The landscape of the technology industry is ever-changing, and Nvidia, a frontrunner in graphics processing units (GPUs) and artificial intelligence (AI) infrastructure, is no exception. Despite its robust growth trajectory, challenges loom, primarily due to geopolitical tensions, particularly concerning China. As Nvidia prepares for its upcoming earnings report, the mood is decidedly mixed. While impressive revenue figures remain the standard, underlying uncertainties threaten to dampen the company’s dramatic ascent in AI. This dissonance between performance and pressure underscores a critical juncture for Nvidia.

The China Conundrum: A Double-Edged Sword

The escalating narrative between the U.S. and China, especially regarding technology, has significant ramifications for Nvidia. Following a directive from the Trump administration mandating an export license for its H20 chip, Nvidia faces repercussions that could reshape its revenue landscape. This isn’t merely a bureaucratic hurdle; it’s a fundamental threat to Nvidia’s market position. The new regulations highlight the fears within U.S. leadership that cutting-edge AI technologies could be repurposed for adversarial military applications. Nvidia’s acknowledgment of a staggering $5.5 billion write-down of inventory speaks volumes about the immediate impacts of these restrictions. A loss of this magnitude, described by analysts as historic within the chip industry, indicates a broader issue—Nvidia is no longer just grappling with market competition; it’s wrestling with national security concerns that redefine its business.

The Financial Fallout: Numbers that Speak Volumes

As investors anticipate Nvidia’s financial announcement, the figures are both encouraging and alarming. Projected revenue growth of 66% compared to the previous year might suggest unyielding momentum, yet it starkly contrasts with over 250% growth witnessed just a year prior. This downturn reflects not only the tangible impacts of geopolitical tensions but also an unsettling shift in market confidence. Analysts, previously optimistic, now revise their expectations downward significantly, projecting a potential revenue hit that could reach $15 billion in the next twelve months. Such numbers resonate ominously, underscoring the volatility Nvidia faces in the current climate.

