The U.S. stock market has experienced a significant shift in recent years, with a handful of companies taking center stage. This trend has led to a situation where the top 10 companies in the S&P 500 now account for a substantial portion of the index, increasing from 14% to 27% over the past decade according to a Morgan Stanley analysis. Furthermore, in 2024, this concentration has escalated even further, with the top 10 stocks making up 37% of the index.

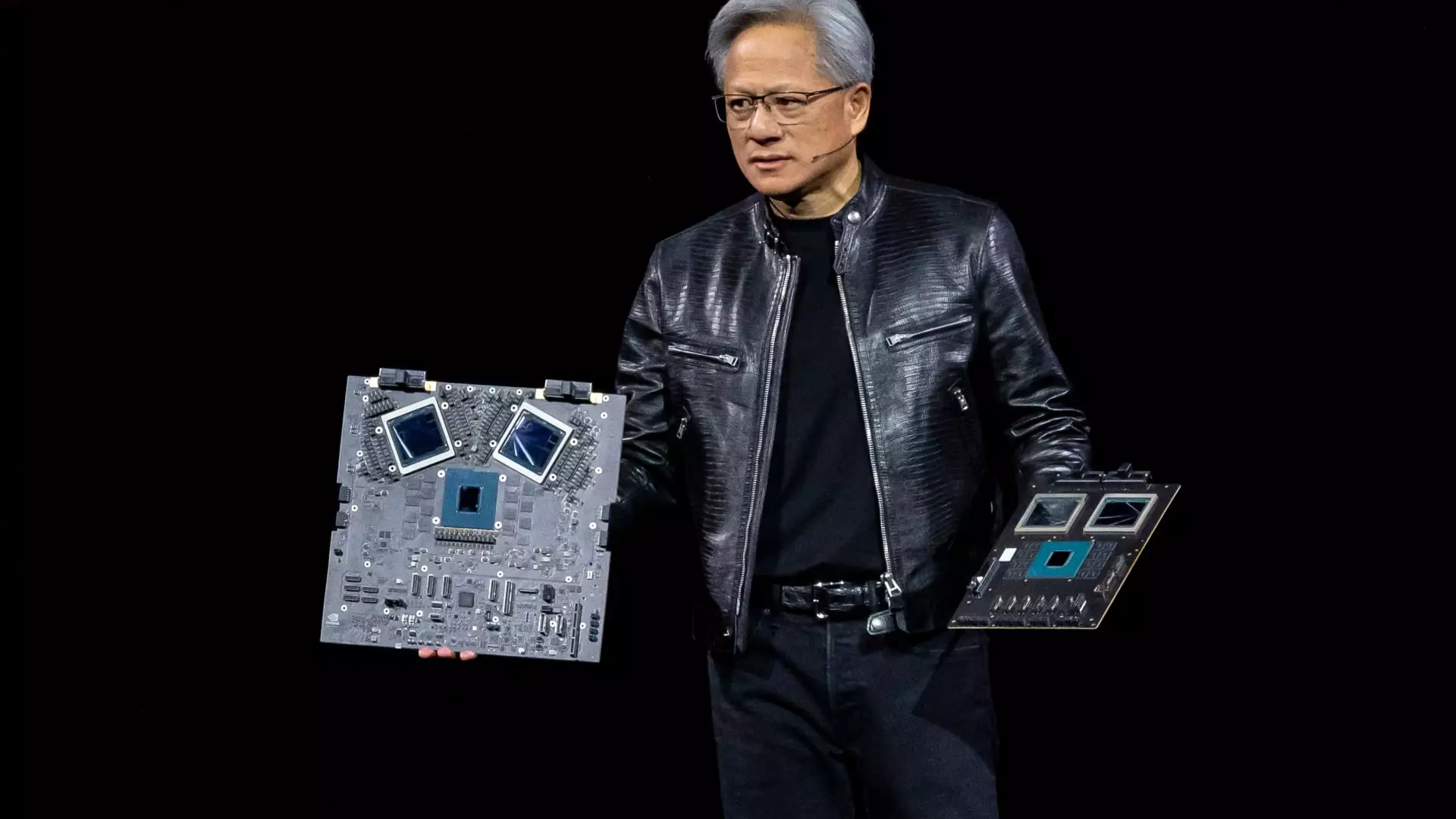

This growing concentration has raised concerns among experts who fear that investors may be at risk due to their heavy exposure to a limited number of companies. The so-called “Magnificent Seven,” including Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, now make up about 31% of the index. These companies have had a significant impact on the overall performance of the S&P 500, with more than half of the index’s gains in 2023 attributed to them.

The increased concentration in the stock market raises questions about the diversification of investors’ portfolios. As noted by Charlie Fitzgerald III, a certified financial planner, having nearly a third of the S&P 500 invested in just seven stocks poses a substantial risk. A downturn in any of these companies could have a significant negative impact on investors holding these stocks.

Despite the concerns raised by the growing concentration in the U.S. stock market, some experts argue that the situation may not be as alarming as it seems. Historical data shows that stock concentration has been higher in the past, with the top 10 stocks accounting for a significant portion of the market at various points in history. Moreover, compared to other global stock markets, the U.S. market remains relatively diversified, offering investors exposure to a wide range of companies.

While the growing concentration in the stock market poses risks for investors, it also presents opportunities for those willing to navigate the market dynamics effectively. Companies like Apple, Amazon, and Microsoft have demonstrated strong financial performance, with solid profits and returns on equity. This contrasts with the dot-com bubble of the late 1990s, where high valuations were not supported by underlying profits.

To address the challenges posed by the concentration in the stock market, experts recommend diversifying portfolios beyond the S&P 500 and including exposure to mid-sized, small, and foreign companies. Real estate and other asset classes can also play a role in building a well-rounded investment portfolio. For the average investor, a target-date fund offers a simple and effective way to achieve diversification while adjusting asset allocation based on age and risk tolerance.

Overall, while the increased concentration in the U.S. stock market raises valid concerns about portfolio diversification and risk management, historical data and global comparisons suggest that the situation may not be as dire as it appears. By adopting a diversified approach to investing and carefully monitoring market dynamics, investors can navigate the challenges and opportunities presented by the evolving stock market landscape.