In recent months, China’s real estate sector has faced significant challenges that threaten the nation’s economic stability. With an economy heavily reliant on property markets, this sector’s downturn could have far-reaching implications. As top leaders convened for a high-level meeting, the urgency to reverse this trend became clear. With government officials acknowledging the decline, there is growing pressure on the Chinese Communist Party to implement systemic solutions that could provide relief to both the economy and the populace.

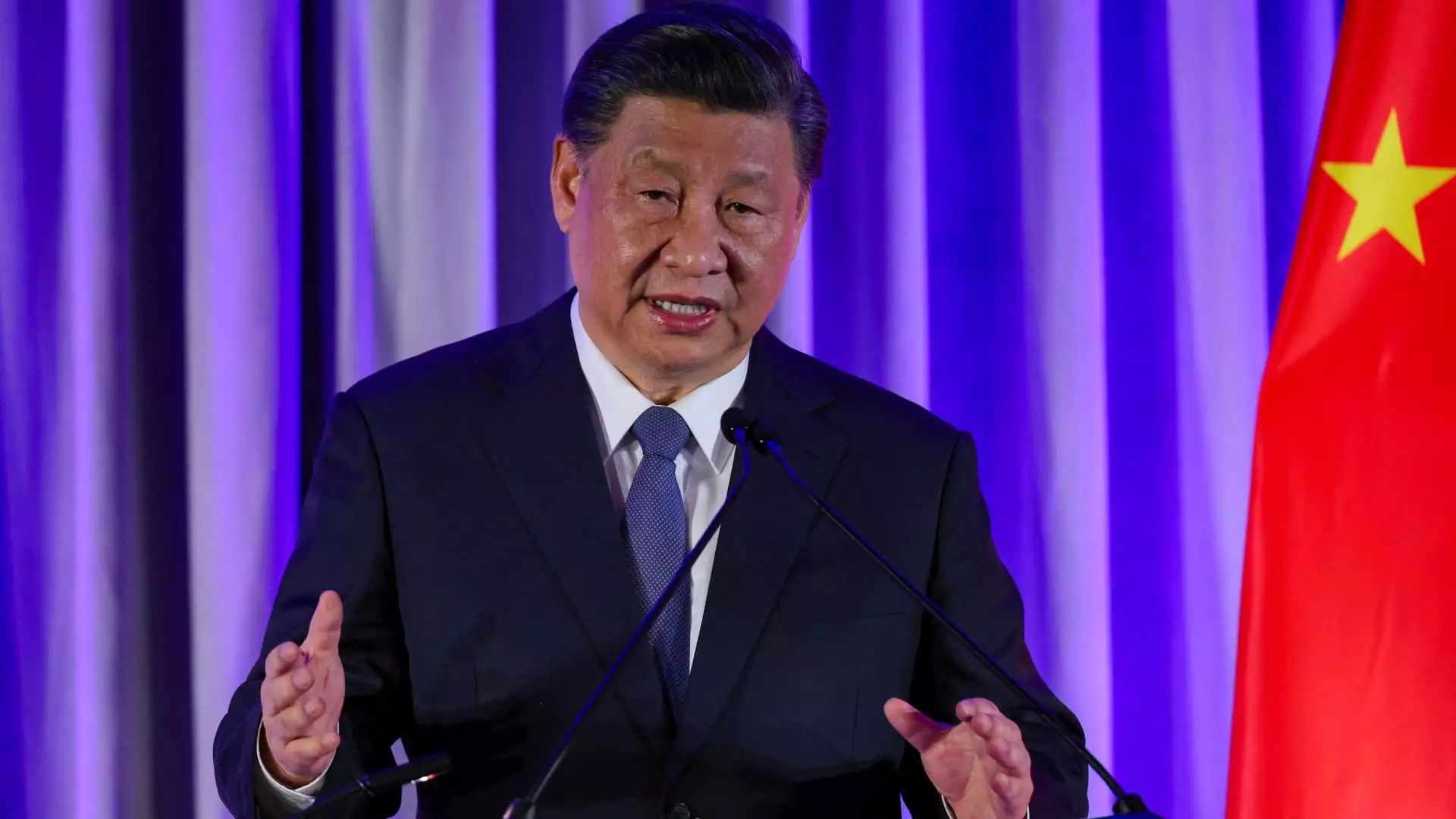

The recent Politburo meeting, chaired by President Xi Jinping, marks a critical juncture in China’s governance. The discussions centered around developing fiscal and monetary measures aimed at halting the real estate slump, addressing societal concerns, and restoring public confidence in the economy. The decision to address these challenges signals that Beijing is aware of the depths of the crisis, especially given the sector’s historical contribution to economic growth.

Despite the optimism in the official statements, the readout from this meeting deliberately left out specific timelines and scale for proposed measures. This vagueness raises questions about the government’s capacity to act decisively. Zhiwei Zhang, an economist, viewed the meeting as a step in the right direction, yet acknowledged that formulating a coherent fiscal package to tackle these economic obstacles could take time.

Following the announcement of the meeting’s outcomes, stock markets in mainland China and Hong Kong experienced a notable upswing, with property stocks in Hong Kong soaring nearly 12%. This immediate market response indicates investor optimism based on the potential for renewed government support; however, it contrasts sharply with the grim reality of ongoing economic deterioration. The real estate sector was once a foundational pillar of China’s economy, accounting for over 25%, but a crackdown on excessive debt in 2020 has instigated a downward spiral.

Concerns over the slumping economy are compounded by the threat to local government revenues and diminished household wealth. The broader economic growth rate has noticeably slowed, leading many observers to question whether China can meet its GDP target of approximately 5% without implementing substantial stimulus measures. Recent interest rate cuts by the People’s Bank of China reflect urgency but also signal underlying worries about economic resilience.

