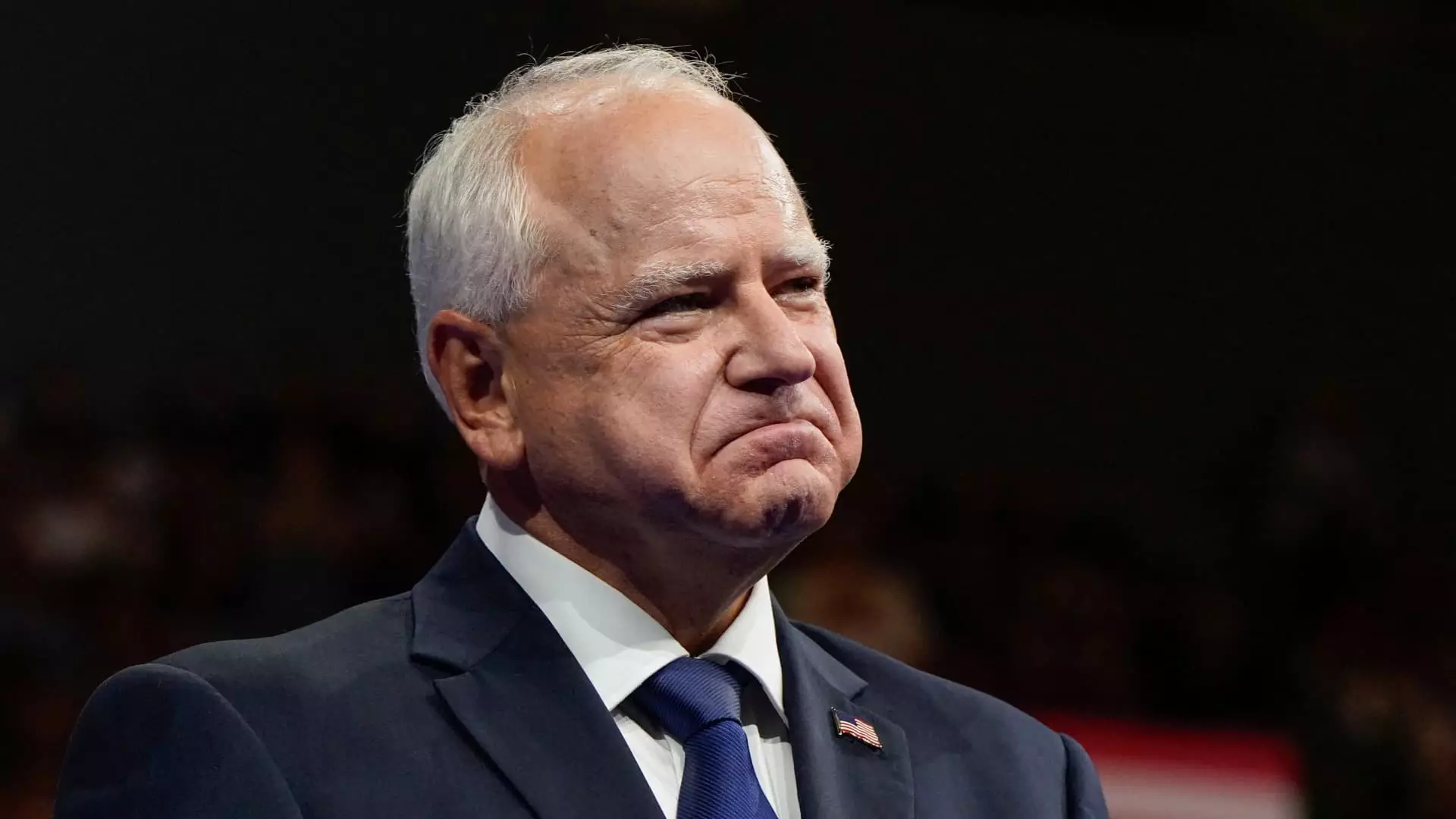

The issue of exempting Social Security from income taxes has gained bipartisan support, with notable figures like Former President Donald Trump and Minnesota Gov. Tim Walz advocating for such a policy. Trump, in a recent interview, emphasized the need to provide relief to seniors on Social Security by eliminating taxes on their benefits. This proposal comes in the wake of increasing financial strain on retirees, highlighting the urgency of addressing this issue.

While both federal and state governments are considering measures to exempt Social Security from income taxes, there are significant differences in their approach. Federal income taxes on Social Security are determined by “combined income,” which includes various factors such as adjusted gross income and non-taxable interest. The thresholds for taxation vary based on filing status, with up to 85% of benefits being subject to tax for certain income levels. On the other hand, Minnesota’s state legislation focuses on expanding tax exemptions for Social Security recipients with lower adjusted gross incomes, providing relief to a specific group of seniors.

The proposal to exempt Social Security from federal income tax, as suggested by Trump, has the potential to be transformative. According to experts, such a policy could have significant implications for the budget deficit and the overall funding of Social Security. Estimates suggest that implementing this exemption could increase the budget deficit by $1.6 trillion over 10 years, accelerating the insolvency of Social Security and Medicare trust funds. While Trump’s campaign has not provided additional comments on this proposal, the potential impact on the future sustainability of these programs cannot be ignored.

In contrast to the federal proposal, Minnesota has taken a more targeted approach to tax exemptions for Social Security. By expanding the state tax exemption for most seniors, Minnesota aims to alleviate the tax burden on a specific income group. This state-level initiative, enacted in 2023, reflects a different strategy compared to the broad federal proposal. While Minnesota’s policy aligns with other states that exempt Social Security benefits from income taxes, the impact on state revenue and budget considerations may vary.

The debate surrounding the exemption of Social Security from income taxes raises important considerations for both policymakers and beneficiaries. While the intention behind these proposals is to provide relief to seniors and address financial challenges, the potential long-term consequences must be carefully evaluated. The impact on the budget deficit, program solvency, and overall fiscal sustainability of Social Security and Medicare is significant and requires a comprehensive analysis. States like Minnesota have the opportunity to implement targeted measures to support seniors, but the broader implications of such policies should be closely monitored. It is essential to strike a balance between providing immediate relief and ensuring the long-term viability of social safety net programs.