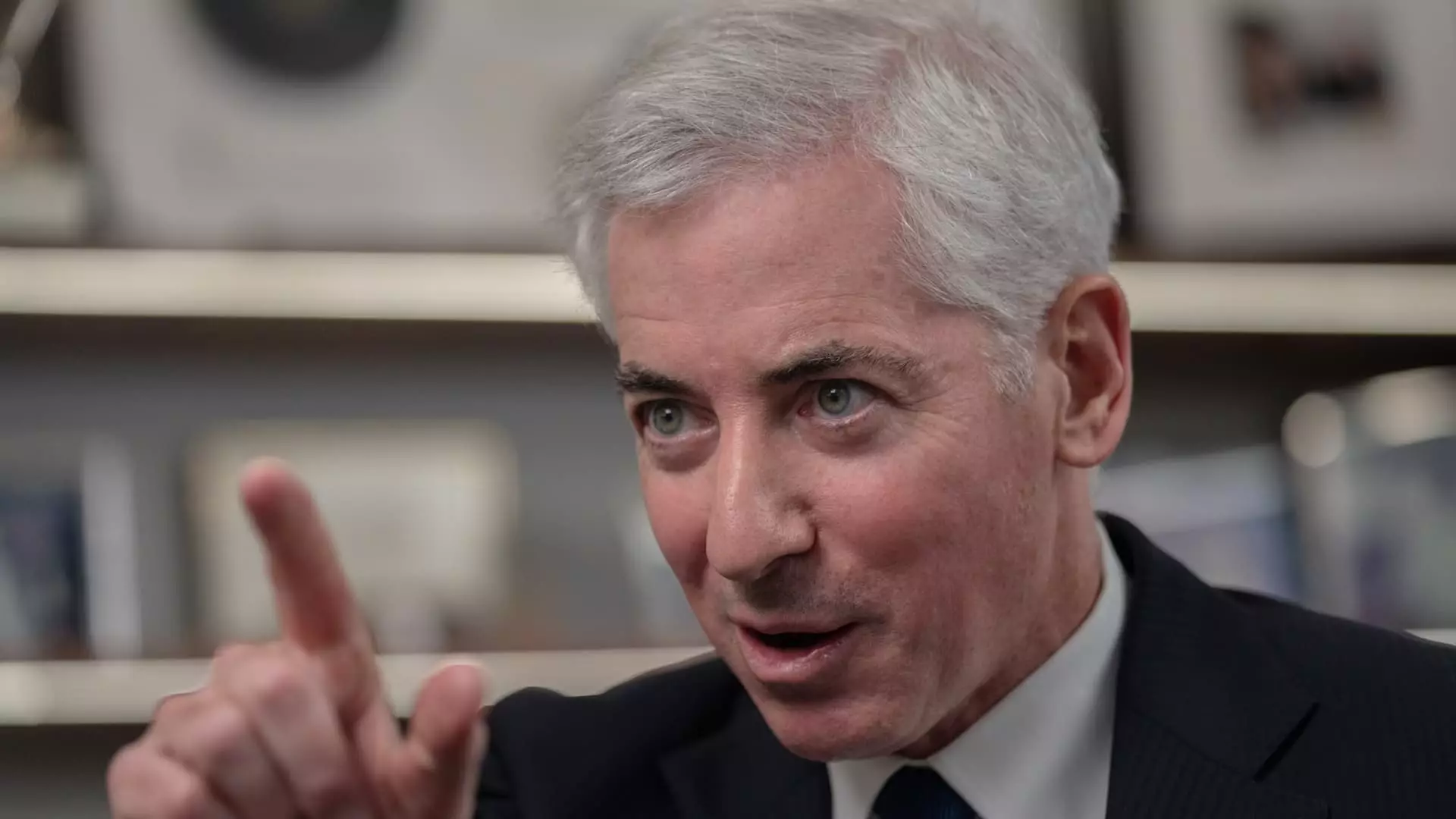

Bill Ackman’s Pershing Square USA faced a setback in its initial public offering plans after investor demand appeared to fall short of original expectations. The hedge fund titan, Bill Ackman, announced the withdrawal of the IPO, but reassured investors that he would be back with a revised plan for the offering. Ackman had initially aimed to model his fund after Berkshire Hathaway, but had to reevaluate his approach due to the lackluster response from investors.

The decision to withdraw the IPO plans came just a day after Pershing Square announced its intentions to raise $2 billion, a significant reduction from the previously speculated $25 billion. This drastic change in fundraising goals raised concerns among potential investors and led to the fund’s withdrawal from the IPO market.

The delay in Pershing Square’s public listing was evident from a notice on the New York Stock Exchange’s website, which indicated that the billionaire investor was postponing his IPO. With $18.7 billion in assets under management as of June, Pershing Square had high hopes for the public offering but had to face the reality of investor interest falling short of expectations.

A significant blow to Ackman’s IPO plans came when Baupost Group opted against investing in the offering, despite Ackman’s earlier claims that Seth Klarman’s Boston-based hedge fund was participating. This investor backlash raised questions about Ackman’s ability to attract top-tier investors and cast doubts on the success of Pershing Square’s revised IPO plans.

Ackman’s decision to publicly list Pershing Square was seen as a strategic move to tap into the growing trend of retail investors. With over one million followers on social media platform X, Ackman had built a strong online presence where he shared his views on various topics, including the U.S. presidential election and antisemitism. However, the lack of institutional investor support could be a significant challenge for Pershing Square in its future fundraising efforts.

Bill Ackman’s Pershing Square USA faced a setback in its IPO plans due to a lack of investor demand and reduced fundraising goals. The delay in the public listing and the backlash from institutional investors have raised concerns about the fund’s future prospects. Ackman’s strategy to attract retail investors may not be enough to overcome the challenges posed by the failed IPO attempt.