AppLovin, a firm entrenched in online gaming and digital advertising, experienced an extraordinary 45% surge in its stock value on Thursday. This leap followed the company’s release of an optimistic earnings forecast that surpassed analyst expectations, alongside earnings and revenue results that performed even better than anticipated. As of early afternoon trading, AppLovin shares soared past the $245 mark, solidifying an impressive 515% increase in value since the beginning of the year. Such a leap has propelled the company’s market capitalization to over $80 billion, far exceeding the growth trajectory of its competitors within the tech space valued at $5 billion or more.

In the third quarter, AppLovin reported a remarkable 39% year-on-year increase in revenue, amounting to $1.2 billion—comfortably above the average projection of $1.13 billion by analysts. Furthermore, the firm recorded earnings per share of $1.25, well above the predicted 92 cents. Looking forward, the company anticipates fourth-quarter revenue to land between $1.24 billion and $1.26 billion, indicating a robust growth forecast of roughly 31% at the midpoint, a projection that exceeds previous analyst expectations of around $1.18 billion.

Although AppLovin started as a games company, recent advancements reveal that its online advertising division is the powerhouse driving its explosive growth rates. Central to this growth is AppLovin’s AI-driven advertising engine, AXON, which has greatly enhanced targeting capabilities, especially after the rollout of its 2.0 version in the previous year. The popularity of this software is reflected in the 66% increase in revenue from the software platform, which amounted to $835 million in the last quarter alone, driven largely by the efficacy of AXON’s models. The company has credited these advancements for enabling advertising partners to amplify their spending effectively.

Beyond revenue generation, AppLovin’s profitability figures have also captured Wall Street’s interest. The net income for the quarter surged by a staggering 300% to $434.4 million—or $1.25 per share—up from $108.6 million, which equated to 30 cents per share, a year prior. The substantial profit margin of 78% for their software platform has drawn commendations from analysts, who have responded favorably by raising their price target from $170 to $270, strongly recommending the stock.

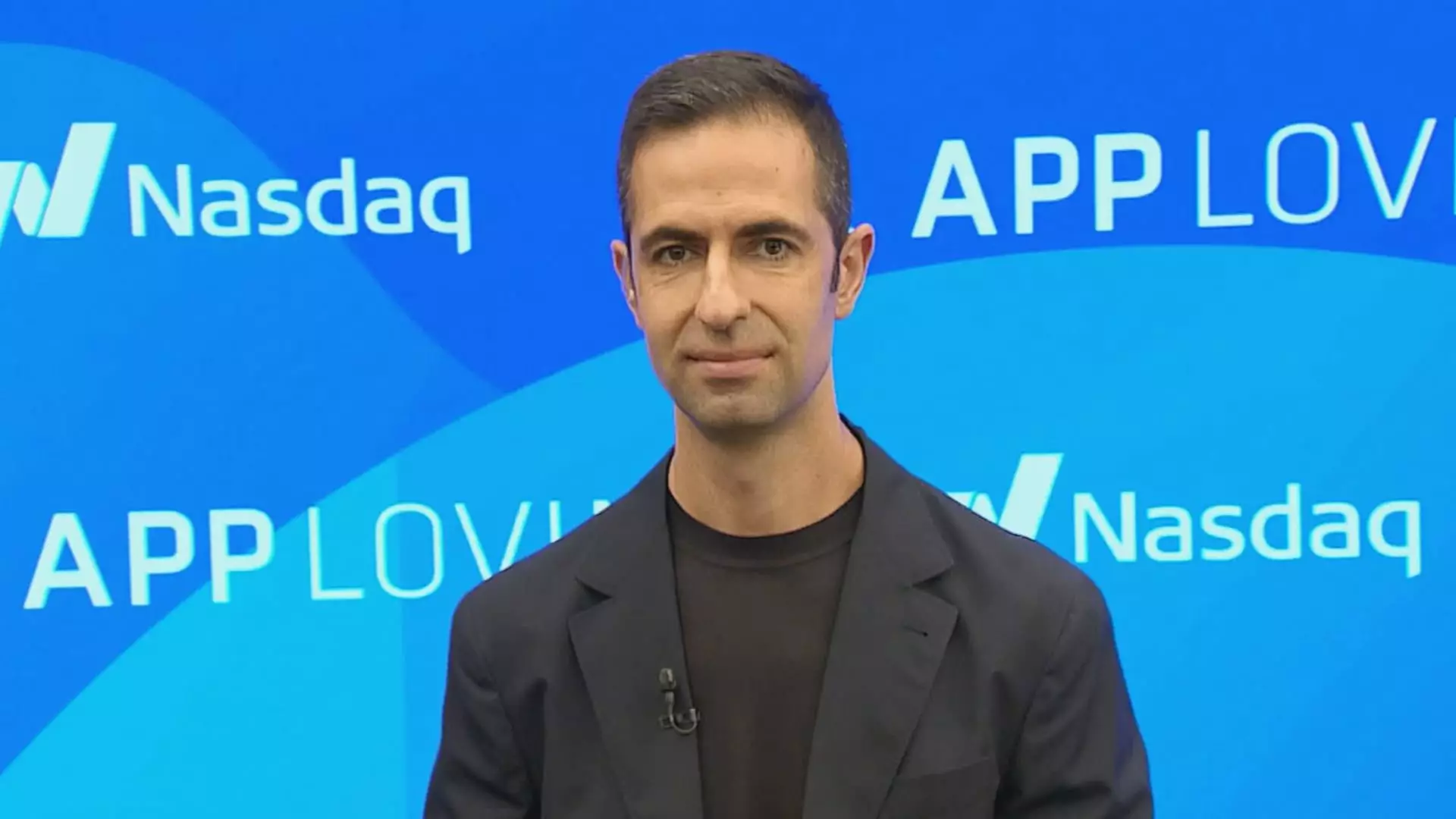

CEO Adam Foroughi, whose personal fortunes markedly increased by over $2 billion to approximately $7.4 billion following the stock surge, shared insights on a pilot e-commerce initiative during the earnings call. This venture integrates targeted advertisements within games, demonstrating AppLovin’s commitment to innovating and diversifying their revenue streams. Foroughi emphasized the project’s potential, citing it as the most compelling product the company has launched, enhancing their portfolio and industry standing.

AppLovin’s recent financial success reflects remarkable growth driven by innovative AI technology, a burgeoning advertising sector, and a forward-looking strategy that keeps investors optimistic about the company’s trajectory in the fast-evolving tech landscape.