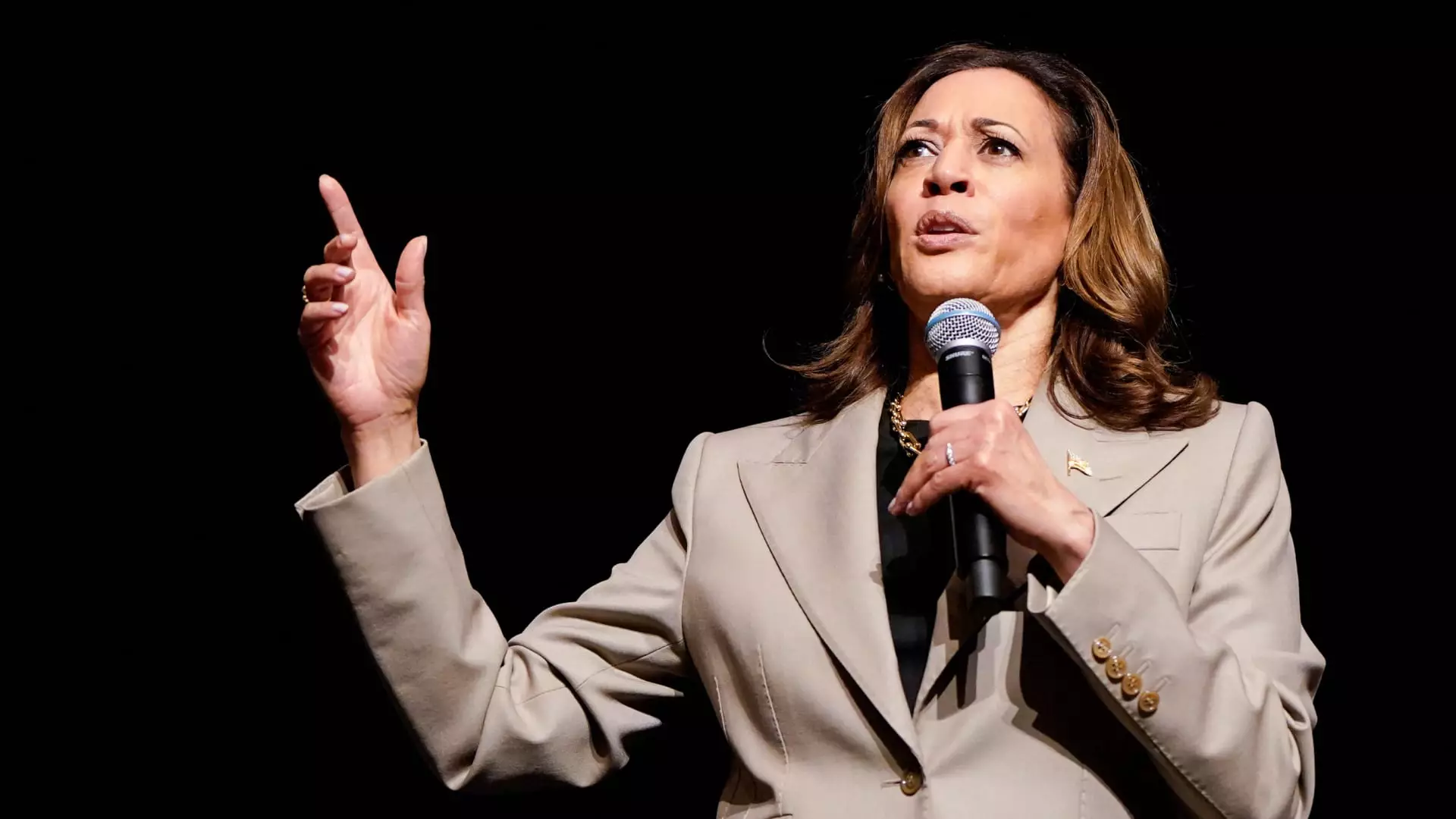

Vice President Kamala Harris recently unveiled an economic plan that includes an expanded child tax credit worth up to $6,000 in total tax relief for families with newborn children. This proposal is aimed at restoring the higher child tax credit that was enacted through the American Rescue Plan in 2021. The 2021 credit provided a maximum credit of up to $3,600 per child, depending on the child’s age and family’s income. Harris’ plan seeks to increase the tax break for middle- to lower-income families for the first year after a child is born. During a policy speech in Raleigh, North Carolina, Harris stated, “We will provide $6,000 in tax relief to families during the first year of a child’s life.”

The unveiling of Harris’ economic plan comes shortly after Senator JD Vance proposed a $5,000 child tax credit. It is interesting to note that during his time in office, former President Donald Trump had also considered a significant expansion of the child tax credit. While Harris’ proposed credit expansion aligns with President Joe Biden’s agenda, the introduction of a $2,400 bonus for newborns has raised eyebrows among some experts. Specifically, Kyle Pomerleau from the American Enterprise Institute described the newborn bonus as “different and somewhat surprising,” suggesting that it may have been influenced by Vance’s proposal.

Despite the widespread support for an expanded child tax credit, Senate Republicans had previously blocked such a measure that passed in the House. However, there is hope that both parties will revisit the issue after the upcoming election. It is crucial to underscore that the size of the expansion and the future design of the credit will heavily depend on which political party ultimately controls the White House and Congress. The economic repercussions of such an expansion are significant, with estimates suggesting that increasing the child tax credit to $3,000 or $3,600 could cost the government roughly $1.1 trillion over a decade. In comparison, the proposal to extend the credit to $6,000 for newborns could cost around $100 billion.

While the expansion of the child tax credit has proven effective in reducing child poverty rates, there are legitimate concerns about the sustainability of such a costly venture. With the federal budget deficit already a pressing issue, lawmakers are grappling with the prospect of additional tax cuts that could exacerbate the financial burden on the government. It is worth noting that Harris’ economic plan emphasizes a commitment to fiscal responsibility, which includes calls for higher taxes on wealthy individuals and large corporations.

The unveiling of Kamala Harris’ economic plan, particularly the proposal to expand the child tax credit, has generated both support and skepticism. The financial implications of such a plan are substantial, and the success of its implementation will hinge on bipartisan cooperation and prudent decision-making. As the debate surrounding the child tax credit continues, it is essential for policymakers to prioritize the long-term economic stability of the country while addressing the immediate needs of struggling families.