In an ever-evolving music industry characterized by rapid technological advances and shifting consumer preferences, Reservoir Media has carved a distinctive path as an independent powerhouse. Established with a strong emphasis on both music publishing and recorded sound, Reservoir Media operates a multifaceted business model that is crucial to understanding its position in a competitive landscape.

Core Business Segments: Understanding the Structure

Reservoir Media’s operations are bifurcated into two primary segments: Music Publishing and Recorded Music. The Music Publishing segment focuses on acquiring music catalog interests, which provide steady streams of royalty income, while also signing new songwriters to expand their repertoire. This strategy not only preserves classic hits from notable artists such as Joni Mitchell and John Denver but also secures emerging talents like Ali Tamposi and Jamie Hartman.

On the other hand, the Recorded Music segment plays a critical role in discovering new artists and managing their sound recordings. By marketing, distributing, selling, and licensing these music catalogs, Reservoir ensures that a wide array of soundtracks reaches fans across various platforms. The blend of legacy and contemporary artists enriches the catalog, providing a robust foundation for growth.

Reservoir Media has reported impressive financial metrics since its public debut through a merger with Roth CH Acquisition II in July 2021. The company’s revenue model is heavily reliant on subscription streaming, an industry that has exhibited steady growth—rising by 11.2% in 2023 alone. Currently, streaming services account for approximately 54% of Reservoir’s total revenue, enhancing its financial stability.

However, despite experiencing a significant increase in its gross profits—from $47.39 million to $89.38 million—Reservoir has faced stock price declines since its IPO, reflecting a 22% drop in share value. This discrepancy between growth and stock performance raises questions about investor sentiment and market valuation.

The involvement of activist investor Irenic Capital has introduced an additional layer of complexity to Reservoir’s financial landscape. Through a series of strategic recommendations, Irenic has urged Reservoir’s leadership to consider a comprehensive review of its operations and potential strategic alternatives, including possible asset sales. Such activism can often be contentious, but in this scenario, it appears to stem from a recognition of the company’s unique position as a royalty collector, akin to a bond issuer.

It’s important to note that while Irenic’s push for a strategic review aligns with short-term shareholder interests, it also raises broader considerations about long-term value creation. Reservoir’s structure allows for a stable revenue stream, contingent on the evolution of the streaming landscape. Moreover, increased fees from streaming platforms can lead to higher royalty payments without an uptick in streaming volumes.

The rationale for Reservoir’s strategy to go public via a SPAC merger was to leverage potentially inflated stock values to acquire peers. Nevertheless, the current trading multiples of Reservoir—between 8 to 9 times net publisher’s share (NPS)—contrast sharply with the market valuations of peers, some trading in the mid to high teens. Consequently, opportunities for acquisition may have shifted from being a proactive strategy to a defensive maneuver.

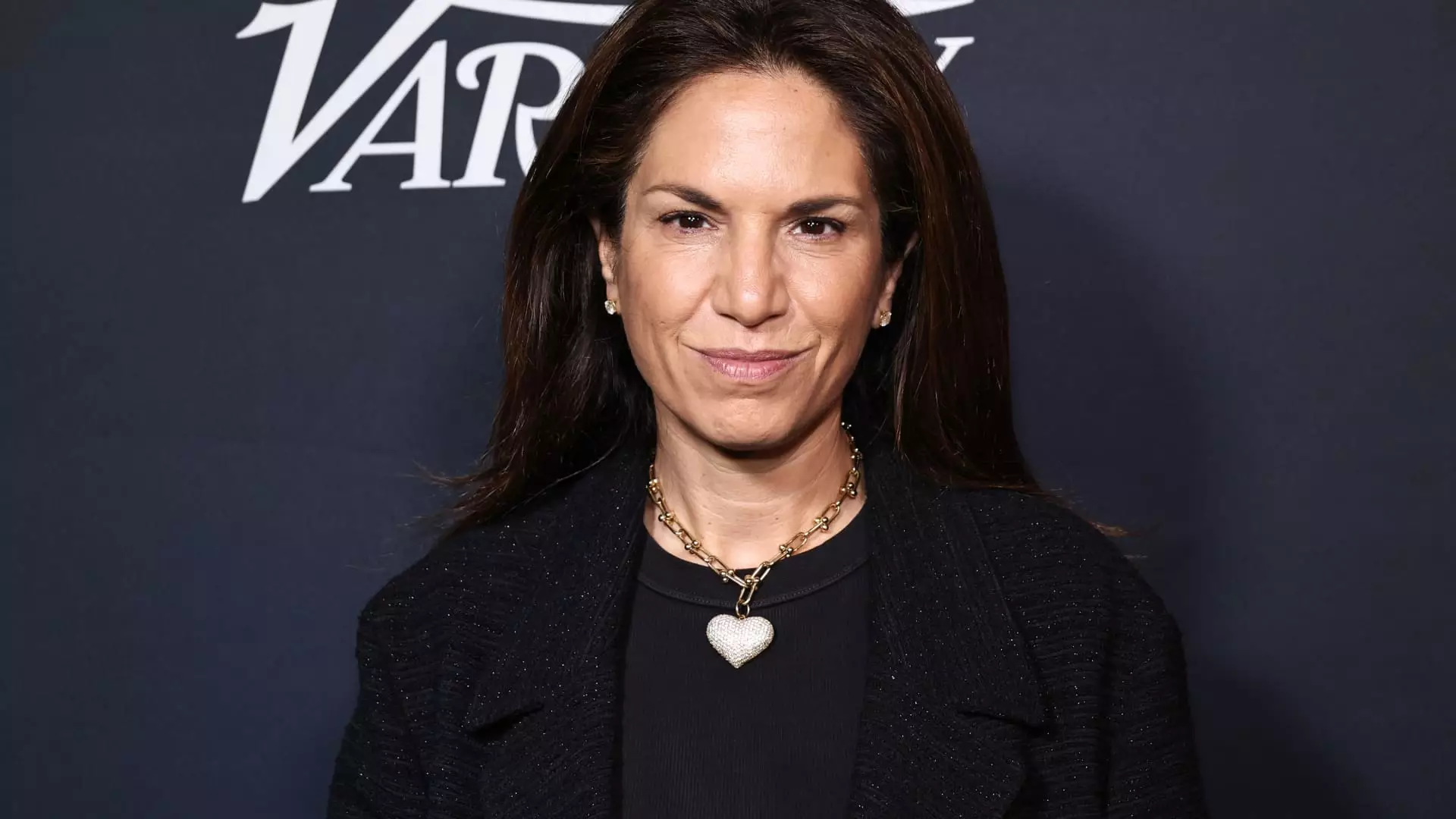

Moreover, the concentration of ownership among the Khosrowshahi family and Irenic Capital suggests that any potential acquisition would likely need to reconcile the interests of major stakeholders. The family’s significant shareholding—combined with the expertise of Golnar Khosrowshahi as CEO—positions Reservoir attractively for any potential acquirers, particularly from the financial sector.

As the music industry continues to reshape itself in response to technology and consumer tastes, Reservoir Media stands at a crossroads. With its diverse catalog, resilient revenue streams, and passionate management, the company’s future remains promising. Nonetheless, ongoing pressures from activist investors and the complexities of navigating financial markets will require a thoughtful approach from its leadership.

Ultimately, whether Reservoir decides to pursue growth through further acquisitions or focuses on optimizing its existing assets, a clear vision that harmonizes shareholder interests with strategic pursuits will be pivotal in determining its path forward. The prospect of Reservoir Media not only enduring but thriving in this competitive arena hinges on its ability to adapt, innovate, and maintain its unique position in the music industry.