As Wall Street navigates the current chaotic landscape, one is compelled to reflect on the erratic nature of our financial markets. Last week’s trading was emblematic of this volatility, reflecting a world where stability feels like a distant illusion. The key players, including the S&P 500, may have shown an impressive recovery, closing more than 5% higher, but lurking beneath the surface are signs of deepening instability stemming from the U.S.-China trade war. This turmoil has not just pulled the market into its maelstrom; it has sent ripples worldwide, casting doubt on a purported economic recovery.

It’s fascinating how investors painfully oscillate between optimism and fear, buoyed one moment by a hopeful White House statement and shaken the next by Beijing’s retaliation in the form of aggressive tariff hikes. With each headline, stocks rise and fall like a pendulum, causing most everyday investors to lose sight of the bigger picture: the trades we see in the wake of such news are often reactions driven by emotions rather than the underlying data.

The Stakeholders Behind the Numbers

When we delve into the dynamics of this week’s trading, corporations like Wells Fargo and BlackRock have emerged as points of analysis. Their earnings reports, while promising for some, have merely highlighted a broader uncertainty across the financial sector. Wells Fargo’s drop of 5% points to fundamental issues within the banking titan, while BlackRock’s rise of nearly 3% reveals a slight comfort in the marketplace—but is that enough to substantiate a sense of security?

The reality is, while Wall Street may celebrate short-term gains, the long-term outlook remains shrouded in doubt. How can we trust a market skewed by earnings that don’t necessarily align with potential growth, especially when sectors like finance are riddled with stagnant metrics? This inconsistency raises important questions about the sustainability of such gains.

