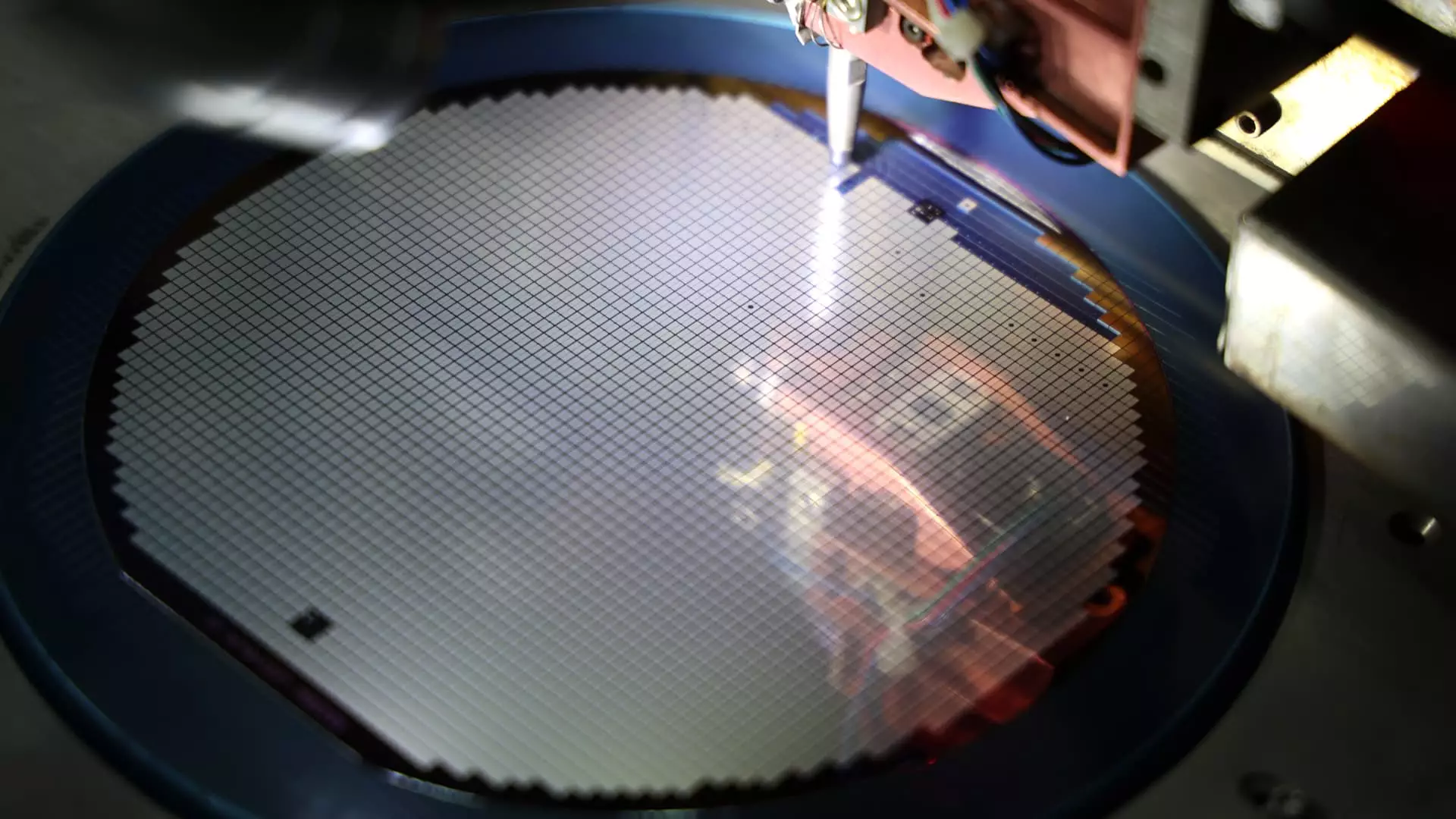

The semiconductor industry has been a focal point in the ongoing trade tensions between the United States and China. Recent reports have shown that four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue. According to analysts at Bank of America, China’s share of revenue for these companies more than doubled from 17% in the fourth quarter of 2022 to 41% in the first quarter of 2024. This surge in revenue highlights China’s efforts to bolster its own semiconductor manufacturing capabilities in response to tighter export restrictions imposed by the U.S.

Impact of Trade Tensions

The intensified trade tensions between the U.S. and China have prompted China to accelerate its purchases of semiconductor manufacturing equipment. The U.S. initiated sweeping export controls in October 2022 on sales of advanced semiconductors and related equipment to China. As a result, China has been focusing on reducing its dependence on foreign technology by investing in domestic semiconductor production. This strategic shift is evident in the rapid increase in the revenue share of semiconductor equipment manufacturers operating in China.

The escalating trade tensions between the U.S. and China pose a significant risk to the global semiconductor industry, particularly as tech companies become entangled in geopolitical disputes. The potential for further escalation in tensions could have far-reaching consequences on the semiconductor supply chain. The Biden administration is reportedly considering broader restrictions on semiconductor equipment exports to China, which could impact not only U.S. companies but also non-U.S. manufacturers.

In response to external pressures, Beijing has been actively promoting self-sufficiency in the tech sector. Chinese leaders have emphasized the importance of reducing reliance on foreign technology and developing indigenous capabilities. This strategic objective was reaffirmed at a recent policy meeting, signaling China’s determination to enhance its technological independence. The surge in semiconductor equipment purchases reflects China’s broader strategy to strengthen its position in the global semiconductor market.

Despite the uncertainties surrounding trade tensions, the semiconductor industry continues to experience growth. The VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has maintained strong gains throughout the year. While recent developments have created volatility in the market, the overall outlook for the semiconductor sector remains positive. Companies operating in this space must navigate the complex landscape of international trade relations while capitalizing on the opportunities for growth and innovation.