In a fiscal fourth-quarter earnings announcement that outperformed Wall Street’s projections, Nvidia has once again demonstrated its potential as a formidable player in the semiconductor industry. The company’s reported revenue reached an impressive $39.33 billion, surpassing the analysts’ expected $38.05 billion. Earnings per share tallied at 89 cents, edging past the anticipated 84 cents. The robust results reflect Nvidia’s unshakable confidence in sustaining its extraordinary growth trajectory, predominantly fueled by the burgeoning artificial intelligence (AI) sector. However, investors should remain vigilant, as Nvidia’s stock exhibited minimal movement in extended trading hours, signaling a complex narrative beyond the raw numbers.

As Nvidia sets its sights on the current quarter, the company has provided a forward-looking revenue estimate of around $43 billion—an optimistic outlook compared to the market’s consensus of $41.78 billion. This forecast suggests an ambitious yet realistic growth trajectory as it seeks to expand its revenue by approximately 65% year-over-year, a notable deceleration from the staggering 262% growth seen during the same timeframe last year. Notably, Chief Financial Officer Colette Kress has emphasized the anticipated “significant ramp” in sales for Nvidia’s next-generation AI chip, Blackwell, commencing in the first quarter. This rapid product introduction positions Nvidia strategically within the competitive landscape of AI hardware, as organizations increasingly look to optimize their operational efficiencies.

The company’s net income in the latest quarter rose to $22.09 billion, marking a substantial increase from the previous fiscal year, which reported $12.29 billion in net income. However, while these financial achievements are commendable, Nvidia’s gross margin of 73% revealed a slight dip of three percentage points compared to last year. This decline can primarily be attributed to the introduction of newer, complex data center products that entail higher costs but also the potential for greater return opportunities.

In broader terms, revenue from Nvidia surged by 78% compared to $35.1 billion in the previous quarter, and the total revenue for the fiscal year achieved a remarkable $130.5 billion with an annual increase of 114%. Yet, as Nvidia solidifies its market position, concerns arise about the sustainability of this growth, especially as increasing competition and market saturation become more pronounced themes within the tech sector.

A focal point of Nvidia’s success remains its data center business, which has become the cornerstone for revenue generation, now accounting for an impressive 91% of total sales. This represents a significant jump from 83% over the past year, underlining the growing dependence on data-driven technology solutions among businesses looking to leverage cloud infrastructure. The fourth-quarter data center revenue reached $35.6 billion, showcasing a 93% increase from the previous year and exceeding analyst expectations.

Nvidia’s strategic pivot from simply developing AI to delivering AI software, a process termed “inference,” constitutes a critical evolution in its business model. The company anticipates that advancements in AI algorithms will further escalate the demand for computing power, effectively necessitating many more Nvidia chips to manage increasingly complex tasks. Kress elucidates this by stating that next-generation AI applications may require up to 100 times the computational capacity of present models.

