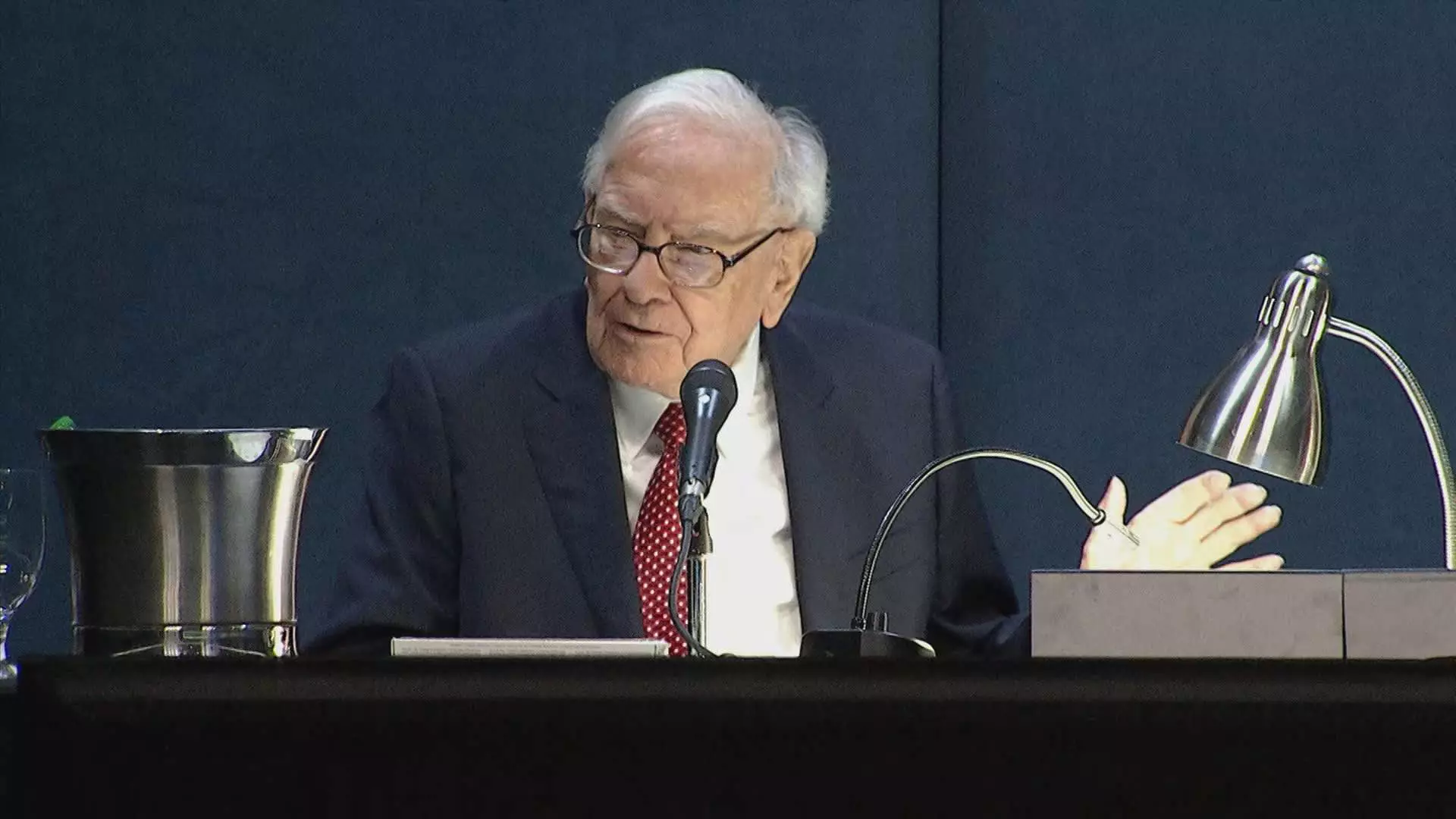

Warren Buffett, also known as the “Oracle of Omaha,” has sparked curiosity among his followers with his recent move in the stock market. After cutting his tech holdings by half, Buffett now owns the exact same number of shares in Apple as he does in Coca-Cola. This intriguing coincidence was revealed in a regulatory filing that showed a 400 million share count in both Apple and Coca-Cola, raising questions about Buffett’s strategic investment decisions.

Buffett’s long-standing position in Coca-Cola has been a key component of his investment portfolio for over 30 years. He first acquired shares of Coca-Cola in 1988 and steadily increased his stake to reach 100 million shares by 1994. With the impact of stock splits in 2006 and 2012, Berkshire’s Coca-Cola holding reached the round number of 400 million shares, mirroring his current share count in Apple. This similarity has led some to speculate that Buffett’s attachment to round numbers may indicate a reluctance to further reduce his stake in Apple.

Despite being known for his value investing principles, Buffett’s investment in tech giant Apple has raised eyebrows in the financial world. However, Buffett has emphasized that he views Apple more as a consumer products company, akin to Coca-Cola, rather than a traditional tech investment. He has praised the loyalty of Apple’s customer base, likening the significance of the iPhone to that of a car. This consumer-centric approach has guided Buffett’s investment strategy, highlighting his unique perspective on the tech industry.

The recent reduction in Berkshire’s stake in Apple by over 49% has led to speculation about Buffett’s intentions. While some have interpreted this move as a strategic portfolio adjustment, others believe it may be influenced by broader market trends. Despite this significant sale, Berkshire’s Apple holding remains at a consistent round number of 400 million shares, indicating a deliberate choice in maintaining this position. Additionally, Buffett’s comparison of Apple to Coca-Cola as long-term investments reinforces the idea of strategic planning in his portfolio.

Buffett’s investment decisions have always been closely scrutinized by market observers, given his reputation as a seasoned investor. While some view his equal shareholding in Apple and Coca-Cola as a coincidence, others see it as a deliberate strategy. Buffett’s emphasis on consumer attractiveness and long-term holding periods for both companies suggests a methodical approach to his equity investments. As Berkshire’s portfolio continues to evolve, investors will be watching closely to decipher the underlying rationale behind Buffett’s moves in the market.

Warren Buffett’s unique investment style and strategic decision-making have once again captured the attention of the financial community. His equal shareholding in Apple and Coca-Cola reflects a blend of long-term vision, consumer focus, and round-number preferences. As Buffett continues to navigate the complex landscape of the stock market, his followers will be eagerly awaiting his next move and the insightful wisdom he imparts on the investment world.