As we step into 2025, the financial landscape is witnessing a surge of speculative trading reminiscent of the more volatile market days. With the S&P 500 recently closing out its most impressive two-year stretch since 1998, investors are feeling the fervor that often accompanies new beginnings in the stock market. This article delves into the recent dynamics of trading activity, the catalysts behind them, and the implications for the broader market.

One of the most striking developments at the start of this year was the resurgence of cryptocurrency trading. Bitcoin, the pioneering digital asset, has reclaimed its position above the $96,000 mark. This revival has had ripple effects across the market, uplifting stocks tied directly to cryptocurrencies. Notably, Microstrategy, a prominent player in the crypto sphere, saw its shares rise by 3% after an astonishing 360% increase in 2024. Other crypto-related companies like Coinbase, Robinhood, Mara Holdings, and Riot Platforms also experienced upward momentum, demonstrating that the crypto market is reigniting investor enthusiasm.

Moreover, the excitement extends to smaller, quirky digital tokens, such as a lesser-known asset jokingly dubbed “fartcoin,” which soared by 45%, securing a market valuation of $1.38 billion. Such erratic trading behaviors highlight the high-risk allure that cryptocurrencies continue to hold for adventurous investors looking for the next big win.

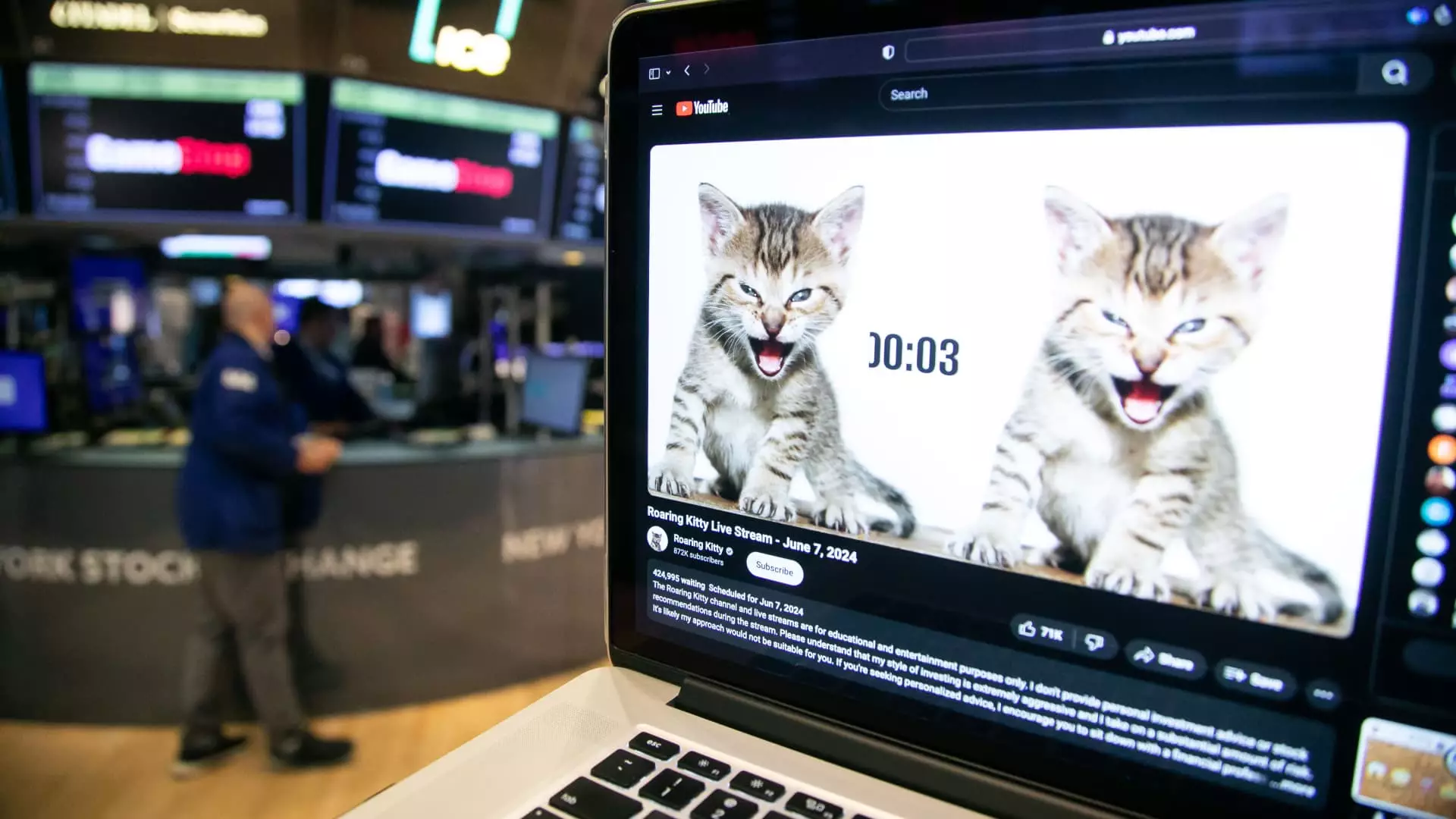

Alongside the cryptocurrency boom, meme stocks have captured the spotlight once more. Ground zero for this resurgence is none other than social media dynamics, where groups of retail traders congregate to share insights and speculation. The enigmatic figure known as Roaring Kitty, or Keith Gill, has been noted for his influence in this space. His latest cryptic posts on social media have left traders speculating about potential stock picks. Whether referencing Unity Software or drawing parallels with GameStop’s historic narrative, this trend exemplifies how social media forums can generate significant price movements, even in established companies that have strayed from their initial meme stock roots.

The dramatic rise of stocks like Unity, which surged by 11%, and the resurgence of GameStop’s shares underscore the unpredictable nature of meme stock trading. These trends not only create wealth for some but also risk obliterating investments for others, reinforcing the volatility of this speculative trading phenomenon.

