Philadelphia Federal Reserve President Patrick Harker has recently spoken out in favor of an interest rate cut in September, providing a strong endorsement for the move. His statement during the Fed’s annual retreat in Jackson Hole, Wyoming, indicated a high level of confidence in the necessity of monetary policy easing in the near future. This endorsement comes at a time when officials are increasingly concerned about the trajectory of inflation and the potential weaknesses in the labor market. Harker’s direct approach to the issue signals a significant shift in the Fed’s stance.

Market Predictions and Uncertainty

While markets are currently pricing in a 100% chance of a quarter percentage point rate cut, with a smaller chance of a 50 basis point reduction, Harker himself remains cautious about the decision. He emphasized the need for more data before committing to a specific rate cut amount, indicating that he is not firmly in the camp of either option at this time. This uncertainty adds a layer of complexity to the decision-making process, especially as the Fed seeks to strike a balance between supporting economic growth and controlling inflation.

Independence from Political Concerns

Harker reiterated the Fed’s commitment to making policy decisions independently of any political considerations, particularly as the presidential election draws closer. He emphasized the role of the Fed as “proud technocrats” whose duty is to analyze data objectively and respond accordingly. This commitment to data-driven decision-making reinforces the Fed’s credibility and underscores the importance of maintaining independence from external pressures.

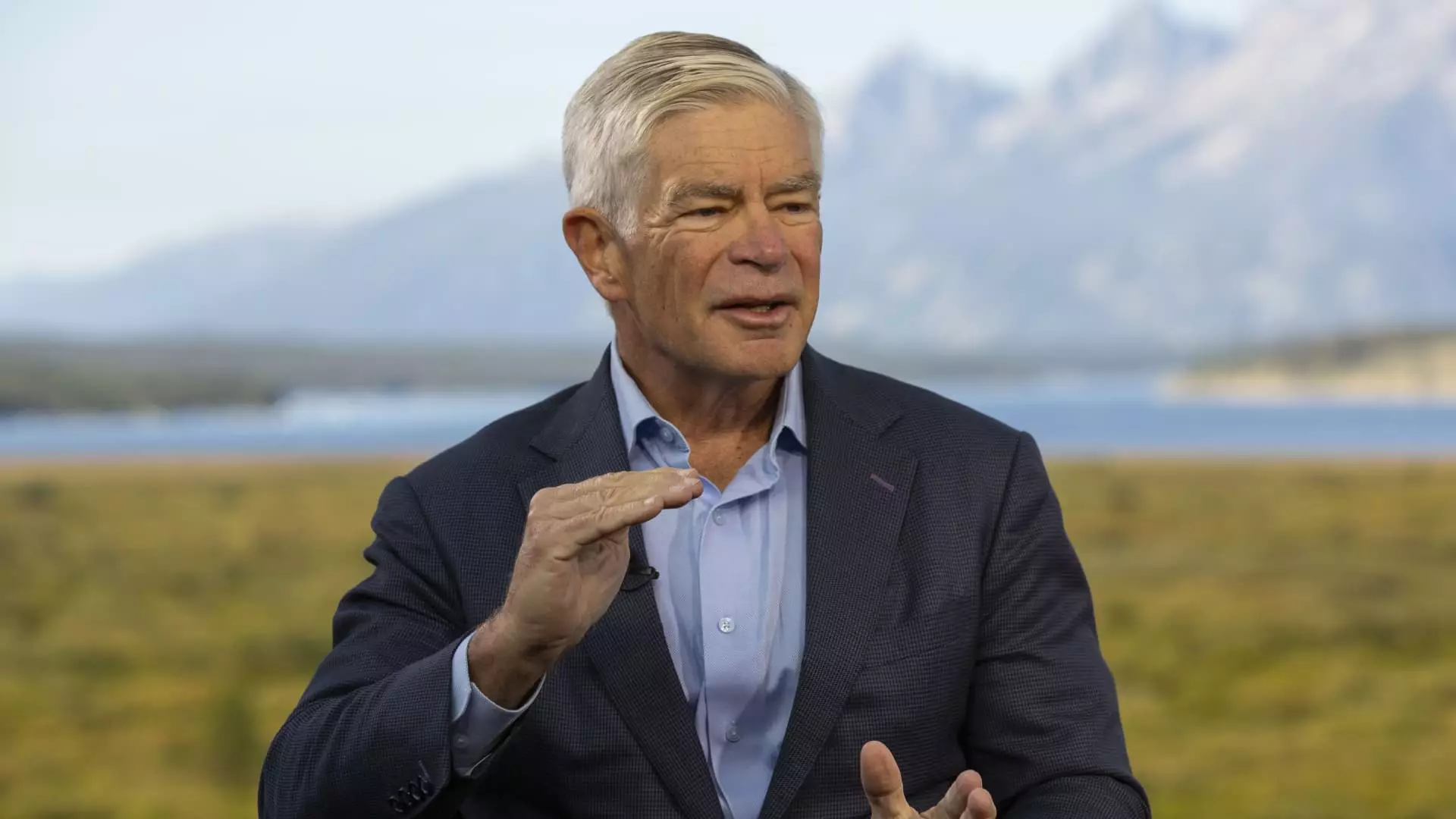

Kansas City Fed President Jeffrey Schmid also weighed in on the future of policy, highlighting the challenges in the labor market as a key factor influencing the decision to cut interest rates. Schmid pointed to rising unemployment rates and a shift in the supply-demand dynamics as contributors to the inflationary pressures that have characterized recent months. While acknowledging some improvement in the labor market conditions, Schmid emphasized the need for continued vigilance and proactive measures to address any remaining weaknesses.

Schmid expressed his belief that banks have weathered the high-rate environment well and that monetary policy is not overly restrictive at this time. This assessment suggests a measured approach to policy adjustments, aiming to strike a balance between supporting growth and maintaining stability in the financial system. Schmid’s perspective offers a more nuanced view of the situation, indicating that while challenges exist, they are not insurmountable with the right policy measures in place.

Future Voting Schedule

Both Harker and Schmid are non-voting members of the Federal Open Market Committee this year, but their input at meetings remains valuable in shaping policy decisions. Harker is scheduled to vote on rates next in 2026, while Schmid will have a vote next year. This timeline underscores the continuity of decision-making processes at the Fed and the importance of consistent engagement from all members, whether voting or non-voting, in shaping the future direction of monetary policy.