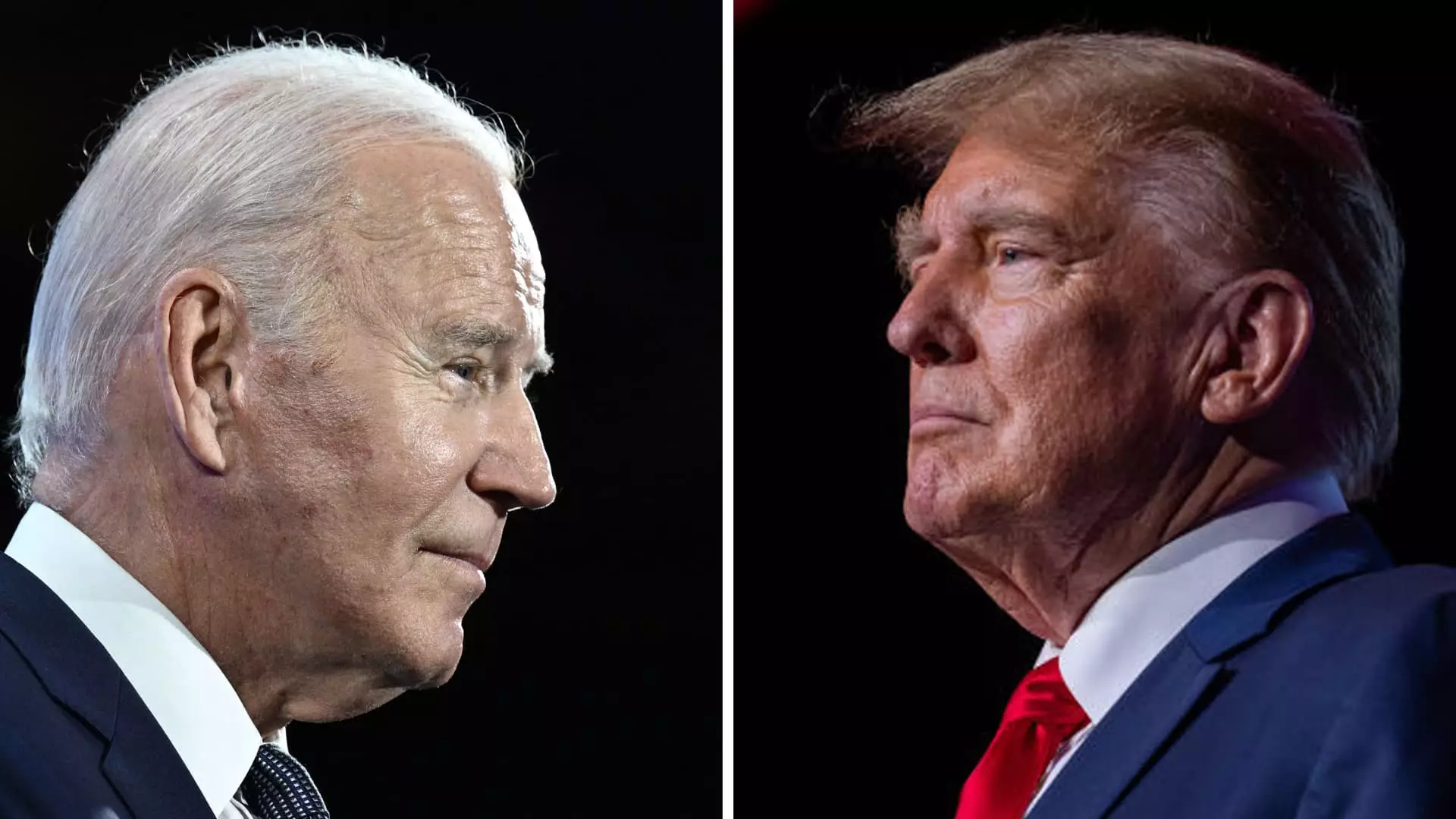

As the 2025 deadline for the expiration of crucial tax breaks enacted by former President Donald Trump approaches, both President Joe Biden and Trump have pledged to extend these provisions for most Americans. However, the real challenge lies in determining how these extensions will be funded given the looming federal budget deficit. This article aims to delve into the implications of extending these tax breaks under the two administrations, highlighting the potential economic impacts and feasibility of such decisions.

Trillions of dollars in tax breaks introduced by Trump through the Tax Cuts and Jobs Act of 2017 are set to expire after 2025 if no action is taken by Congress. These tax breaks encompass various provisions such as lower federal income brackets, higher standard deductions, and a more generous child tax credit. According to the Tax Foundation, over 60% of taxpayers will face increased taxes if these provisions are allowed to expire. The impending federal budget deficit poses a significant hurdle as the deadline approaches, raising questions about how these extensions will be financed.

Fully extending the Tax Cuts and Jobs Act provisions could potentially add a staggering $4.6 trillion to the deficit over the next decade, as reported by the Congressional Budget Office in May. This figure represents a 50% increase from the initial estimates provided in 2018. While some proponents argue that economic growth resulting from these tax cuts would offset a portion of the costs, studies have shown that the effects were far less significant than anticipated. Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, emphasized that the Tax Cuts and Jobs Act did not come close to paying for itself, casting doubt on the feasibility of extending or making these provisions permanent.

President Biden intends to extend tax breaks for individuals earning below $400,000, which encompasses the majority of Americans. His economic advisor, Lael Brainard, has advocated for higher taxes on the ultra-wealthy and corporations to fund these extensions for the middle class. In contrast, Trump has reiterated his support for tariffs on imported goods as a means of generating revenue. However, the uncertainty surrounding these policy proposals is amplified by the lack of clarity on which party will secure control of the White House and Congress.

The decision to extend expiring tax breaks introduced under the Tax Cuts and Jobs Act of 2017 poses a complex challenge for both the Biden and Trump administrations. While both candidates have expressed intentions to safeguard these provisions for most Americans, the economic viability of such extensions remains a contentious issue. As the 2025 deadline draws nearer, policymakers will need to navigate the delicate balance between stimulating economic growth and addressing the federal budget deficit. The repercussions of these decisions will undoubtedly shape the future economic landscape of the United States.