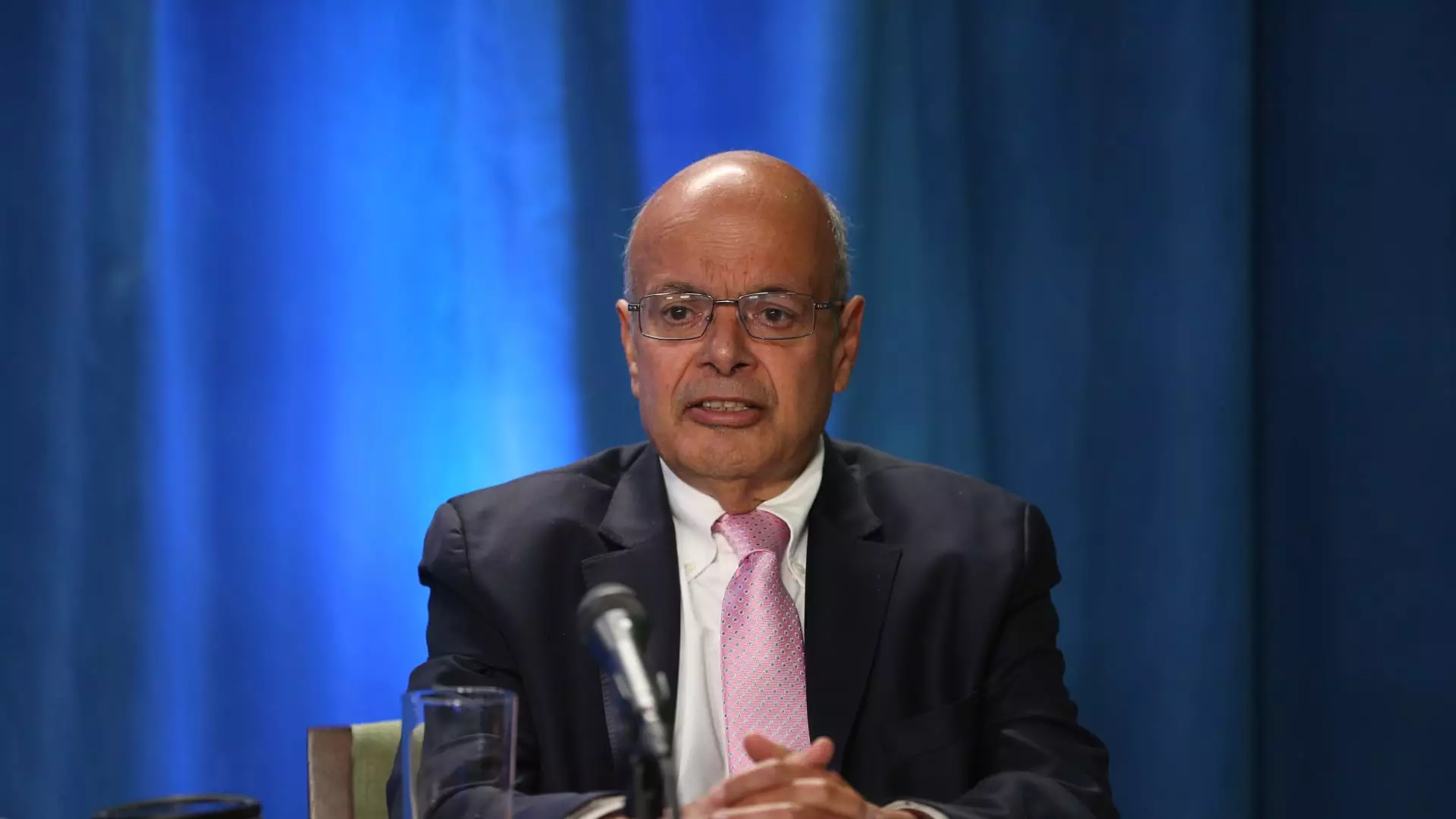

In a notable move within the realm of investment, Ajit Jain, Warren Buffett’s trusted insurance executive, made headlines by divesting more than half of his holdings in Berkshire Hathaway. According to a recent regulatory filing, Jain sold 200 shares of Berkshire Class A stock at an average price of $695,418 each, amassing a total of approximately $139 million from this transaction. This sale, amounting to 55% of his total stake, has stirred discussions and speculations regarding motivations behind such a significant reduction in his holdings.

Notably, this sale leaves Jain with a mere 61 shares, while other entities associated with him maintain additional shares: family trusts set up for his descendants hold 55 shares, and his nonprofit corporation, the Jain Foundation, owns another 50. This unprecedented reduction in holdings marks the steepest decline Jain has experienced since his entrance into Berkshire in 1986, a fact that raises questions about his current outlook on the company’s future.

The timing of Jain’s sale is particularly significant, coinciding with a period when Berkshire Hathaway’s stock was at a historic high. In late August, the conglomerate’s market capitalization soared above $1 trillion, with stock prices breaching the $700,000 mark. This trend provided a lucrative opportunity for insiders, including Jain, to capitalize on the high valuation of the stock. Financial experts and analysts have begun interpreting this sale as a signal that Jain may perceive Berkshire as fully valued at this point.

David Kass, a finance professor at the University of Maryland, highlighted that the sale could suggest Jain’s view that Berkshire’s stock is reaching its peak value. Adding to this perspective, Bill Stone, Chief Investment Officer at Glenview Trust Co., mentioned that the pricing, currently at over 1.6 times its book value, aligns closely with Warren Buffett’s conservative estimates regarding intrinsic value. Stone expressed skepticism about the likelihood of further stock repurchase activities by Berkshire under such high valuation conditions.

Jain’s decision to divest a substantial portion of his shares does not merely reflect personal financial strategies; it also sheds light on Berkshire Hathaway’s broader operational context. In recent months, the company has exhibited a noteworthy slowdown in its own stock buyback endeavors. The second quarter saw Berkshire repurchase only $345 million worth of its shares—a stark drop from the $2 billion repurchased in preceding quarters. This pronounced reduction could imply that the company is exercising caution regarding its stock’s current value trajectory.

Furthermore, Jain’s influence on Berkshire Hathaway over the years cannot be overstated. His pivotal contribution includes steering the company into the reinsurance sector while revitalizing Geico, its flagship auto insurance division. Since being named vice chairman of insurance operations in 2018, Jain’s strategic decisions have been recognized by industry leaders, including Buffett himself, who notably lauded Jain for generating tens of billions in shareholder value.

The recent sale also prompts inquiries into the leadership landscape of Berkshire Hathaway. Before the announcement that Greg Abel will eventually succeed Buffett, there had been speculation regarding Jain as a potential leader of the conglomerate. However, Buffett recently clarified that Jain has never aspired to lead Berkshire, indicating a clear demarcation in their respective roles within the organization. This clarification dispels any notions of competition between Jain and Abel, allowing both figures to focus on their specialized domains within the insurance and non-insurance sectors of Berkshire.

In the end, Ajit Jain’s divestment serves as a significant chapter in the ongoing narrative of Berkshire Hathaway, highlighting elements of value assessment within the company. As investment paradigms shift, shareholders and market analysts will be keeping a close eye on both Jain’s strategic maneuvers and the implications for Berkshire’s future valuation and operational decisions. This case exemplifies the complex interplay between personal financial decisions and broader market dynamics, shedding light on potential future trends for one of the most powerful conglomerates in the world.