GameStop shares faced a significant sell-off on Wednesday afternoon, causing concern among investors. This sell-off coincided with a surge in trading volume in call options owned by the infamous “Roaring Kitty,” whose real name is Keith Gill. Gill revealed on Monday night that he still held 120,000 call options contracts with a strike price of $20 and an expiration date of June 21. The trading volume of GameStop calls with the same strike price and expiration date skyrocketed to 93,266 contracts on Wednesday, far exceeding its 30-day average volume of 10,233 contracts. As a result, the price of these contracts plummeted by more than 40%, leading to a 16.5% drop in the stock price.

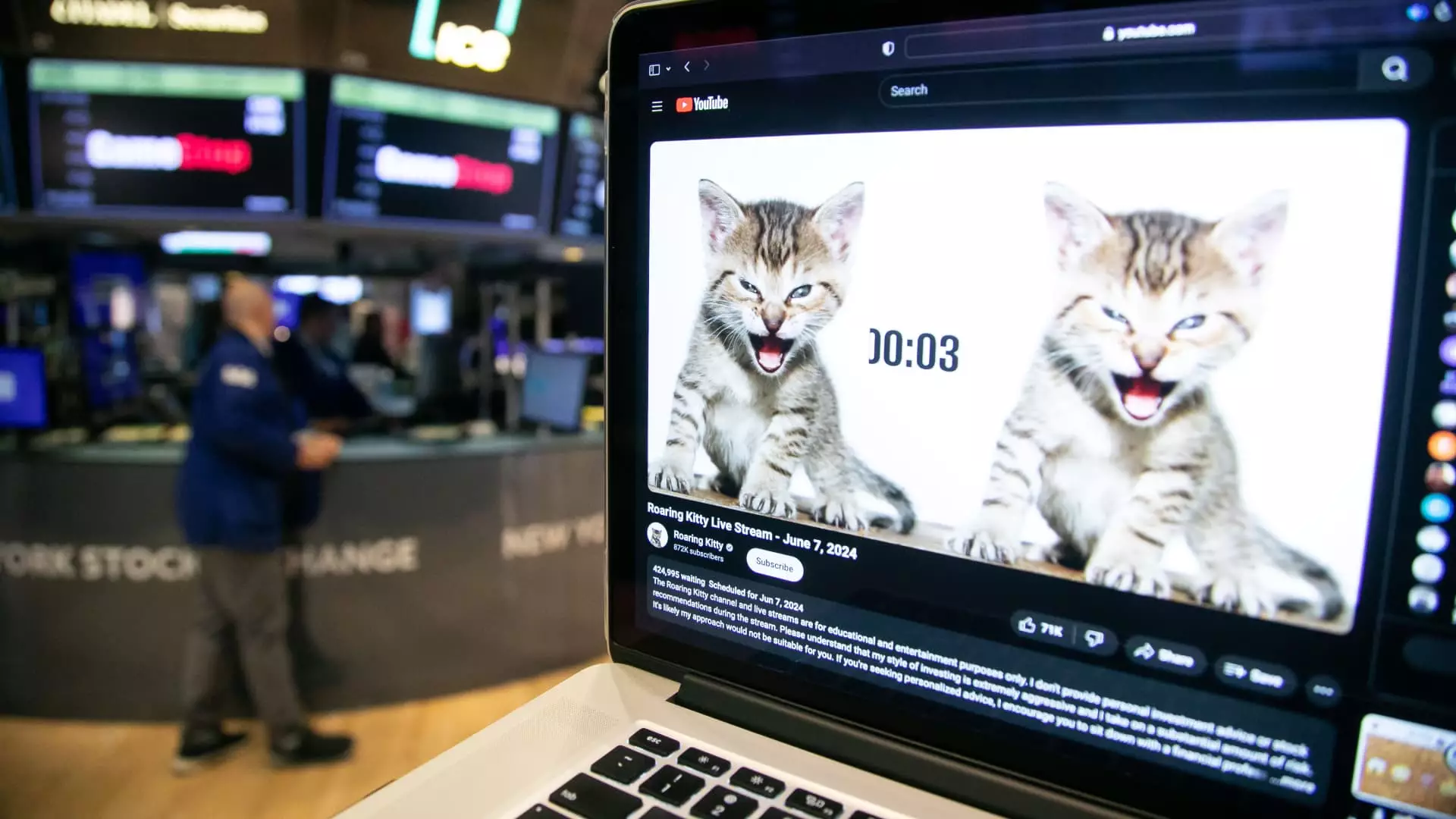

The sudden surge in trading activity raised questions about Roaring Kitty’s involvement in the market. While it remains unclear if Gill was behind the influx of volume, options traders suggested that he might be connected due to his substantial holdings of these contracts. Speculation began to circulate within the market about Gill’s potential actions regarding his call options. Traders speculated that Gill might need to sell his calls before the expiration date or roll over the position into another call option to avoid the need for a significant amount of cash to exercise them on June 21. The potential sale of Gill’s calls could have a considerable impact on GameStop’s stock price, which had Wall Street closely monitoring the situation.

For Gill to exercise his calls, he would have to come up with $240 million to acquire the stock, equivalent to 12 million shares purchased at $20 each. However, the public information available from his E-Trade account did not indicate that he had access to such a substantial sum. This raised concerns about how Gill would handle his options position and whether he would be able to fulfill the financial obligations associated with exercising the contracts. The uncertainty surrounding Gill’s actions added to the volatility in GameStop’s stock price, leaving investors on edge about the potential outcomes.

The market’s reaction to Roaring Kitty’s call options highlighted the interconnected nature of trading activities and their impact on stock prices. The speculation and uncertainty surrounding Gill’s position added an additional layer of complexity to an already volatile market environment. As investors continue to monitor the situation, the future trajectory of GameStop’s shares remains uncertain, reflecting the unpredictable nature of the financial markets.