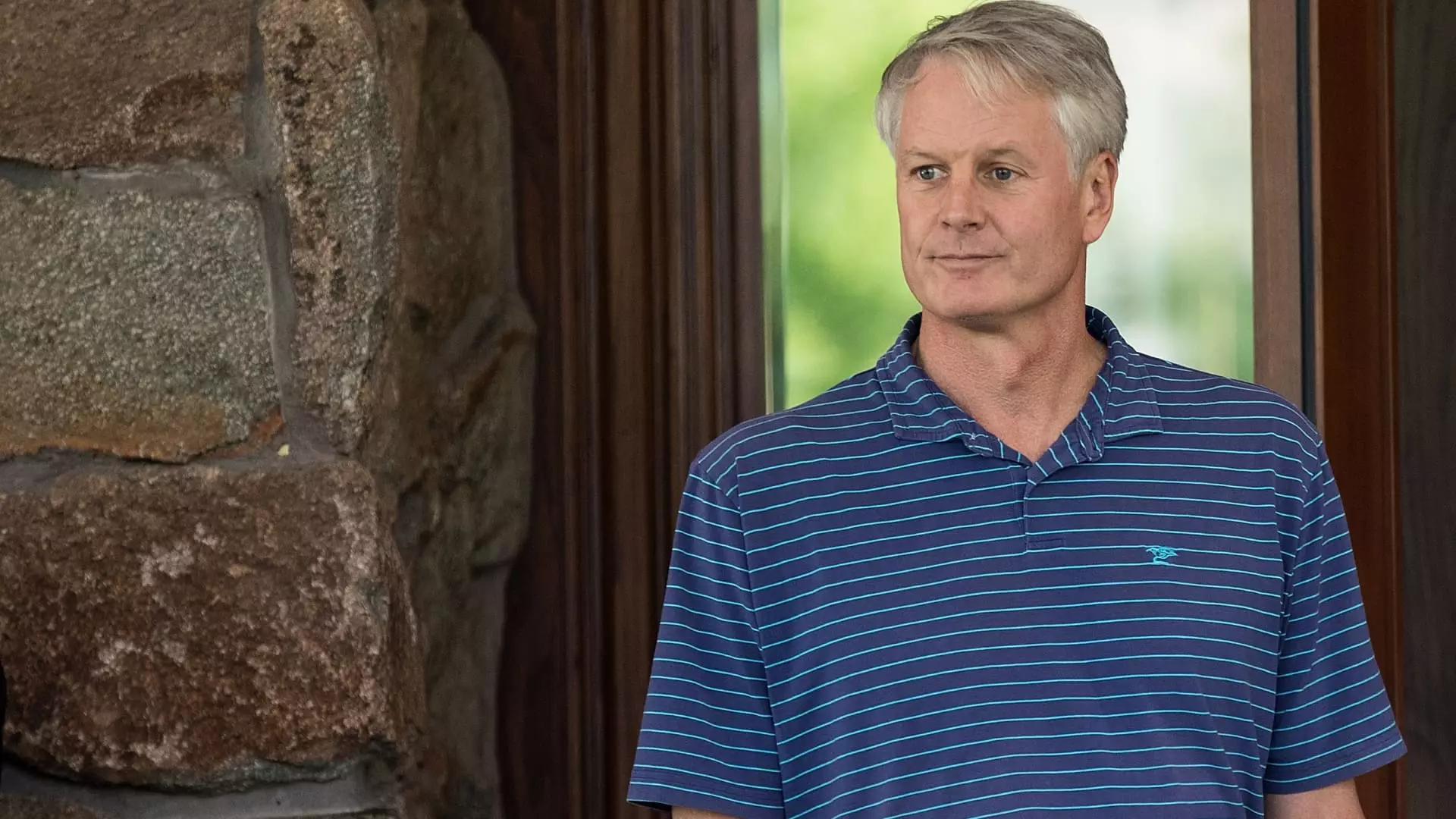

Nike CEO John Donahoe is currently facing a challenging time as Wall Street’s confidence in him and the company is starting to dwindle. Nike has recently issued a warning about the expected decline in sales in the current quarter, projecting a drop of 10%, which is significantly worse than the 3.2% decline predicted by LSEG. Their slowest annual sales gain in 14 years, excluding the effects of the Covid-19 pandemic, has further impacted their credibility in the market. As a result, Nike has faced a 20% decline in its stock value and has received multiple downgrades from investment banks. Analysts have criticized the management, questioning their credibility and calling for potential regime change to address the ongoing issues.

Since John Donahoe took over as the CEO of Nike, the company’s stock has plummeted by about 25%, underperforming both the S&P 500 and the retail-focused ETF XRT. This significant drop is contrary to the gains seen in the broader market indices during the same period. The finance chief of Nike attributes the guidance cut to a multitude of factors, including challenges in China, foreign exchange headwinds, and internal problems created under Donahoe’s leadership. Nike’s decision to scale new styles, move away from classic franchises, and restore relationships with key retail partners has not been met favorably by customers, leading to a decline in sales and overall market share.

Nike’s focus on its direct-selling strategy has resulted in a loss of core customers, particularly in the sneaker lines such as Air Force 1s, Air Jordan 1s, and Dunks. The overemphasis on these core franchises has deterred customers looking for innovative designs and fresh styles. Competitors like On Running and Hoka have capitalized on this gap in the market, gaining market share as Nike struggles to connect with runners, a crucial customer segment. Consumer behavior post-pandemic has shifted towards more active lifestyles, emphasizing the need for Nike to adapt and innovate quickly.

Analysts and industry experts have been vocal about the need for a change in Nike’s management, citing the failure to respond to key consumer shifts and industry trends. The company’s internal issues, underperformance in stock, and declining sales all point towards a leadership change. The speculation around Donahoe’s employment contract expiring and the possibility of a management shift in the next six months indicates the mounting pressure on the CEO to deliver results and steer Nike in a new direction.

In his defense, John Donahoe has had to navigate the challenges brought by the Covid-19 pandemic shortly after assuming the role of CEO. The closure of stores, remote work arrangements, and changing consumer preferences have tested his leadership skills. Despite the decline in stock value, Nike’s annual sales have seen growth under his tenure, showcasing some positive outcomes during a tumultuous period. However, with increasing scrutiny from investors, analysts, and industry experts, the future of Nike with John Donahoe at the helm remains uncertain.

Nike’s CEO John Donahoe is facing a critical juncture in his leadership as the company grapples with declining sales, underperformance in stock, and the need for a management change. The pressure to adapt to changing consumer demands, innovate in a competitive market, and regain investor confidence looms large over Nike’s future. As the industry watches closely, the fate of Nike and its CEO hangs in the balance, awaiting decisive action to address the challenges ahead.