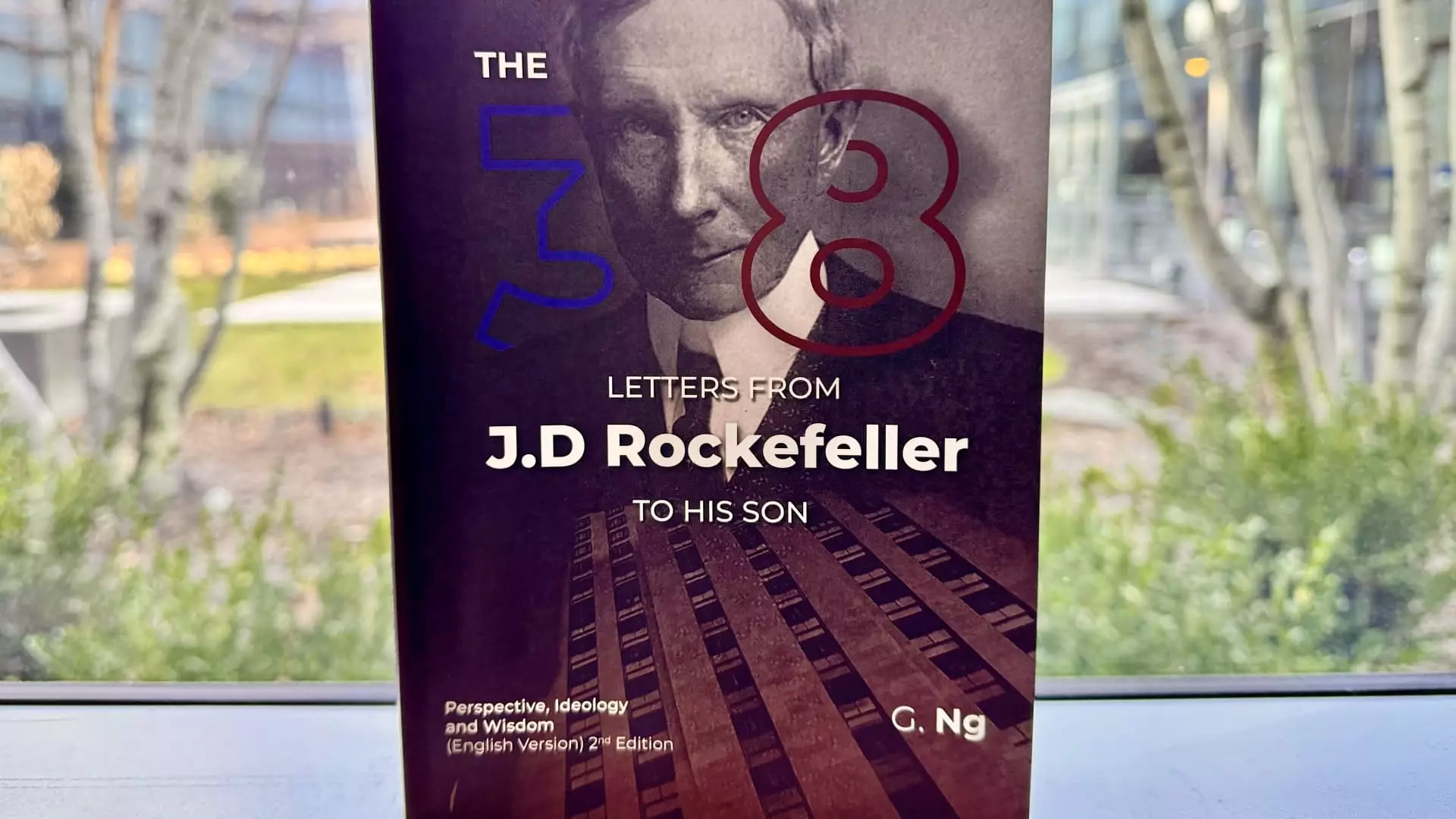

The buzz surrounding the book titled “The 38 Letters from J.D. Rockefeller to His Son: Perspective, Ideology and Wisdom” raises numerous intriguing questions that delve into authenticity, authorship, and the nature of modern publishing. This work, attributed to John D. Rockefeller Sr., is being sold on platforms like Amazon and Barnes & Noble, yet it has become the center of controversy due to its questionable origins. CNBC’s investigation reveals inconsistencies in the book’s content and raises the specter of a broader issue regarding the credibility of self-help literature in today’s market. Despite being perched near the top of the best-seller list for economic history books, this title is riddled with factual inaccuracies, leading one to wonder if readers are being misled by its very presentation.

The Rockefeller Archive Center has cast doubt on the authenticity of this collection, asserting that they found no evidence of letters within the book matching historical records. This librarian perspective adds weight to skepticism, especially when one considers glaring errors—such as the incorrect graduation year of John D. Rockefeller Jr. and a misdated reference to Citibank, which simply did not exist at the time the letter allegedly originated. These revelations do not merely debunk the book; they raise significant questions about the standards of publication in a climate dominated by a thirst for financial wisdom encapsulated in digestible formats.

Such oversight, or perhaps neglect, poses important inquiries about how this book, seemingly brimming with insights, managed to evade thorough scrutiny by readers and reviewers for an extended period. It begs the questions: Who is truly benefiting from this book’s sales, and at what cost to the integrity of knowledge dissemination?

In a twist, OpenStax—a nonprofit publisher known for producing open educational resources—has been inadvertently swept into this controversy. Their name appears on some editions of the book, yet they vehemently denied any affiliation, indicating they are investigating the misattribution. This raises pressing concerns over the mechanisms by which educational and commercial entities protect their brands in an increasingly complicated publishing environment. As the lines between reputable scholarship and consumer-oriented literature blur, the disarray poses a potential threat not just to individual organizations but to readers seeking genuine guidance amidst a proliferation of dollar-driven publishing practices.

While Amazon and Barnes & Noble enjoy booming sales in the self-help sector, they must grapple with the implications of allowing questionable titles to proliferate. Readers’ trust, once established, is easily undermined by the appearance of misleading content that masquerades as legitimate, especially when set against the backdrop of an aging yet iconic figure like John D. Rockefeller whose legacy remains influential.

Despite the contradictions within “The 38 Letters,” the work owes its allure to the timeless fascination with the Rockefeller dynasty. As one of America’s most storied billionaires, John D. Rockefeller’s life and philosophy still command attention and reverence—even today. The Rockefeller brand continues to thrive, evidenced by the high-value auction of items once belonging to family members that fetch prices far beyond their intrinsic worth. The ongoing interest in everything Rockefeller-related demonstrates a cultural fixation with wealth, privilege, and the financial principles that supposedly drive success.

The book has, nevertheless, gathered momentum within the self-help genre, boasting an impressive average rating and hundreds of reviews. This raises concerns over how people perceive financial wisdom, with many possibly viewing the book as an authoritative source of guidance—despite the evidence pointing to its dubious legitimacy.

This controversy not only underlines the need for due diligence in personal finance literature but also invites a wider discussion about the standards of truth in publishing. When individuals turn to texts for guidance, they deserve clarity and authenticity rather than half-truths that may lead them astray in their quests for personal betterment.

With apologies to the legacy of one of history’s wealthiest figures, it falls upon modern readers, publishers, and platforms alike to ensure that wisdom is adequately vetted and that facts precede fictional idealizations. As society clamors for smart financial advice, embracing transparency and authenticity must become not just an ideal but a necessity. The narrative surrounding “The 38 Letters” serves as a cautionary tale in an evolving literary landscape where truth is as critical as the messages portrayed.