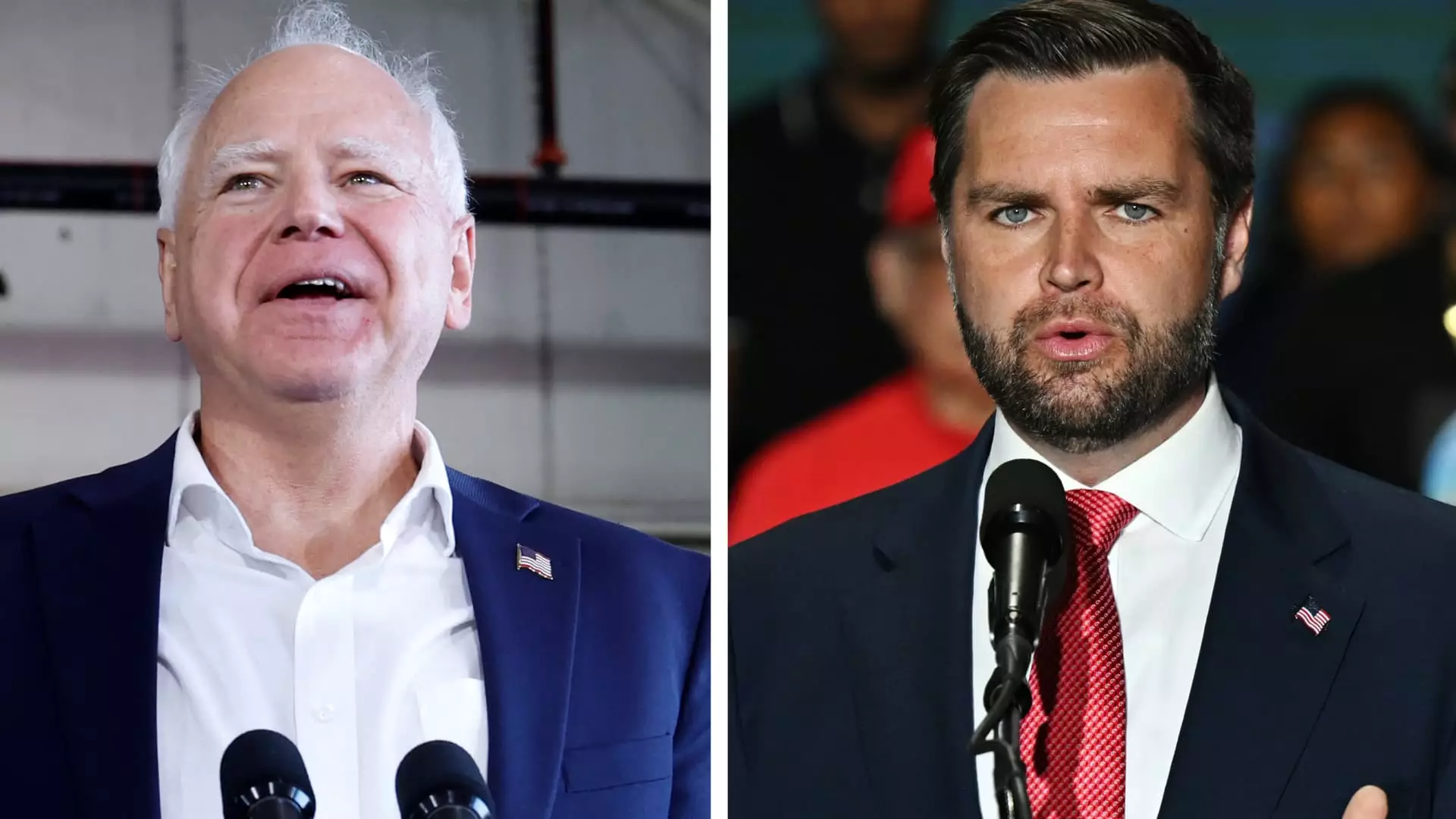

As the presidential election approaches, voters are closely scrutinizing the personal finance policies of the candidates and their running mates. The recent announcements of Vice President Kamala Harris’s running mate, Minnesota Gov. Tim Walz, and former President Donald Trump’s choice, Sen. JD Vance of Ohio, have shed light on the economic agendas of both parties. There is a clear focus on class warfare, with each side vying to appeal to middle-class Americans with their proposed policies.

Affordable housing is a pressing issue for many Americans, and both Walz and Vance have addressed it in their respective campaigns. Walz signed housing legislation that allocated significant funding for down payment assistance, housing infrastructure, and workforce housing. On the other hand, Vance has emphasized the importance of addressing affordable housing as a means to combat poverty. He has particularly criticized institutional ownership of rental homes and Chinese buyers entering the U.S. real estate market, showing his stance on the issue.

The child tax credit has been a key focus in recent policy discussions, with potential changes looming after 2025. While trillions of tax breaks, including the child tax credit, are set to expire, a temporary expansion in 2021 reduced child poverty rates significantly. Minnesota implemented a state-level child tax credit, praised as a landmark achievement by Walz. However, the possibility of a federal child tax credit expansion faces challenges amid a divided Congress and concerns about the budget deficit.

The issue of student loan forgiveness has also emerged as a divisive topic, with Vance taking a firm stance against blanket forgiveness. He argues that forgiving student debt benefits the wealthy, the well-educated, and university administrators rather than those in need. Despite his opposition to general loan forgiveness, Vance has supported targeted relief for specific cases, such as parents of permanently disabled children.

The growing concerns over outstanding education debt, which amounts to $1.6 trillion in the U.S., have prompted discussions on debt relief policies. Vance’s views on student loan forgiveness have sparked criticism from opponents who believe debt relief is a crucial working-class issue. Conversely, Walz has demonstrated support for programs aimed at easing the financial burden of student debt, echoing his commitment to education as a former school teacher.

The personal finance policies of Vice President Kamala Harris’s running mate, Tim Walz, and former President Donald Trump’s pick, JD Vance, offer contrasting perspectives on critical economic issues such as affordable housing, child tax credits, and student loan forgiveness. As the election draws near, these policies will play a significant role in shaping the economic landscape under a potential Harris or Trump presidency. Voters must carefully consider these policy differences and their potential impact on their financial well-being when heading to the polls.