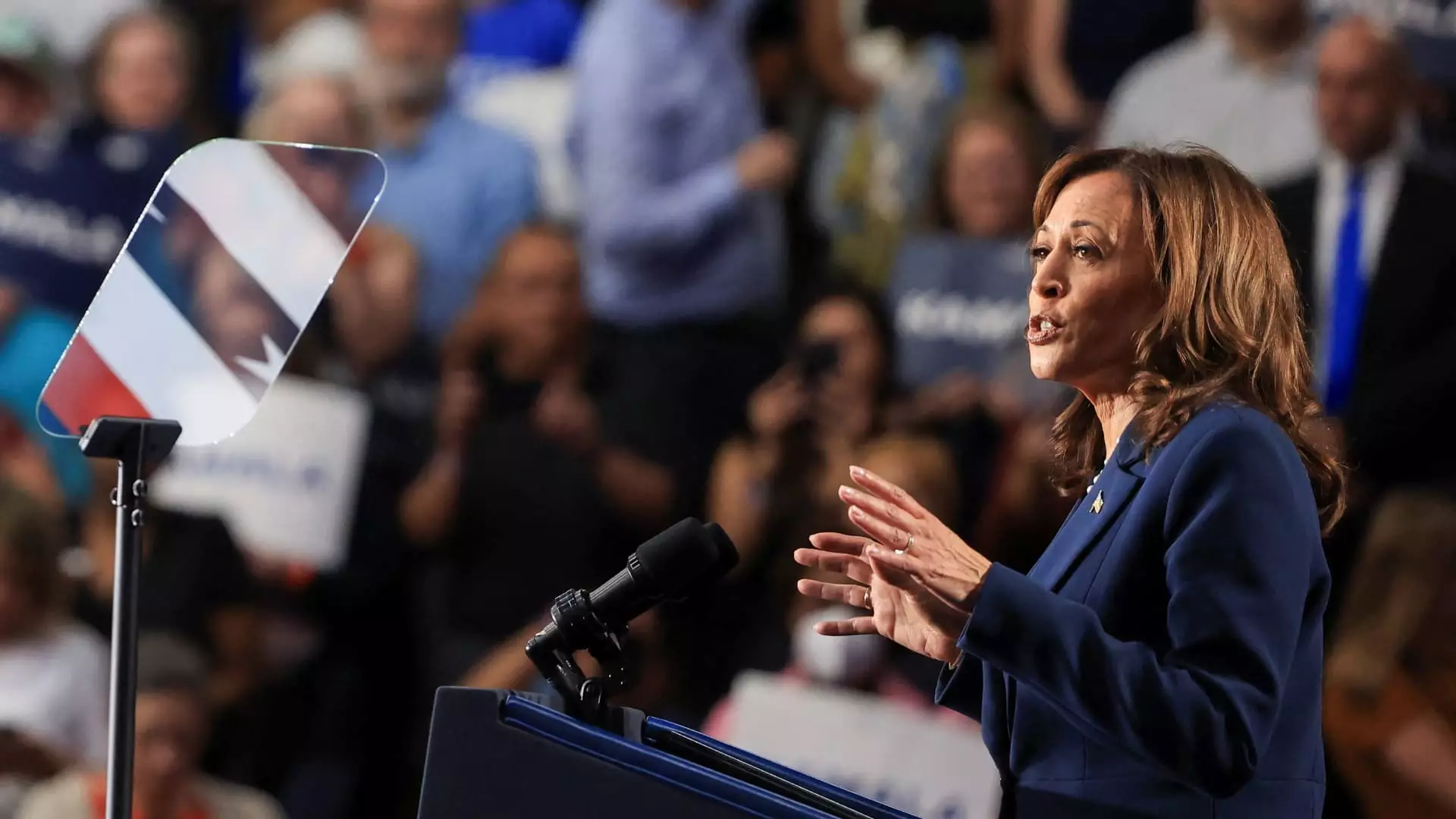

Vice President Kamala Harris recently outlined a compelling vision for her potential presidency during an event in West Allis, Wisconsin. Emphasizing the significance of a robust middle class, she declared, “Building up the middle class will be a defining goal of my presidency.” This statement marks a pivotal departure in her campaign strategy, positioning economic equity and the wealth gap as central tenets. In the evolving landscape of American politics, where economic disparities have reached alarming levels, her stance resonates with many who are feeling the pressure of inflation and stagnant wages.

