Super Micro’s shares faced a dramatic plunge of 22% on a recent Wednesday, marking the lowest point for the server manufacturer since May of the previous year. This sudden decline brought the stock price down to $21.55 in early afternoon trading, and it now represents an astonishing 82% downturn from its peak earlier this year. This alarming drop translates to a staggering loss of approximately $57 billion in market capitalization, demonstrating the severity of the situation that has left investors rattled.

As tension mounts for Super Micro, the company recently released unaudited preliminary financial results that have failed to reassure shareholders and market analysts alike. The lack of concrete plans regarding its Nasdaq listing compliance adds to the uncertainty, sparking fears of potential delisting. The unfiled audited financial statements since May have exacerbated concerns, as financial transparency is critical for maintaining investor confidence and adherence to regulatory standards.

One of the most unsettling developments was the resignation of Ernst & Young, the company’s auditor, which now marks the second such departure in less than two years. A resignation of this nature typically raises red flags for investors, as it suggests deeper issues within the company’s financial practices or corporate governance. Critics, including an activist shareholder, have alleged accounting irregularities and hinted at potential violations of export controls, painting a bleak picture of Super Micro’s operations.

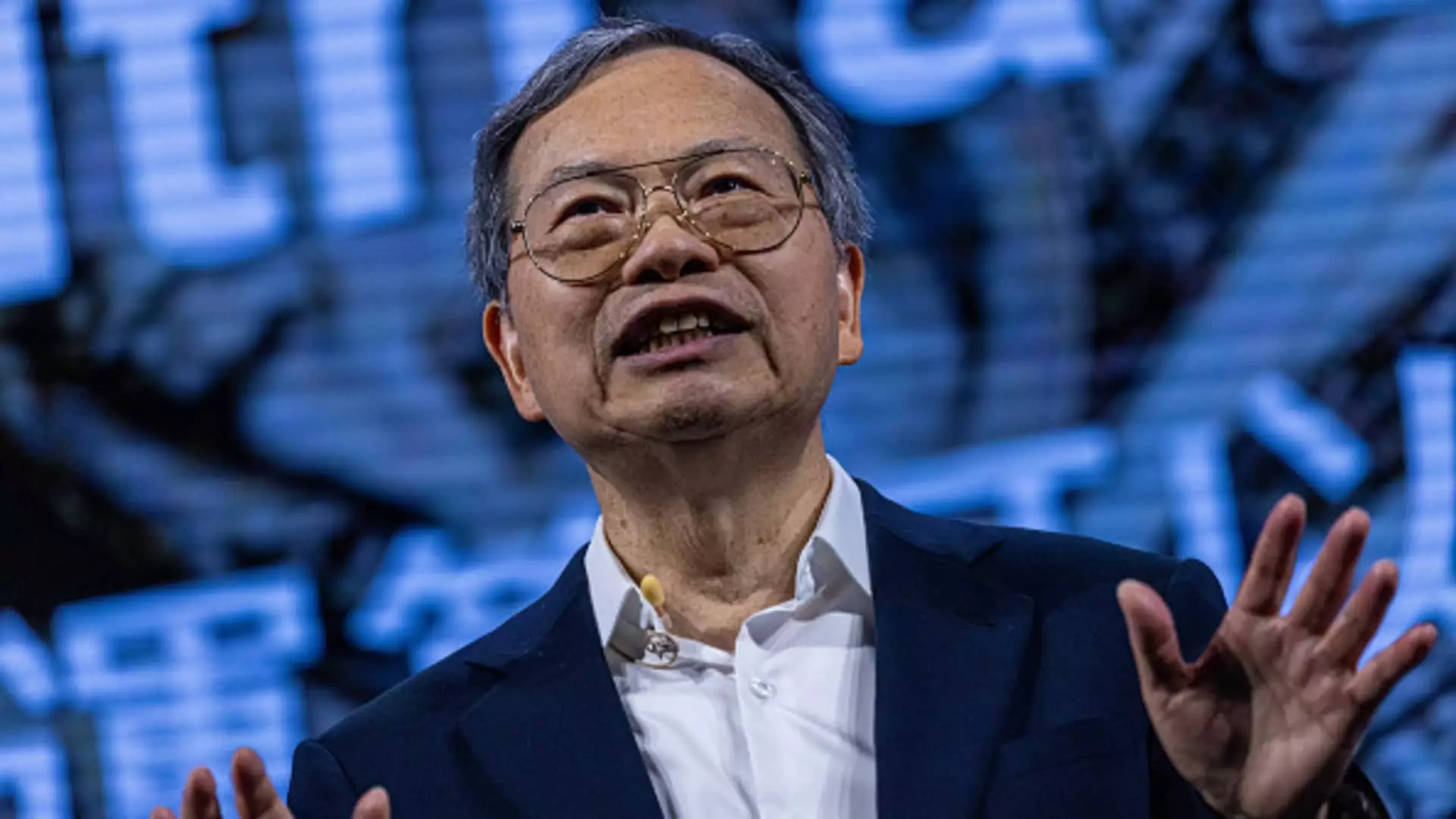

During a recent call with analysts, CEO Charles Liang notably avoided questions regarding the audit firm’s exit, further fueling speculation about internal issues. Deflections on corporate governance and a lack of substantial updates on hiring a new auditor only deepened investors’ apprehension. With a significant amount of uncertainty hanging over the firm, market analysts are reluctant to provide coverage, reflecting the precarious position that Super Micro now finds itself in.

Financial Performance Amid Chaos

Despite these tumultuous developments, Super Micro reported preliminary net sales between $5.9 billion and $6 billion for the quarter ending September 30, falling short of analyst expectations. While this figure reflects staggering growth—an increase of 181% compared to the same quarter last year—the shortfall relative to the projected $6.45 billion indicates a company struggling to maintain momentum amidst a chaotic backdrop.

