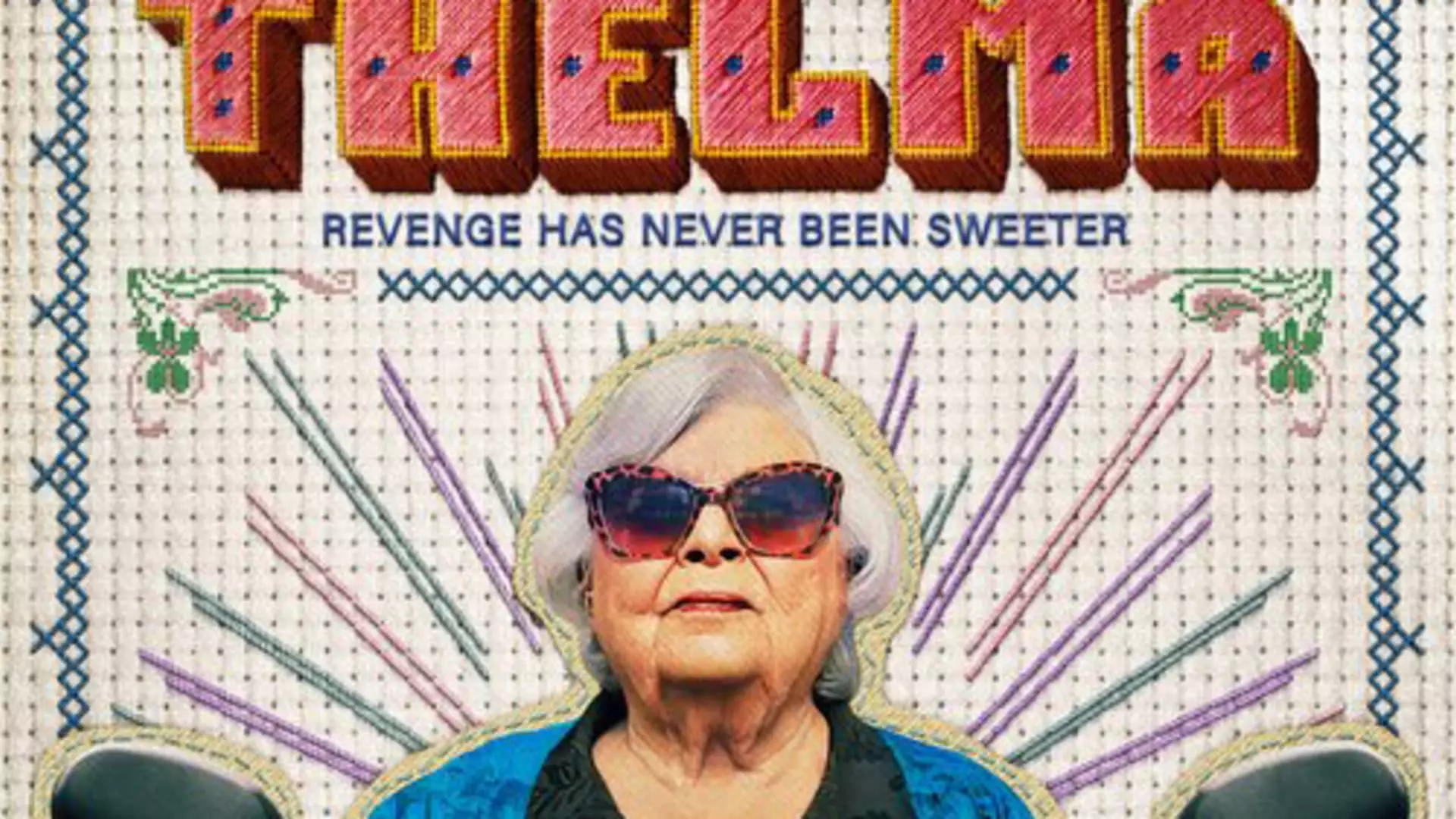

As portrayed in the movie “Thelma,” the elderly are particularly vulnerable to scams that prey on their emotions and ability to make quick decisions. The story of Thelma Post, a 93-year-old grandmother who almost fell victim to a family emergency scam, sheds light on the increasing threat of imposter fraud in today’s society. The ease with which scammers can use artificial intelligence to manipulate voices and create distressing situations for their targets is a concerning trend. Thelma’s near miss with losing $10,000 to scammers highlights the urgency for vigilance among the elderly population.

Imposter fraud, particularly in the form of family emergency scams, is on the rise, with losses reaching nearly $2.7 billion last year alone. The prevalence of these scams is evident in the fact that imposter fraud was the most reported type of fraud to the FTC in 2023. The use of generative AI to create deep fake voice calls adds another layer of sophistication to these scams, making it increasingly difficult for individuals to discern real from fake. The emotional manipulation and urgency tactics used by scammers further exacerbate the vulnerability of the elderly and other at-risk populations to falling victim to these schemes.

The Impact on Vulnerable Populations

While the elderly are often targeted due to their cognitive decline and slower decision-making processes, younger populations are not immune to the threat of imposter fraud. With the prevalence of social media and online interactions, younger individuals are increasingly vulnerable to falling victim to scams that rely on fear and urgency tactics to compel quick action. The need for awareness and education on recognizing and preventing scams is essential for protecting vulnerable populations from financial exploitation and emotional distress.

Establishing an aging plan and involving family members in discussions about financial surrogate roles can help proactively address the risk of falling victim to scams in later life. Basic security practices such as freezing credit, implementing multifactor authentication, and investing in identity theft insurance can serve as protective measures against potential scams. By taking proactive steps to safeguard personal information and financial assets, individuals can mitigate the risk of falling prey to imposter fraud and other forms of financial exploitation.

The threat of scams targeting the elderly and vulnerable populations is a pressing concern in today’s increasingly digital and interconnected world. The rise of imposter fraud and the use of AI technology to manipulate voices and create fraudulent scenarios pose significant challenges to individuals’ ability to discern real threats from fraudulent schemes. By raising awareness, promoting education, and implementing preventive measures, we can work towards protecting vulnerable populations from falling victim to scams and financial exploitation. It is essential for individuals to remain vigilant, seek support from trusted sources, and take proactive steps to safeguard their financial well-being and personal security.