The recent livestream of the CNBC Investing Club with Jim Cramer highlighted the positive rebound of the U.S. stock market on Wednesday. After a three-day losing streak, the S & P 500 surged by 1.5%, with the Dow Jones Industrial Average and Nasdaq Composite also posting significant gains of 1% and 1.9% respectively. Jim Cramer expressed optimism about the market performance, referring to the previous day’s decline as possibly just a “one-day glitch”. The sell-off was attributed to the unwinding of the “yen carry trade” and concerns about a U.S. recession following a disappointing jobs report.

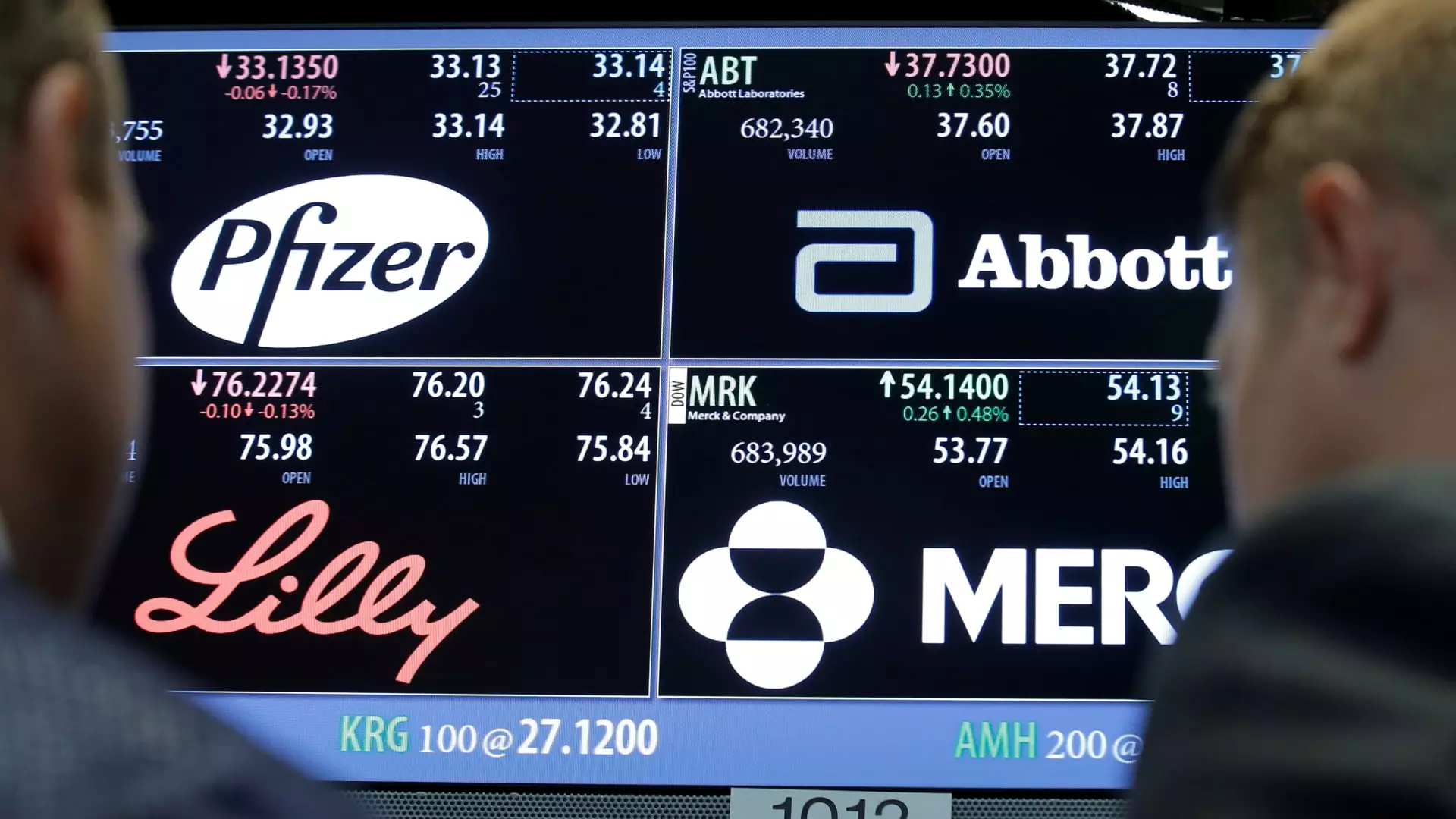

During the livestream, the decline of Eli Lilly shares by 1.7% was discussed in light of Novo Nordisk’s disappointing earnings results earlier in the day. Novo Nordisk reported a weaker-than-expected net profit and missed sales expectations for its weight-loss drug. Investors are now questioning whether Eli Lilly, particularly their GLP-1 drugs Zepbound and Mounjaro, could face a similar fate. While Novo Nordisk’s sales miss was attributed to concessions made to U.S. pharmacy benefit managers rather than softening demand, there is still concern about Eli Lilly’s upcoming quarterly results. Jim Cramer acknowledged the possibility of further share declines for Eli Lilly but also expressed optimism about the company’s overall potential.

Another highlight of the livestream was the positive news for Amazon’s e-commerce business following CVS Health’s quarterly earnings report. CVS Health announced plans to close 900 retail drug stores by the end of the year as part of a restructuring initiative that began in 2022. This development was seen as an opportunity for Amazon to further establish itself as a go-to platform for everyday essential items. Consequently, Amazon’s stock saw a nearly 3% increase in value on Wednesday. Jim Cramer’s Charitable Trust holds positions in both Eli Lilly and Amazon, reflecting his confidence in these companies.

Trading Alerts

As a subscriber to the CNBC Investing Club with Jim Cramer, individuals receive trade alerts before Jim makes a trade. Jim adheres to specific waiting periods before executing trades in his charitable trust’s portfolio, such as waiting 45 minutes after sending a trade alert or 72 hours after discussing a stock on CNBC TV. These practices are in place to ensure transparency and strategic decision-making in the club’s investment activities. It is important for subscribers to be aware of the terms and conditions, privacy policy, and disclaimer of the club, as no specific outcome or profit is guaranteed.

The CNBC Investing Club with Jim Cramer livestream provided valuable insights into the market rebound, challenges faced by companies like Eli Lilly, positive developments for Amazon, and the trading practices of the club. The analysis and recap of key moments from the livestream underscore the importance of staying informed, making strategic investment decisions, and being prepared for market fluctuations.