In an ambitious attempt to spur economic growth, China recently announced a series of measures aimed at enhancing domestic consumption. This strategy includes the introduction of 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds, dedicated primarily to broadening the existing trade-in and equipment upgrade policies. While the intent behind this initiative is to invigorate consumer spending, initial feedback from businesses suggests that tangible outcomes remain elusive. The implementation of these measures raises critical questions about their effectiveness and potential to genuinely stimulate consumer behavior amidst a backdrop of caution in spending.

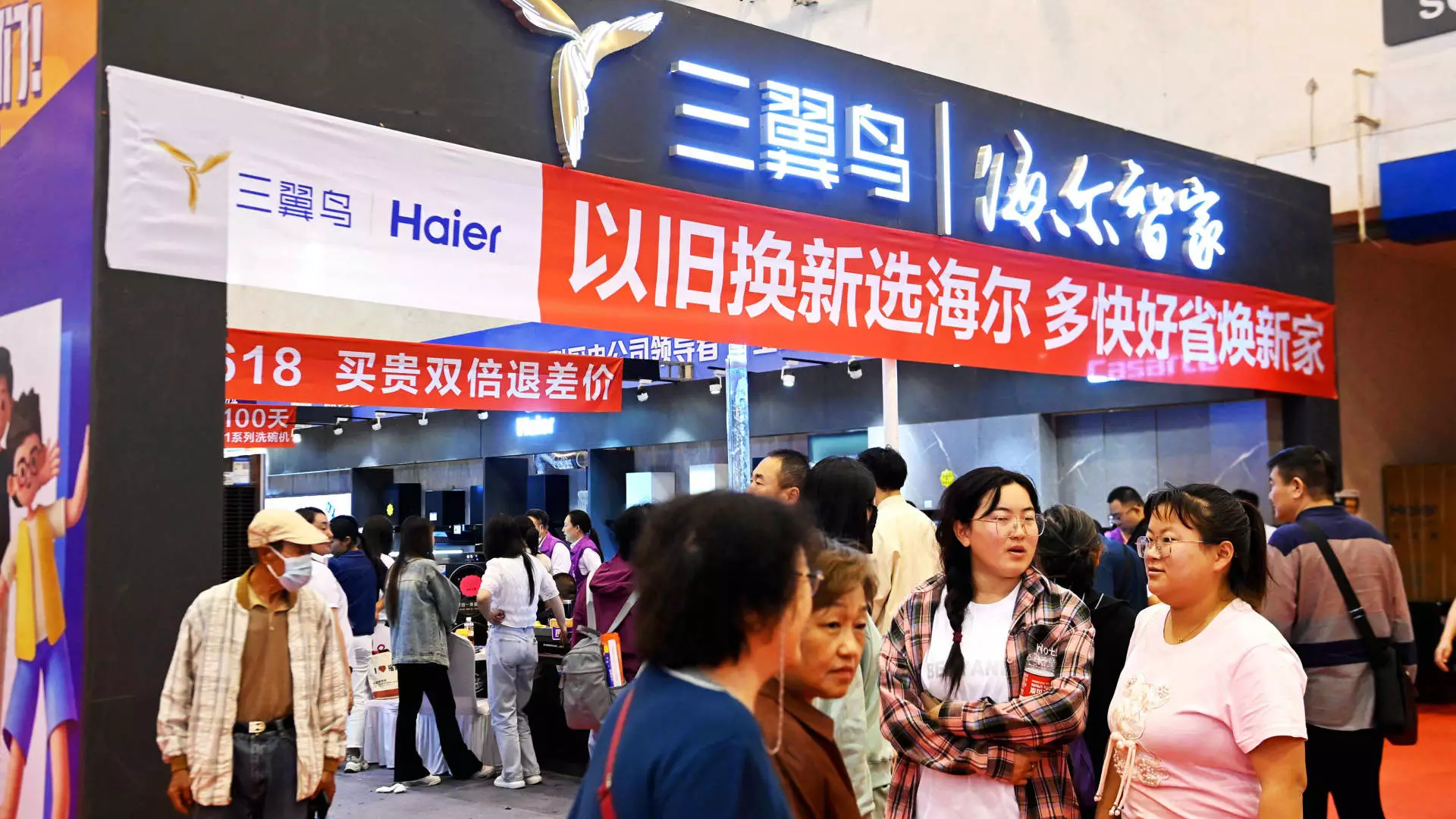

The government’s strategy allocates approximately half of the proposed budget to subsidizing trade-ins for significant consumer goods, such as cars and home appliances, while the remaining funds focus on upgrading large equipment, including elevators. This approach allows local governments to utilize these bonds to encourage consumer purchases and inspire businesses to upgrade their equipment. However, the design of the policy necessitates that consumers invest some resources upfront and possess an old item suitable for trade-in, which may hinder participation. Analysts have expressed skepticism that this measure will substantially lift retail sales, given that many consumers are still hesitant to spend.

Feedback from various sectors indicates a divergence between governmental aspirations and actual market responses. For instance, Jens Eskelund, the president of the EU Chamber of Commerce in China, noted that there has been no significant translation of these policy announcements into visible results on the ground. His observations highlight a critical gap between policy formulation and actual implementation, raising concerns about the real impact on consumer behavior. Moreover, research by the chamber estimated that the per capita budget, approximately 210 yuan ($29.50), is unlikely to provide meaningful incentives for household consumption given that only a fraction may actually reach consumers.

Despite the cautious outlook overall, specific segments, such as new energy vehicles, have reported unexpected sales growth. Notably, sales surged nearly 37% in July against a backdrop of a general decline in the passenger car market. This suggests that certain areas within the broader consumer landscape may respond more favorably to trade-in incentives than others.

Economic analysts remain cautious in their projections concerning retail growth fueled by this trade-in program. Switzerland-based UBS Investment Bank estimates that the new trade-in initiative could potentially bolster retail sales by only 0.3% this year. The slow growth noted in recent months—retail sales increased merely 2% in June and slightly improved to 2.7% in July—reflects a continued trend of weak consumer spending, underscoring the fragility of the economic recovery.

To evaluate the success of the trade-in measures, analysts will closely monitor forthcoming retail sales data. If spending remains stagnant or grows marginally, it may prompt reconsideration of the policies or further adjustments to better address consumer hesitations.

Elevator manufacturers, which are among the key beneficiaries of the trade-in policy, have also expressed concerns regarding the early stages of implementation. Major companies like Otis and Kone have indicated a lack of clarity around the distribution of subsidy funds aimed at upgrading aging infrastructure. Many elevators in China have surpassed their operational life spans, emphasizing the urgency of their replacement.

Kone, for example, has indicated cautious optimism about future opportunities but has acknowledged the slow rollout of the trade-in initiative. Although the government’s focus on energy-efficient replacements may eventually yield results, industry stakeholders recognize that localized implementation varies significantly, causing delays in converting potential interest into immediate orders.

The objective of China’s trade-in policy represents a critical step towards invigorating domestic consumption in a post-pandemic economy, yet significant hurdles remain in translating policy into practice. While some sectors may showcase resilience, the overall economic landscape appears cautious, necessitating a more aggressive and transparent approach to stimulate genuine engagement from consumers and businesses alike. For this initiative to succeed, clearer communication, proactive execution, and sustained support from both central and local governments will be crucial to fostering the public’s confidence and encouraging a vibrant marketplace. As economic conditions evolve and consumer behaviors shift, the coming months will serve as a critical period to assess the effectiveness of these strategies in bolstering China’s economy.