The Technology Sector: A Double-Edged Sword

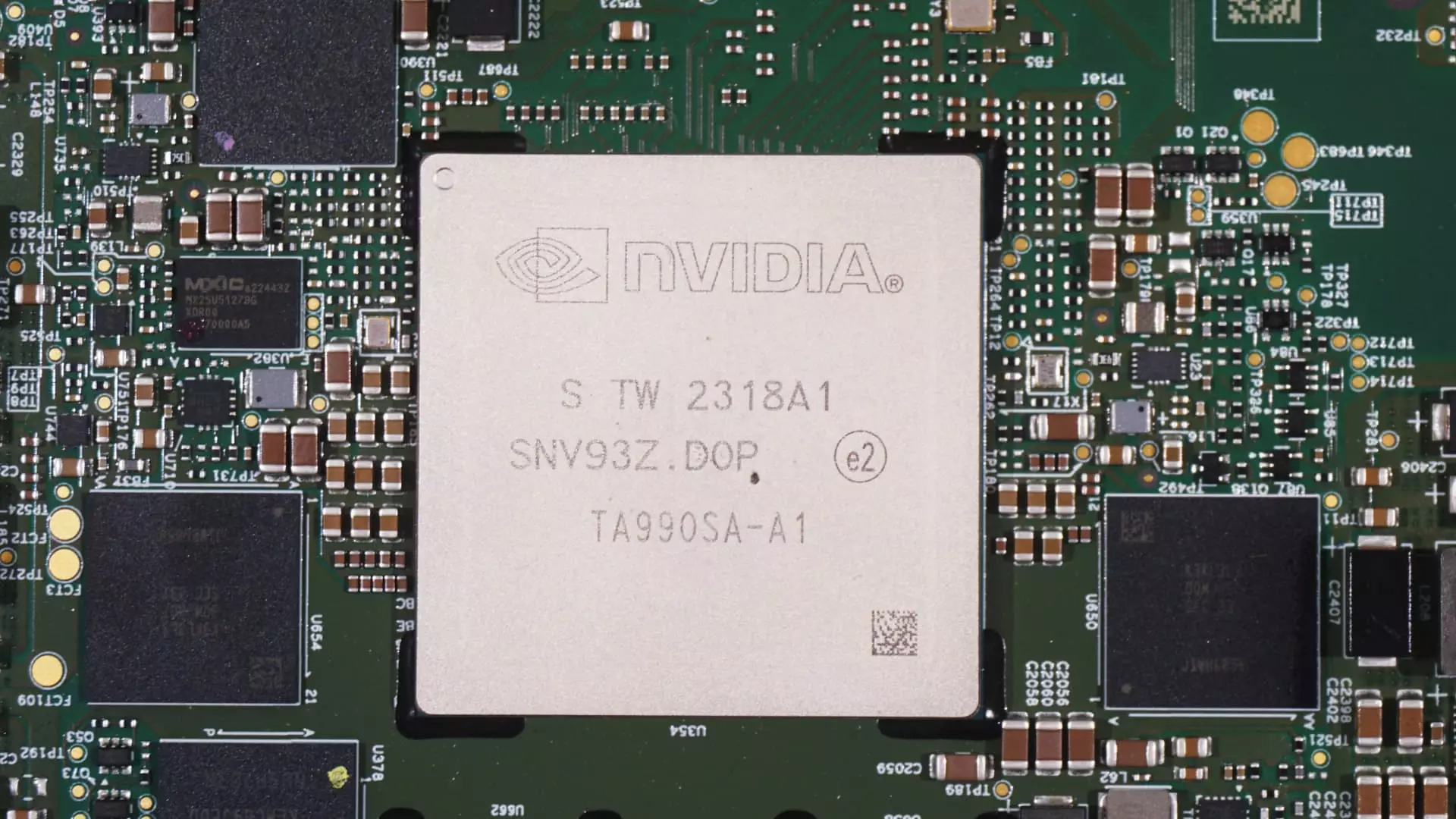

While stocks like Broadcom and Nvidia saw an extraordinary resurgence during the week, with Broadcom soaring 22% and Nvidia rising 17%, these numbers warrant skepticism rather than applause. The tech industry has been the bullseye for speculative activity, which is fraught with danger. Similarly, gains stemming from positive headlines can mask underlying volatility. For instance, burgeoning tensions between the U.S. and China pose a serious threat to the tech sector, which relies heavily on stable trade relationships.

The notion that companies like Broadcom could insulate themselves with stock buyback programs is a momentary bandage on a much larger wound. The market’s heave upwards in response to news of tariffs based on manufacturing locations rather than shipment points is a breath of relief, but it also highlights just how fragile this recovery is. We can’t overlook the caution with which we should interpret such rebounds, especially when the overarching geopolitical landscape is turbulent.

The Irony of Investor Sentiment

At the crux of this chaotic week is the contradicted investor sentiment. Analysts at Citigroup cutting their price target on Nvidia to $150 despite reiterating their buy rating does reflect a dual narrative: optimism for future growth while recognizing the threat of economic moderation. The decision of companies regarding capital expenditure suggests fear rather than a confident advance towards technological innovation. Yet, the marketplace often overlooks these undercurrents favoring a rally to celebrate ephemeral surges.

In this market, where neural pathways are often disengaged, the call for caution is not just prudent; it’s essential. Investors must resist the temptation of euphoric trading and delve into the realities of the economic landscape. Stronger correlations between markets and subtle signs of unrest could offer better insights into sustainable investment strategies, moving beyond blind trust in a volatile market narrative.

Navigating the Uncertain Road Ahead

Looking ahead, as first quarter earnings season continues, the economic winds could shift dramatically. The Bureau of Labor Statistics reports will offer a peek into the undercurrents of the U.S. economy, and the coming weeks may see reports indicating consumer spending trends that could either lift or sink the prevailing sentiment.

The question remains: can investors maintain a balanced perspective amidst all the noise? It is vital to scrutinize the narratives crafted by market speculators and media outlets, reconnecting with economic fundamentals and the broader state of the global economy.

As the fabric of our financial reality shakes, grappling with these complexities is imperative for a future marked by sustainable growth rather than fleeting victories marked by mere numbers on a trading screen.