While cryptocurrencies and meme stocks are capturing headlines, the semiconductor sector continues to be a cornerstone of market performance. 2024 was a banner year for semiconductor companies, and as the market anticipates a fresh wave of innovation, firms like Broadcom and Nvidia reported solid gains of 2% and 1.6%, respectively, at the start of 2025. This sector’s robust performance is partly attributed to a shift in focus back towards technology as artificial intelligence cooling off led to renewed interest in hardware and manufacturing capacity necessary to support digital growth.

In addition to tech, another intriguing growth story unfolds with golf-related stocks, particularly Topgolf Callaway Brands, which leapt by 8.5% following a favorable evaluation from Jefferies. The investment bank’s bullish outlook, predicting a significant upswing relative to its previous closure price, adds yet another layer to the increasingly diversifying portfolio of winning sectors that investors are keen to exploit.

As broad stock indexes increase at the dawn of 2025, the market sentiment is echoing the exuberance observed during earlier bullish runs, such as the aftermath of Donald Trump’s election in 2016. Investors are gambling on the notion that the new administration will implement pro-business policies capable of stimulating growth across various sectors. Nonetheless, concerns persist regarding inflation and potential disruptions in the supply chain, signaled by the Federal Reserve’s cautious approach to interest rate cuts.

In her recent commentary, Lisa Shalett, Morgan Stanley’s chief investment officer, articulates this sentiment by suggesting that investors are banking on the new administration’s approach to deregulation to foster an environment conducive to risk-taking. The concept of “animal spirits” is alive and well, influencing traders as they navigate the complex landscape of 2025’s financial ecosystem.

While speculation and volatility dominate the beginnings of 2025’s trading landscape, the intertwining of sectors—from cryptocurrencies and meme stocks to semiconductors—presents an intricate picture. Stakeholders, from casual retail investors to seasoned professionals, are tasked with deciphering these trends to position themselves wisely in an unpredictable market.