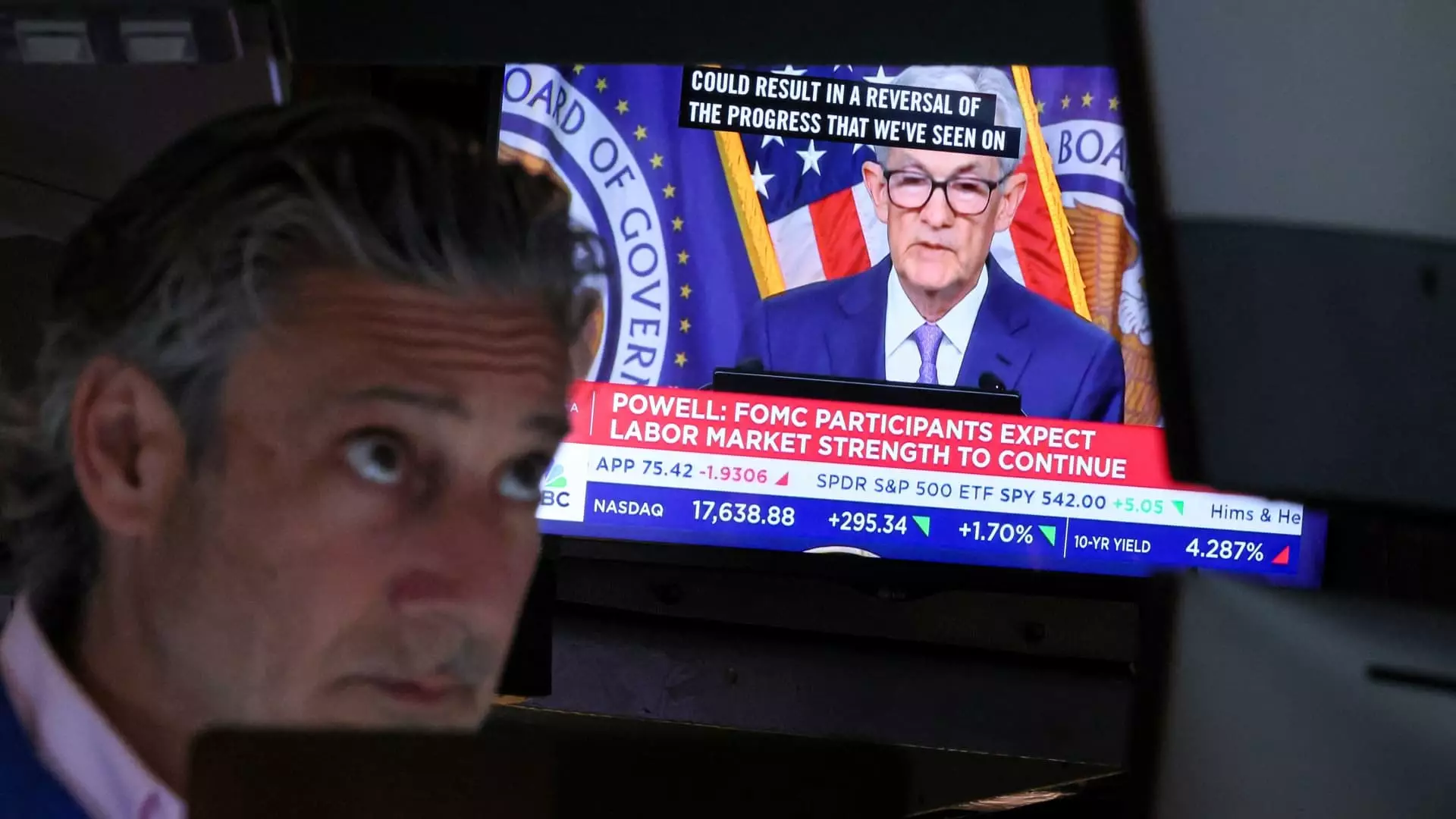

The stock market has seen a significant upward trend since the last monthly meeting in June. This can be largely attributed to the growing likelihood of the Federal Reserve lowering interest rates in the near future. Recent positive inflation data has further fueled this upward movement in the stock market, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all reaching new highs in the past few weeks.

Amidst the overbought market conditions, the club has made strategic trades to take advantage of the current situation. Shares of TJX Companies were offloaded to raise additional cash, while profits were locked in by selling Meta Platforms and Palo Alto Networks. These sales resulted in significant gains since the initial purchase of these stocks.

A key theme that has emerged in the stock market is the shift towards sectors outside of Big Tech. The Russell 2000, which tracks small-cap U.S. stocks, saw a substantial increase in performance compared to the tech-heavy Nasdaq. This shift in investor sentiment is evident in the performance of mega-cap stocks like Amazon, Alphabet, Meta, and Microsoft, which have posted losses since the last meeting.

Among the top five performing stocks in the portfolio, only one company belongs to the mega-cap tech category. This highlights the trend of investors seeking opportunities in sectors beyond Big Tech. Companies like Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover have shown impressive gains driven by various factors specific to each stock.

– Ford Motor: The company’s outperformance can be attributed to improved investor sentiment, driven by signs of increasing sales and the impact of easing inflation on consumer purchasing behavior.

– Morgan Stanley: Investors are optimistic about the potential benefits to big U.S. banks from a hypothetical second presidency for Donald Trump. The company’s strong second quarter report further boosted investor confidence.

– Stanley Black & Decker: Anticipation of monetary policy easing and increased housing market activity have contributed to the stock’s surge. Investors are increasingly looking for alternatives outside of Big Tech.

– Apple: The company hit a record high following positive analyst recommendations and excitement surrounding its artificial intelligence initiatives.

– Dover: The stock benefited from increased interest in sectors that stand to gain from potential interest rate cuts. With a focus on industrial products for data centers, Dover is seen as a promising investment opportunity.

The recent stock market movements reflect a shift in investor preferences towards sectors beyond Big Tech. The current market conditions present both challenges and opportunities for portfolio managers to navigate effectively. By analyzing the key drivers of gains in top-performing stocks, investors can make informed decisions to capitalize on the evolving market trends. Understanding the underlying factors influencing stock performance is crucial for building a resilient and diversified investment portfolio in today’s dynamic market environment.