Official statistics depict a stabilizing effect on the declining real estate market, albeit still alarming; home sales fell by 23.6% year-on-year as of August, an improvement compared to the 24.3% decline previously recorded. Moreover, average home prices dropped by 6.8% on a seasonally adjusted basis in August, again reflecting a slower rate of decline than July’s figures. Such data points may hint at a potential bottoming out, fostering hope that households may soon shed their ‘wait-and-see’ approach.

Yue Su, principal economist at the Economist Intelligence Unit, emphasized that reviving consumer engagement is essential to rejuvenating the housing market. There’s a clear strategy emerging: the goal is not merely to elevate home prices for an inflated sense of wealth but to motivate household purchases, fostering a more vibrant economic environment as a whole.

The Politburo’s directives suggest a multifaceted approach to stabilizing the housing sector—limiting growth in housing supply, boosting loans for prioritized projects, and reducing the interest burden on mortgages are among the proposed strategies. The People’s Bank of China’s aim to ease the mortgage payment burdens by 150 billion yuan ($21.37 billion) annually is indicative of a proactive stance.

Nonetheless, the lack of detail surrounding these measures generates skepticism about their efficacy. While recent policy discussions signify a pivot from a focus solely on economic stability to proactive measures, analysts remain divided. While some predict an increased emphasis on initiatives to foster economic growth, others express concern over the ambiguity surrounding fiscal support, suggesting the government may be adopting a more cautious stance.

The Politburo meeting’s focus on stabilizing growth, particularly in the real estate sector, reflects mounting concerns among Chinese policymakers regarding the trajectory of the economy. With analysts estimating a growth rate below the 5% goal for 2024, a new era of more cautious optimism is unfolding. While immediate market reactions may seem favorable, the underlying issues remain complex and multifaceted, requiring sustained attention and innovative strategies. Transitioning towards a more sustainable economic model will require balancing short-term gains with long-term structural adjustments, a daunting task for any government amid a rapidly changing global landscape.