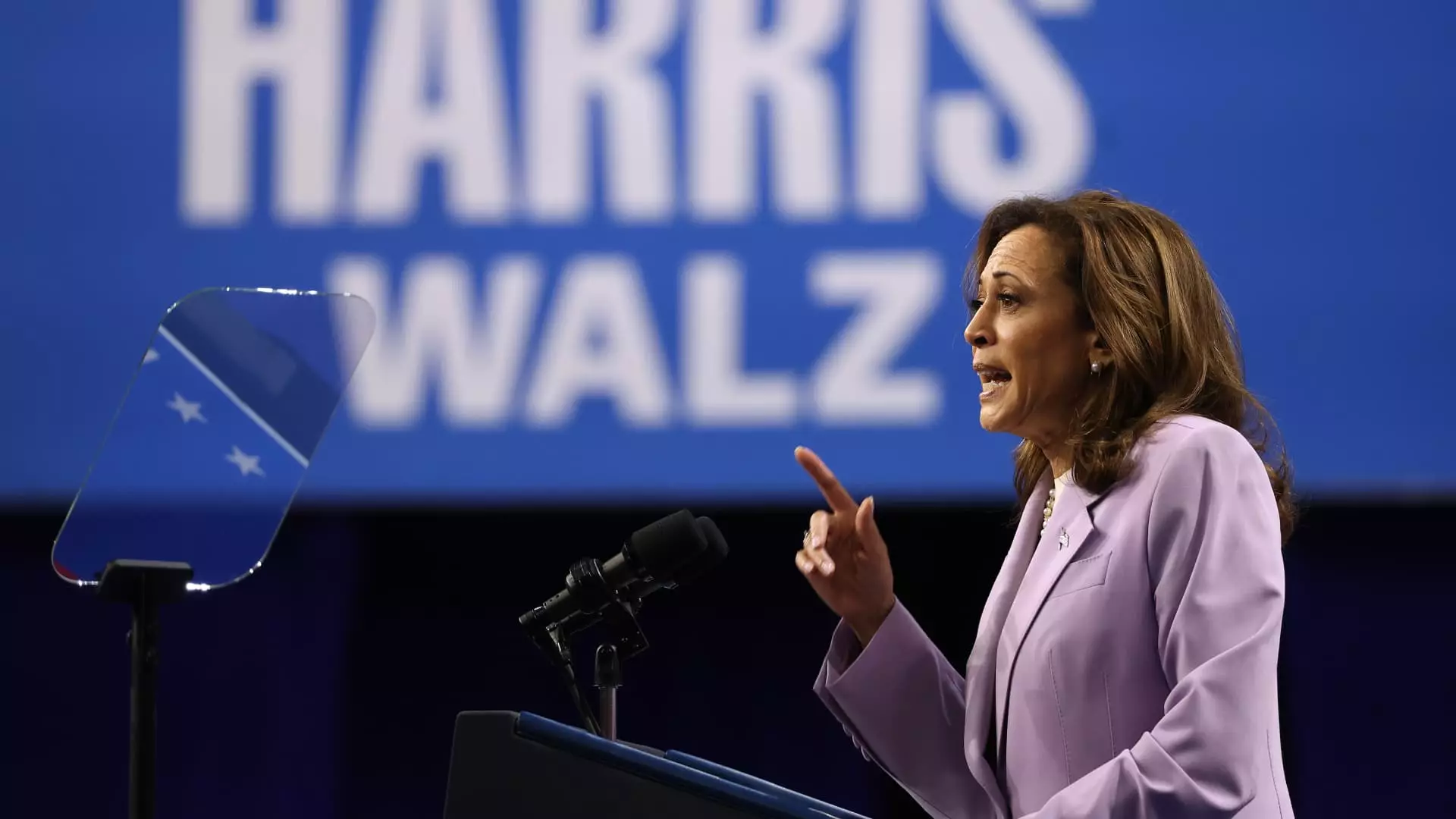

Affordable housing is a key component of the opportunity economy that Vice President Kamala Harris has recently outlined. She emphasized the importance of making homeownership more accessible in the U.S. during a speech in Raleigh, North Carolina. Harris proposed the construction of 3 million new housing units, both for rent and for sale, over the next four years in an effort to enhance affordability. This initiative has been applauded by housing experts who believe that increasing the housing supply is critical to addressing affordability challenges currently faced by renters and first-time buyers.

Challenges and Shortfalls

The U.S. housing market has seen a significant decline in new construction since the foreclosure crisis of 2007-2010. This shortage is particularly acute for affordable housing units, posing challenges for both renters seeking quality accommodations and individuals looking to purchase their first home. In order to reach the target of 3 million new housing units, the proposed incentives would support homebuilders who sell starter homes to first-time buyers. This initiative aims to create and rehabilitate homes in distressed communities, promoting homeownership opportunities for underserved populations.

Former President Donald Trump has also advocated for increasing housing supply, emphasizing the need to utilize federal land for housing construction. However, some experts argue that supply-side proposals face more challenges compared to demand-side initiatives that focus on making homebuying more accessible. There are concerns regarding the definition of a “starter home” and the varying costs associated with building such properties across different markets. Additionally, the proposed $40 billion innovation fund has raised skepticism about its potential efficacy in addressing housing affordability due to limited federal authority over local planning and concerns about bipartisan support for the funding.

Harris’ proposal includes providing $25,000 in down-payment assistance to first-time homebuyers who have a history of timely rent payments, with additional support for qualifying first-generation homeowners. This initiative builds on previous recommendations from the Biden-Harris administration to assist first-time buyers and expand access to homeownership opportunities. In an effort to address rental housing challenges, Harris has called on Congress to pass legislation to prevent predatory investing and regulate algorithms that influence rental prices. However, there are concerns about the potential impact of these measures on housing demand and affordability in the long run.

The push for affordable housing in U.S. policy remains a complex and multifaceted issue that requires careful consideration of various factors and challenges. While initiatives like those proposed by Vice President Harris aim to improve housing affordability and accessibility, there are valid criticisms and uncertainties about their long-term effectiveness and bipartisan support. Addressing the housing needs of underserved populations and promoting sustainable homeownership will require ongoing collaboration and innovative solutions in the years to come.