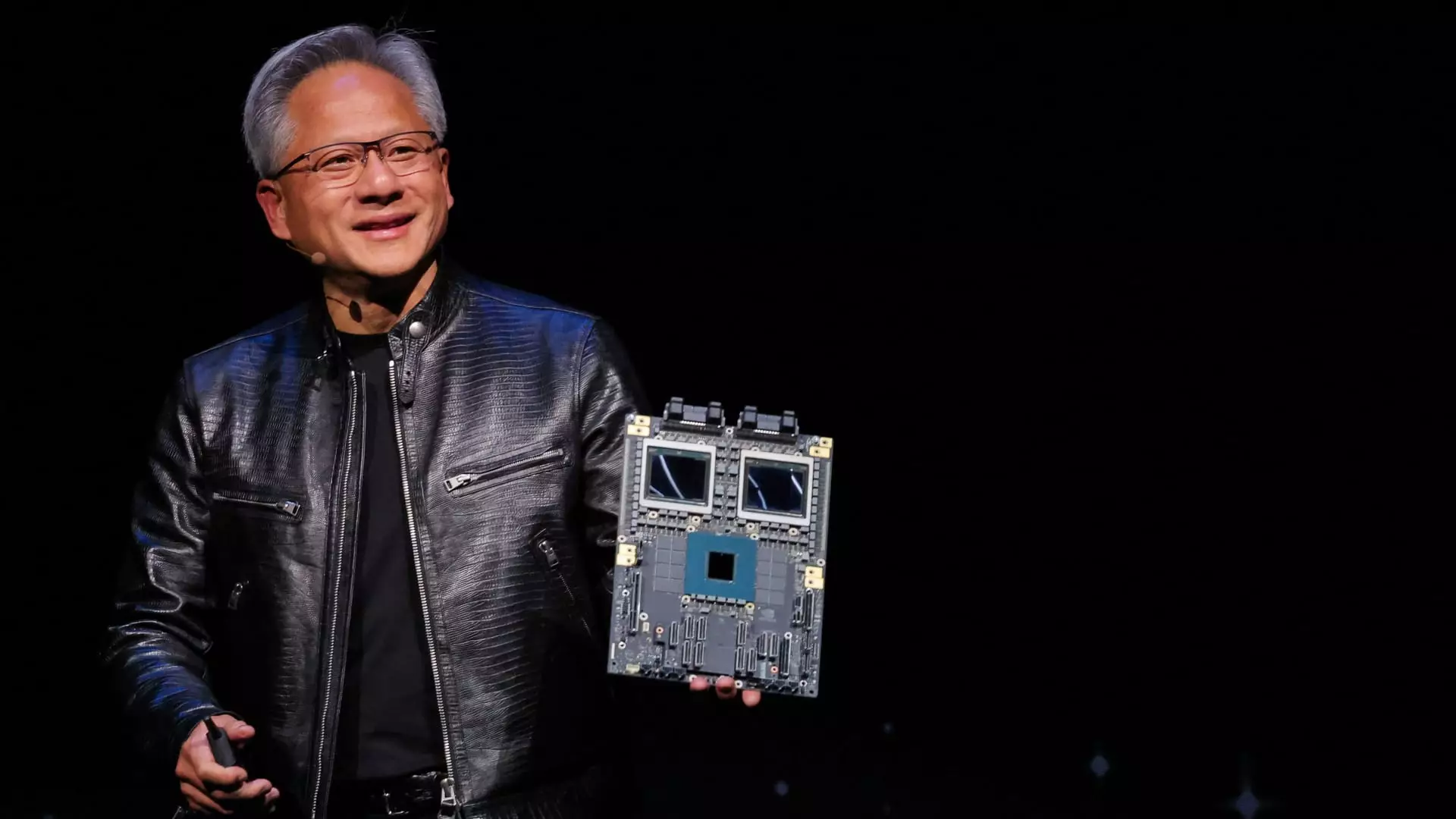

However, the landscape is not without challenges. Notably, potential threats from custom chip development by technology giants such as Amazon, Microsoft, and Google looms large. While these competitors are racing to establish their foothold, Nvidia’s CEO Jensen Huang remains optimistic, asserting that “just because the chip is designed doesn’t mean it gets deployed.” This reflects Nvidia’s continued focus on manufacturing high-performance GPUs that remain essential to AI infrastructure.

Furthermore, despite an increase in automotive chip sales—reporting $570 million in revenue with a remarkable year-over-year growth of 103%—this segment still represents a fraction of Nvidia’s core AI-driven business model. Conversely, the company’s gaming segment showed signs of decline, posing a potential red flag for Nvidia’s strategy as graphics sales fell 11% annually, falling short of the predicted $3.04 billion.

Nvidia’s recent earnings report encapsulates a company on an extraordinarily ambitious growth path anchored in AI potential—yet, it also unveils the intricate complexities and market dynamics that could impact its future. While the consistent surge in data center revenues points to strong demand, it is imperative for Nvidia to navigate competitive pressures and maintain its innovative edge. As the landscape continues to evolve, investors and industry observers will be keen to watch how Nvidia adapts to seize opportunities while mitigating the inherent risks associated with rapid growth.