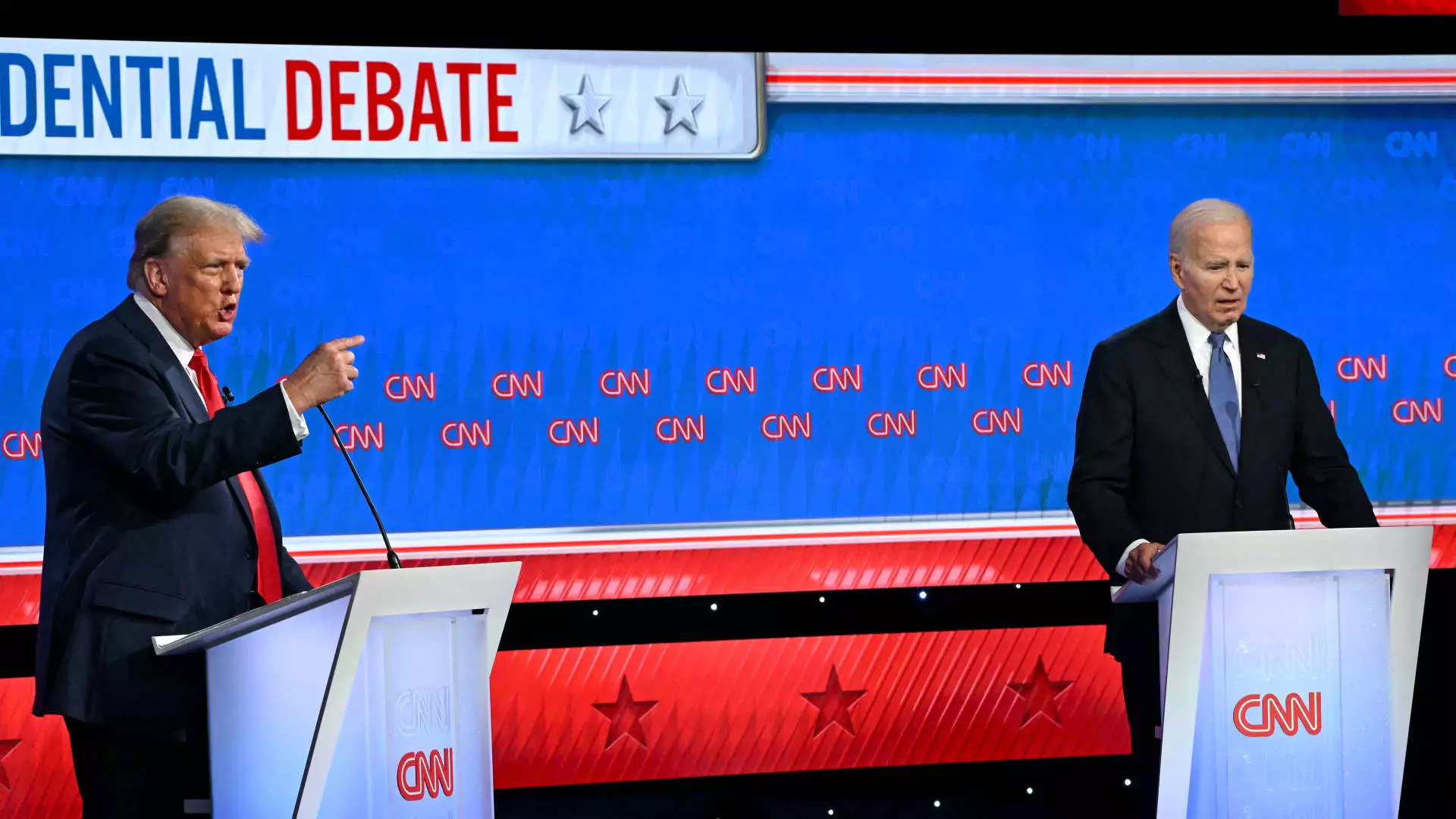

The upcoming presidential election between President Joe Biden and former President Donald Trump has left many investors feeling anxious about the possible impact on their investments. In a survey conducted by investment company Betterment, it was revealed that 57% of investors are feeling nervous about the election, with 40% expecting to make changes to their investments based on the outcome. This level of anxiety is not uncommon during election years, but it is important to note that market performance is not significantly affected by presidential election results.

Political Influence on Investment Decisions

Financial experts advise against making investment decisions based on political reasons, as markets tend to react more to economic factors that politicians have little control over. It is recommended to maintain a diversified portfolio and focus on saving more rather than making decisions based on political events. Attempting to predict market movements based on election outcomes is not a sound investment strategy, as the economy tends to remain stable regardless of the party in power.

Despite the growing trend of investors blending their political opinions with their portfolios, historical data shows that presidential elections have not significantly affected the stock market. According to an analysis from J.P. Morgan Private Bank dating back to 1928, the S&P 500 has returned an average of 7.5% in presidential election years, compared to 8% in non-election years. This data suggests that there is no substantial correlation between presidential elections and market performance.

Investor Response to Election Uncertainty

When considering the potential impact of the election on their portfolios, 29% of investors polled by Betterment indicated that they planned to increase holdings in savings accounts. While having a cash reserve can be a smart move, experts caution against keeping too much money out of the market. It is essential to strike a balance between holding cash reserves and staying invested to ensure long-term financial growth.

Certified financial planner Cathy Curtis advises her clients to remain calm and avoid making impulsive decisions based on fear or political preferences. While some clients express concerns about the potential outcome of the election, Curtis emphasizes the importance of focusing on long-term financial goals and resisting the urge to make drastic changes to investment strategies. By staying informed and sticking to a solid financial plan, investors can navigate election uncertainty with confidence.

The stock market tends to remain resilient regardless of presidential election outcomes. While it is natural for investors to feel anxious during election years, it is crucial to base investment decisions on sound financial principles rather than political predictions. By maintaining a diversified portfolio, saving consistently, and seeking guidance from financial experts, investors can weather market volatility and achieve their long-term financial objectives.