On a pivotal Thursday, the Biden administration unveiled what it is heralding as its ultimate initiative to alleviate student debt burdens across the nation. This move aims to forgive over $600 million in loans for thousands of borrowers, representing a substantial victory for borrowers, particularly those who have been disproportionately impacted by systemic failures in the student loan system. The relief applies to approximately 4,550 individuals eligible through the Income-Based Repayment plan, alongside 4,100 ex-students of DeVry University, which has faced scrutiny for misleading claims about job placement rates. This strategic focus on specific institutions, especially a for-profit entity like DeVry, underscores the administration’s effort to hold educational institutions accountable.

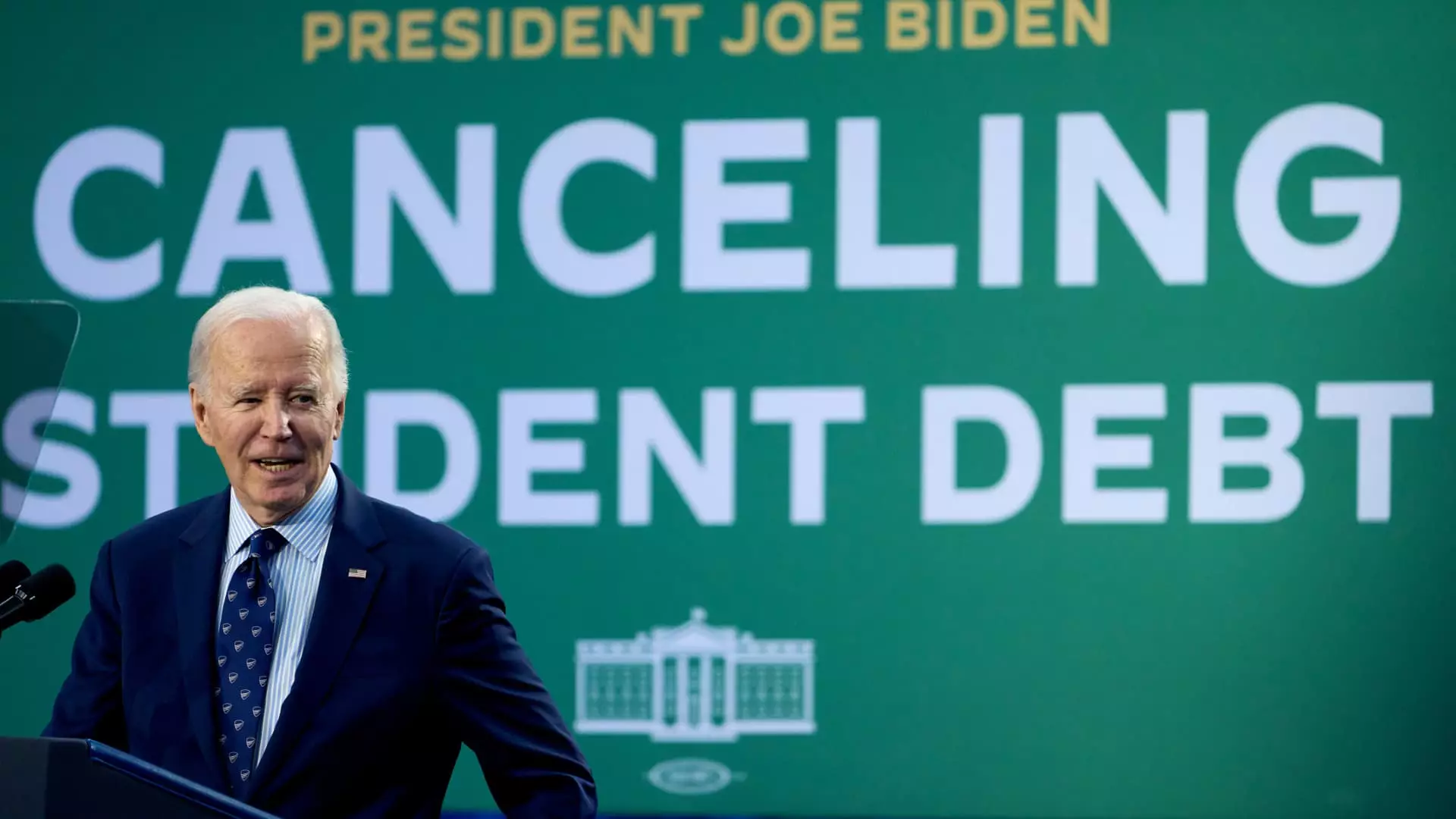

President Biden is now poised to leave office with a remarkable record, having forgiven a staggering $188.8 billion in student loans benefiting roughly 5.3 million borrowers. This accomplishment can be seen as a hallmark of his administration, signaling a distinct shift in federal policies governing student debt. Higher education expert Mark Kantrowitz referred to this moment as “the end of an era,” highlighting the unprecedented scale of relief granted during Biden’s tenure compared to all preceding presidents. Yet, it is essential to view this in a broader context—while a significant amount of debt has been forgiven, the Supreme Court’s blockage of a sweeping relief plan for millions illustrates the legal and political hurdles that continue to exist in discussions surrounding student debt reform.

Despite facing challenges, the Biden administration’s approach emphasizes incremental reforms over broad-based forgiveness. By refining existing debt relief programs, the Department of Education has endeavored to rectify past failures that ensnared borrowers in a cycle of mismanagement and confusion. U.S. Secretary of Education Miguel Cardona articulated this commitment to reform, stating that the team has “rolled up our sleeves” to bring real relief to those who have been wronged by their educational institutions. The implementation of accurate payment tracking for Income-Driven Repayment (IDR) plans represents a crucial step in creating a transparent and reliable system for borrowers seeking forgiveness after lengthy repayment periods.

As the Biden administration concludes its final initiatives on student loan relief, it is crucial to contemplate the future of student debt in America. Borrowers expect more than just forgiveness; they seek a comprehensive restructuring of the educational financing system that prevents future generations from facing similar dilemmas. Advocates have long voiced concerns that loan servicing mishaps and inadequate communications have hindered progress towards effective debt management. Therefore, while recent efforts are commendable, the administration’s legacy will inevitably depend on whether it can instigate lasting changes in the overarching framework of student financial aid.

To ensure the integrity of educational institutions in the future, the government must bolster its scrutiny of for-profit colleges and other institutions that misrepresent their value to students. The action taken against DeVry University represents an essential precedent for potential accountability measures across the sector. As we look ahead, the interplay between policy reform, institutional accountability, and borrower advocacy will determine the landscape of student loans and, by extension, the future of higher education in the United States. The administration’s final announcement of debt relief may not mark the end of student loan reform, but rather the beginning of a new chapter in the ongoing narrative of educational equity and accountability.