Harris’ assertion reflects a long-held belief that a strong middle class is the backbone of American prosperity. At a time when many citizens grapple with financial insecurity, her commitment to elevating the economic status of working Americans speaks to a broader concern for economic sustainability. As she steps into the role of a frontrunner for the Democratic nomination, it is crucial to examine the effectiveness of her strategies for achieving this lofty goal.

At the heart of Harris’ economic plan is the LIFT the Middle Class Act, a proposal designed to provide significant tax credits for lower- and middle-income households. This initiative, initially introduced when she was a senator, promised up to $6,000 for eligible families. Advocates, including experts in economics, argue that such measures would deliver critical relief as living costs continue to rise.

Francesco D’Acunto, a finance expert at Georgetown University, pointed out that the LIFT Act could serve as a more effective form of assistance compared to the Biden administration’s proposed 5% rent cap—a policy that may inadvertently encourage landlords to withdraw properties from the rental market. The distinction is important; while rent caps might provide temporary relief, they can create distortions in the housing market that ultimately harm renters in the long run. Harris’ plan, conversely, seeks to bolster the financial well-being of renters directly through income support, thus addressing the root issue of affordability without adverse side effects.

The backdrop of rising inflation and economic uncertainty amplifies the need for such relief. According to economists like Tomas Philipson, many working-class families are experiencing stagnant or decreasing real incomes, making initiatives like the LIFT Act all the more pertinent. Amid fears regarding job security, especially with the increasing prevalence of technology such as artificial intelligence, the call for robust safety nets and tax benefits has gained urgency.

Laura Veldkamp, a professor of finance and economics, emphasized that as workers in numerous sectors face existential threats to their livelihoods, the government must consider innovative economic policies to promote stability. A universal tax credit could serve as a form of social insurance, helping families navigate these turbulent economic waters.

Despite the promise of the LIFT Act, its implementation is fraught with challenges, particularly in terms of funding. Past estimates from the Tax Policy Center highlighted the potential for substantial costs that would accompany the introduction of such a credit. Harris previously proposed that funding could come from repealing certain tax cuts imposed by the 2017 Tax Cuts and Jobs Act for higher earners, a move that may now face considerable resistance in the current political climate.

With pressures mounting on the federal budget deficit, and as critical tax cuts from the previous administration are set to expire soon, Harris may need to recalibrate her strategy to gain traction for the LIFT Act in a Congress that is increasingly cautious about new financial commitments.

Harris now finds herself at a crossroads: Should she push forward with the LIFT Act, or could she instead refocus efforts on expanding the child tax credit, which recently demonstrated considerable success in reducing child poverty rates during its temporary augmentation under the American Rescue Plan? The enhanced child tax credit led to a drastic decline in poverty rates, suggesting that expanding this benefit could yield immediate impacts for families.

Policymakers and analysts remain divided on whether prioritizing the LIFT Act or the child tax credit would be more advantageous for American families. Some argue that the complexities and costs associated with LIFT may diminish its prospects in favor of a more straightforward approach to enhancing child welfare.

As Harris continues to shape her campaign, the emphasis on fortifying the middle class is a bold and necessary focus in a time of economic fragility. Balancing between ambitious reforms like the LIFT Act and pressing issues such as child poverty will be crucial for gaining the support she needs. Ultimately, Harris’ vision, one rooted in equity and opportunity, reflects a responsiveness to the challenges faced by countless Americans, thereby positioning her as a formidable candidate in the upcoming Democratic primary. In a world where economic fortunes are increasingly polarized, algorithms of policy will need to work harmoniously to uplift those who are still struggling to thrive.