Interestingly, Super Micro’s core business has largely benefited from the booming demand for servers integrated with Nvidia’s advanced processors geared toward artificial intelligence applications. The company experienced an extraordinary 246% increase in its stock last year, buoyed by a notable 87% rise in 2023, leading to a peak stock price of $118.81 following its addition to the S&P 500. However, the recent financial disclosures and uncertainties have overshadowed these accomplishments, resulting in investor skepticism.

While demand for Nvidia’s latest GPU, Blackwell, appears robust, questions loom over when this demand will effectively translate into Super Micro’s financial results. Liang has painted an optimistic picture, claiming that the company maintains a strong relationship with Nvidia and expects to receive new GPU allocations soon. Still, the CEO’s assurances—despite being compelling—do little to quell concerns among wary investors.

Adding to the uncertainty, Super Micro’s outlook for the upcoming December quarter indicates anticipated revenues between $5.5 billion and $6.1 billion, again below analyst expectations of $6.86 billion. Analysts’ projections for adjusted earnings per share have, similarly, not met the company’s recent estimates. This discrepancy indicates a concerning pattern of divergence from market expectations that may further erode investor faith.

The Path Forward

In a bid to navigate these turbulent waters, Super Micro has established a special committee to probe into the issues raised by Ernst & Young. Encouragingly, this committee’s preliminary findings claimed to have discovered “no evidence of fraud or misconduct” from management, yet the lingering doubts surrounding the company’s governance cannot be easily brushed aside.

Super Micro stands at a critical juncture, grappling with both operational challenges and investor skepticism. While the backdrop of rapid growth in AI-related infrastructure offers a tantalizing opportunity, the firm must first restore confidence through financial transparency and solid governance. The ongoing efforts to appoint a new auditor and clarify the company’s financial future will be paramount in determining whether Super Micro can stabilize its position in a fiercely competitive marketplace.