Oracle Corporation has showcased a remarkable surge in its stock value, climbing approximately 6% during after-hours trading on Thursday. This surge was fueled by the company’s bullish revenue projections for the fiscal year 2026, where it anticipates earnings of at least $66 billion, surpassing analyst expectations of $64.5 billion. Oracle’s impressive stock performance over the past week is noteworthy; it has gained nearly 15% in the last three trading sessions, propelling it to an all-time high. This leap is particularly significant given that Oracle’s stock has appreciated by 55% year-to-date, positioning it as one of the leading performers among large-cap tech companies—second only to Nvidia.

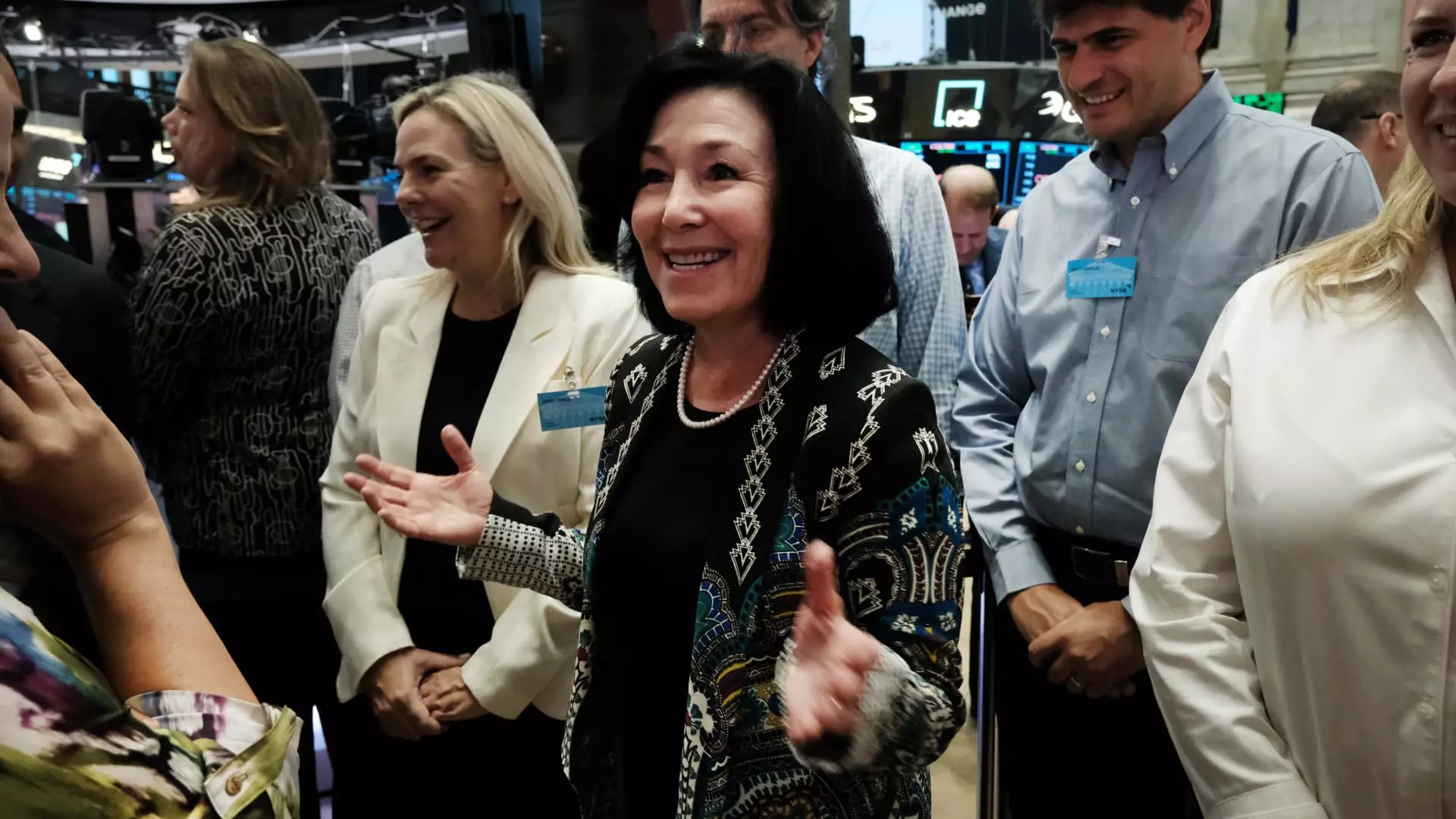

What stands out in Oracle’s recent announcements is not just the short-term optimism for fiscal 2026 but also the ambitious outlook for the 2029 fiscal year. The company is projecting substantial revenue of over $104 billion, along with a year-over-year earnings growth rate of 20%. Oracle’s CEO, Safra Catz, conveyed confidence in achieving these targets, emphasizing the strategic partnerships established with industry giants such as Amazon, Google, and Microsoft to enhance the accessibility of Oracle’s database solutions. These alliances are indicative of a strategic approach aimed at leveraging collective strengths in the competitive tech landscape.

A significant driver of Oracle’s growth is its cloud infrastructure segment, which has reported a staggering 45% growth in the recent quarter. This growth rate exceeds that of competing tech titans like Amazon, Google, and Microsoft. With an increasing number of businesses transitioning their workloads from in-house data centers to cloud environments, Oracle stands to benefit considerably. Furthermore, the company is positioning itself to capitalize on the booming artificial intelligence market. Oracle’s recent announcement regarding its cloud unit’s acquisition of over 131,000 “Blackwell” graphics processing units (GPUs) from Nvidia highlights an intent to delve deeper into AI development and solutions.

Capital Expenditure Strategies

Moreover, as Oracle gears up for expansion, Catz has indicated expectations for the company’s capital expenditures to double during the fiscal year 2025. This intensification of investment underlines Oracle’s commitment to enhancing its technological infrastructure and service offerings, which will be pivotal in supporting its revenue growth and fulfilling its ambitious long-term projections.

Oracle’s recent announcements and stock performance suggest a company on an upward trajectory. Its commitment to strategic partnerships, aggressive revenue forecasts, and expansion into vital sectors like cloud services and artificial intelligence paint a picture of a tech giant strategically navigating the complexities of the modern digital economy. As Oracle moves forward, stakeholders will undoubtedly be watching closely to assess whether the company can actualize its ambitious vision for growth, and whether it can secure a competitive edge in a rapidly changing technological landscape.