The Market Share Dilemma: A Fractured Dominance

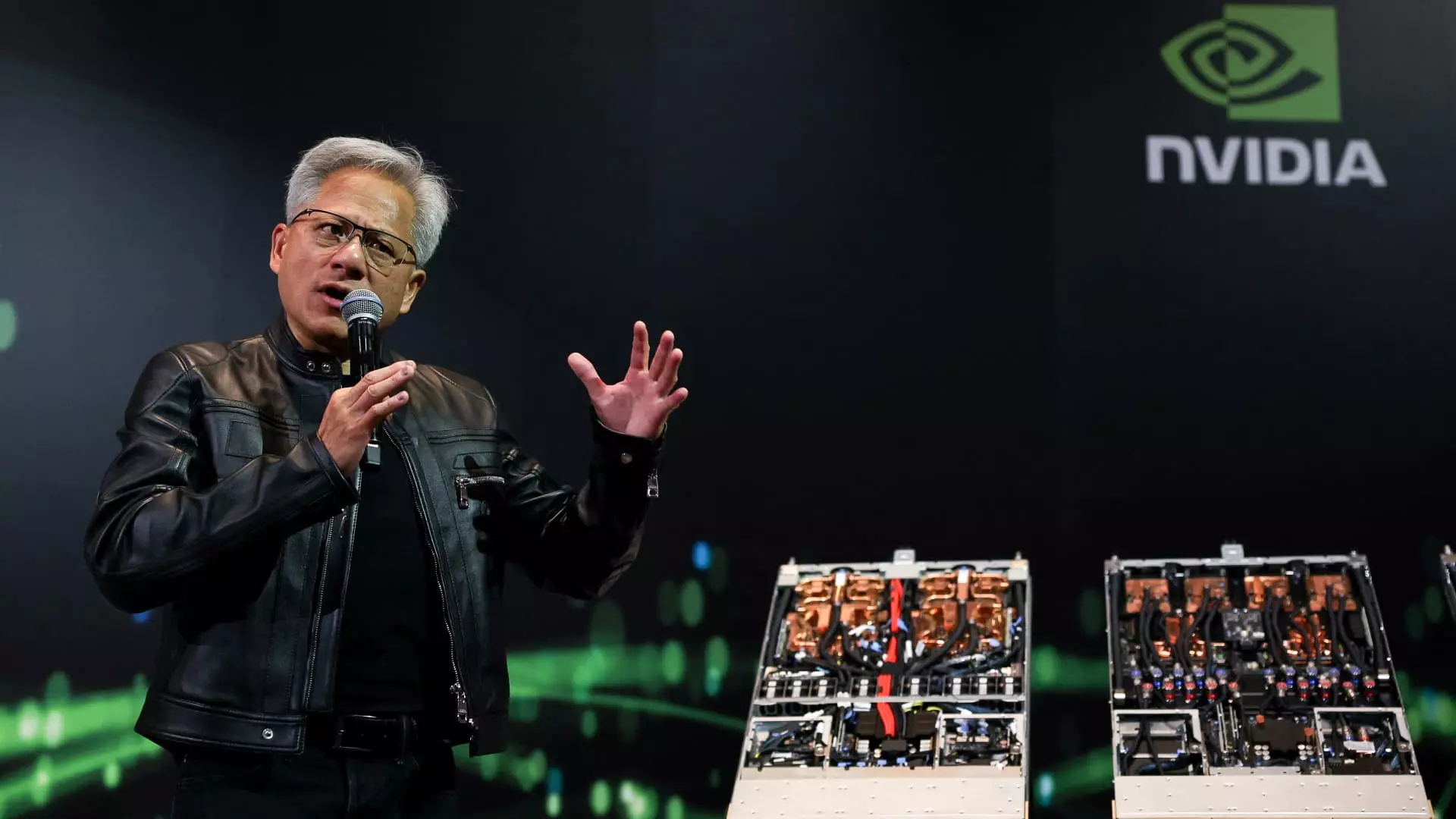

Nvidia’s dominance in the GPU market, particularly in China, is under serious threat. Once accounting for an impressive 95% share, it has dropped disparagingly to about 50% as regulatory constraints tighten. This is not simply a loss of market share; it’s a potential erosion of Nvidia’s competitive edge, prompting fears that it may fuel domestic innovations in China that could further challenge U.S. leadership in technology. CEO Jensen Huang’s assertions that these restrictions merely encourage Chinese engineers to innovate their AI processors highlight the cyclical nature of technological competition—a space where innovation, rather than regulation, typically reigns supreme.

The Evolving Regulatory Landscape: Will It Bring Relief or Further Restrictions?

Recent developments suggest a dynamic regulatory environment. The revival and subsequent revision of the “AI diffusion rule” indicate that the government is recalibrating its approach to technology exports. While this might provide Nvidia with a glimmer of hope, it simultaneously raises questions about the future of its H20 chip and whether it can navigate the complex web of licensing effectively. Analysts remain skeptical, anticipating that discussions around Nvidia’s operational strategies will overshadow this earnings call, leaving investors grappling with uncertainty.

Nvidia’s Future: Opportunities in Adversity

Yet, within the turmoil lies a peculiar opportunity for Nvidia. With analysts pinpointing that engineers in China may drive innovation locally in response to restrictions, this presents a catalyst for Nvidia to reassess its strategies. A clear awareness of the potential for homegrown competition should motivate Nvidia to double down on its research and development while fostering collaborations outside either country. By leveraging its established infrastructure and technological prowess, Nvidia could disprove the notion that U.S. tech giants are narrowing their horizons, instead expanding into emerging markets less subdued by geopolitical frictions.

In an environment where economic and political realities intertwine threateningly, Nvidia stands at a crossroads. Despite the complexities, the company has regularly demonstrated resilience and adaptability. The pathway ahead is undoubtedly littered with challenges, yet it also promises a chance for profound reinvention, underscoring that even giants must sometimes pivot in response to their ever-evolving landscape.