The recent announcement of Donald Trump Jr. joining the board of PSQ Holdings has sparked an incredible surge in the company’s share price, witnessing a remarkable 185% spike during Tuesday’s trading session. This significant increase not only highlights the volatile nature of microcap stocks but also underscores the influence that high-profile endorsements can exert on investor sentiment. The market reacted sharply, buoyed by optimism regarding the potential of a company that operates within the niche of conservative consumerism through its online marketplace, PublicSquare.

PublicSquare aims to carve out a unique space within the crowded e-commerce landscape by prioritizing values aligned with “life, family, and liberty.” This approach resonates strongly with a dedicated consumer base that seeks alternatives to mainstream marketplaces perceived as hostile to conservative viewpoints. As such, PublicSquare’s model has been framed as a vital component of a ‘cancel-proof’ economy, catering to consumers who value ideological alignment in their purchasing decisions. This positioning potentially explains why investors reacted so fervently to the news surrounding Trump Jr.’s board membership.

Despite the promising market momentum, it is essential to scrutinize the underlying financial performance of PSQ Holdings. For the September quarter, the company reported only $6.5 million in net revenue, alongside operating losses surpassing $14 million. These figures indicate a challenging financial landscape that could prompt caution among potential investors. While the recent stock surge might suggest bullish optimism, the disparities between revenue and losses highlight the risks associated with investing in companies that, although experiencing strong price movements, have not yet achieved sustainable profitability.

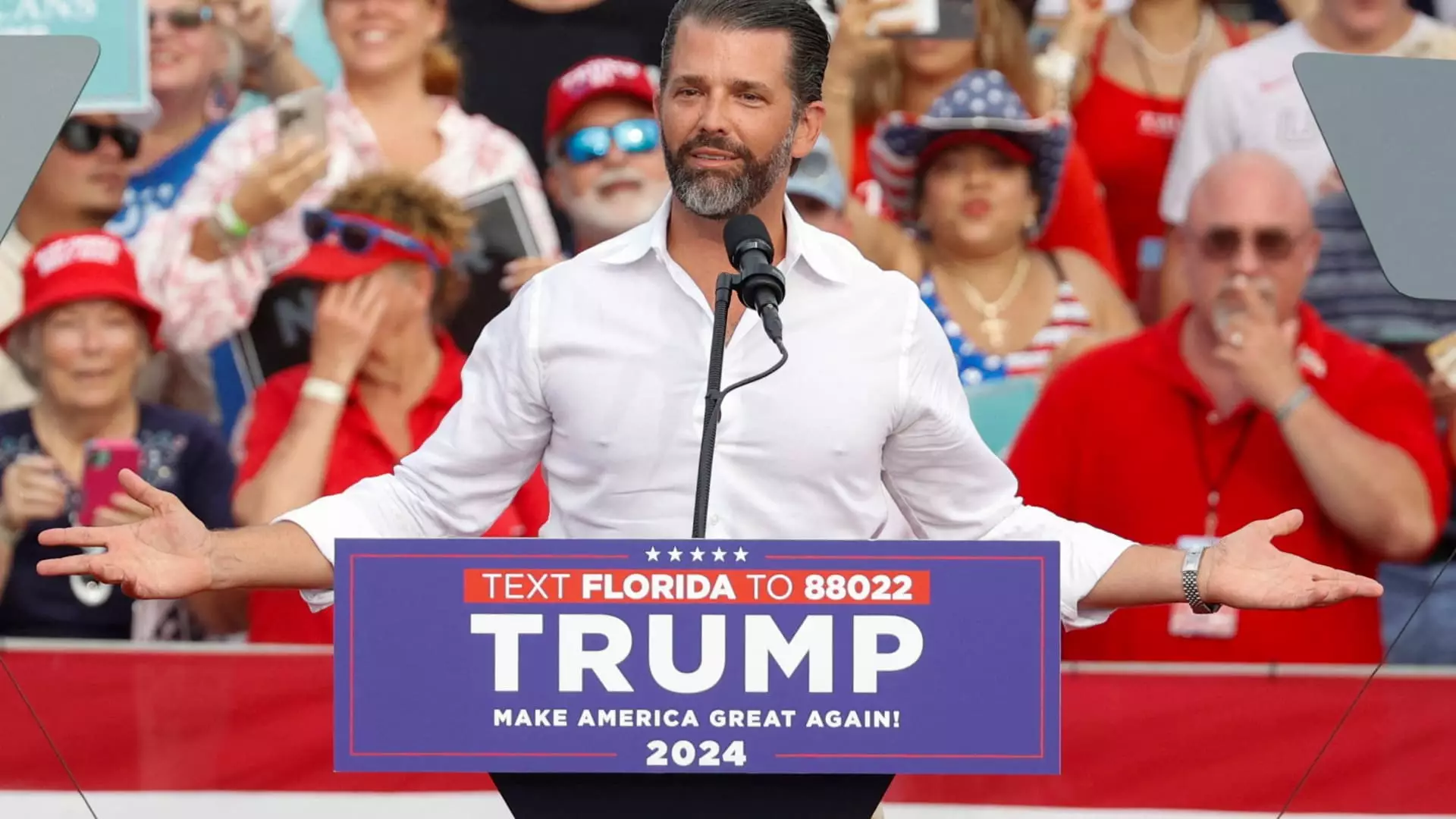

Celebrity endorsements, especially from figures with substantial political ties like Trump Jr., can lead to pronounced market fluctuations. His experience as an investor in PublicSquare prior to this appointment suggests a deep-seated belief in the company’s mission and potential. Furthermore, previous experiences, such as his involvement with Unusual Machines and 1789 Capital, signify a strategic push into sectors aimed at conservative markets. This broader trend may reflect a growing intersection of commerce and political ideology, where each investment not only has financial implications but also cultural significance.

The recent rise in stock value, buoyed by Trump Jr.’s affiliation, raises questions about the sustainability of this growth. As PSQ Holdings aligns itself with conservative ideologies, it might tap into a fervent market base; however, it also risks alienating a broader customer demographic, which could limit future expansion. The investments made by notable figures, such as former U.S. Senator Kelly Loeffler’s sizable purchase of shares, seem to indicate confidence in the company’s prospects. However, investors must remain vigilant about the company’s ability to convert its ideological appeal into fiscal success, recognizing that the volatility in stock prices following such announcements reflects a complex interplay of market psychology, institutional trust, and foundational business realities.

While the initial response to Trump Jr.’s board appointment at PSQ Holdings may invigorate the company’s standing, careful analysis is warranted to navigate the fine line between market enthusiasm and underlying financial health.