MongoDB experienced a significant boost in their shares, climbing by as much as 16% in after-hours trading following the release of their fiscal second-quarter earnings report. The company outperformed expectations, with adjusted earnings per share coming in at 70 cents compared to the anticipated 49 cents. Additionally, MongoDB reported revenue of $478.1 million, exceeding the forecasted $464.1 million.

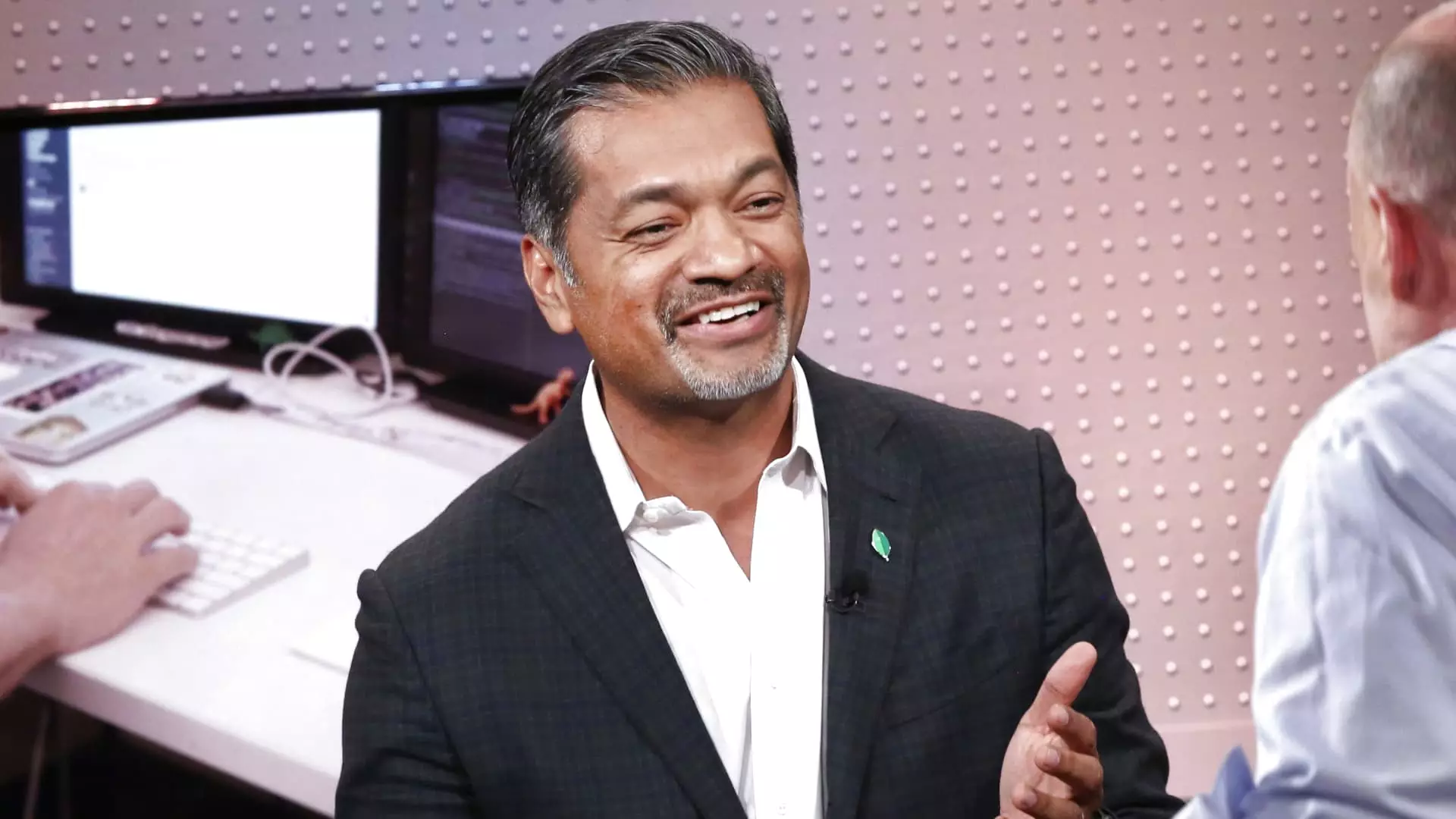

The company’s revenue saw a 13% year-over-year increase for the quarter ending on July 31. Despite a net loss of $54.5 million, or 74 cents per share, MongoDB remained optimistic about their positioning in the market. CEO Dev Ittycheria expressed confidence in their ability to assist customers in implementing generative AI into their operations and upgrading their existing application infrastructure.

Ittycheria highlighted the performance of MongoDB’s Atlas cloud database service, which saw better consumption rates than expected. He acknowledged that economic challenges had impacted Atlas consumption growth in the previous quarter, but the trend continued in the second quarter. Despite the prevailing economic conditions, MongoDB remained resilient in securing new business opportunities.

Looking ahead, MongoDB provided guidance for the fiscal third quarter, anticipating adjusted earnings of 65 to 68 cents per share on revenue ranging from $493.0 million to $497.0 million. The company also revised their fiscal 2025 forecast, projecting adjusted earnings of $2.33 to $2.47 per share and revenue of $1.92 billion to $1.93 billion. These figures represented an upgrade from the initial guidance provided in May, reflecting MongoDB’s confidence in their growth trajectory.

During the earnings call, Ittycheria mentioned competition with search software maker Elastic, whose CEO reported lower than expected client commitments in the first quarter, leading to a sharp decline in their stock price. MongoDB positioned itself as a viable alternative for companies looking to transition from Elastic products, leveraging their strong performance and growth projections to attract new clients.

Despite the positive earnings report, MongoDB’s shares had experienced a significant decline of nearly 40% for the year, contrasting with the 17% gain of the S&P 500 index during the same period. The market’s response to MongoDB’s latest earnings suggests that while the company has demonstrated resilience and growth potential, investors are cautiously optimistic about its future performance.