Berkshire Hathaway, a conglomerate led by Warren Buffett, has been gradually reducing its stake in China’s largest electric vehicle maker, BYD. The recent sale of 1.3 million Hong Kong-listed shares for $39.8 million has brought down Berkshire’s holding from 7% to 6.9%. This move signals a shift in the investment strategy of the conglomerate, which initially acquired around 225 million shares of BYD in 2008 for approximately $230 million.

The decision to invest in BYD has proven to be highly profitable for Berkshire Hathaway, thanks to the foresight of the late Charlie Munger, who introduced the conglomerate to the opportunity. The explosive growth of the electric vehicle market in China and beyond has significantly boosted the value of BYD’s shares, enabling Berkshire to capitalize on the lucrative investment. Despite selling off half of its holding through sales in 2022 and 2023, Berkshire continues to maintain a substantial stake in BYD.

Founded by Wang Chuanfu, BYD initially focused on producing batteries for mobile phones in the 1990s before transitioning to the automotive industry in 2003. Since then, the company has emerged as a leading car brand in China and a prominent manufacturer of electric vehicle batteries. In the fourth quarter of 2023, BYD surpassed Tesla to become the world’s top electric vehicle maker, underscoring its rapid growth and market dominance.

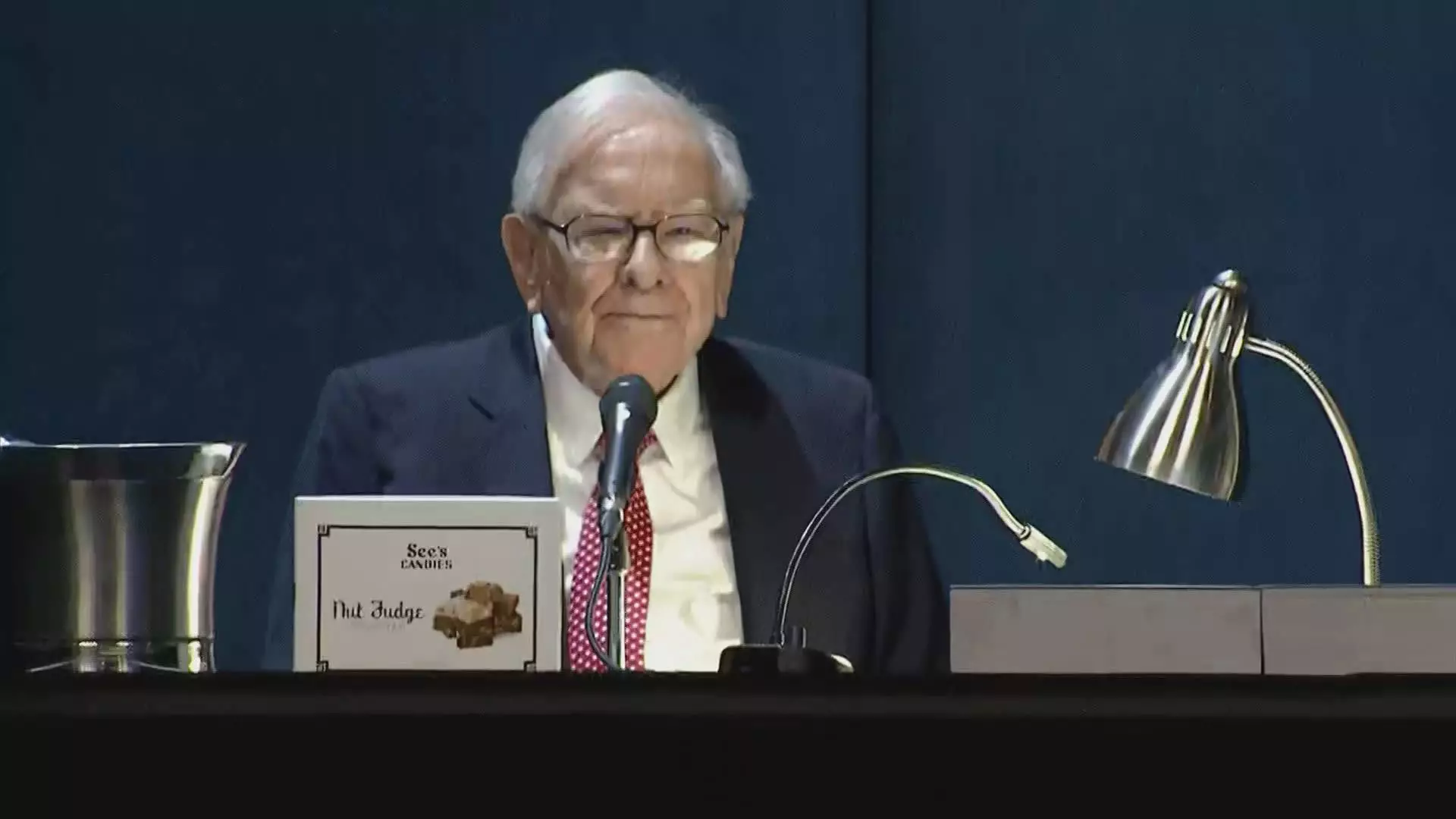

Warren Buffett attributes much of the success of Berkshire Hathaway’s investment in BYD to Charlie Munger, the late vice-chairman of the conglomerate. Munger, introduced to BYD by his friend Li Lu, played a pivotal role in identifying the potential of the electric vehicle maker and advocating for its inclusion in Berkshire’s investment portfolio. Buffett acknowledged Munger’s foresight and vision in recognizing the opportunity presented by BYD, highlighting the importance of having knowledgeable and strategic partners in the investment decision-making process.