Aston Martin, the iconic sports carmaker, is poised to achieve a significant milestone this year as it expects to become cash-flow positive, according to Executive Chairman Lawrence Stroll. The company is at a transitional moment, with Stroll highlighting an inflection point that marks a turnaround in Aston Martin’s financial performance. After years of losses, the company is now introducing a lineup of new models, setting the stage for positive cash flow starting in the third quarter and beyond.

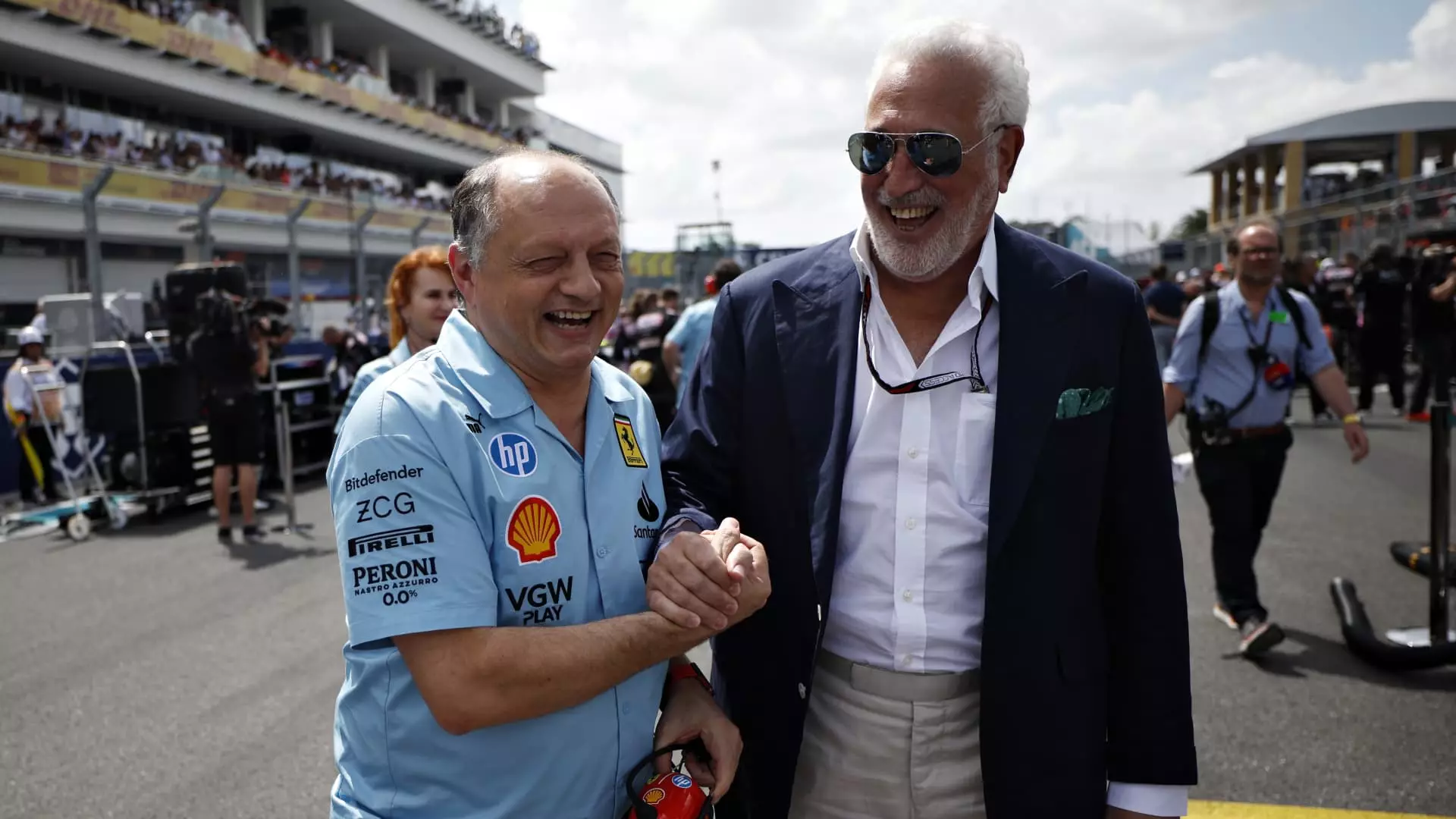

Stroll, a billionaire former fashion mogul, took over as Aston Martin’s executive chairman in 2020 and implemented a sweeping plan to revitalize the brand and drive profits. The company has made substantial improvements in manufacturing, bolstered its financials for future investments, and is now launching a range of high-performance and luxury vehicles. Despite facing production challenges and increased pre-tax losses in the first quarter, Aston Martin is strategically phasing out older models to make room for a new fleet of vehicles set to be introduced in the coming months.

Aston Martin’s new models include the powerful Vantage, a sleek sports car with 656 horsepower and a starting price of $191,000. The company has also unveiled the DBX707, a high-performance SUV capable of accelerating from 0 to 60 mph in 3.1 seconds and reaching top speeds of over 200 mph. Additionally, Aston Martin has introduced the open-topped DB12 Volante and teased an upcoming super-powered V-12 model, expected to be named Vanquish. The launch of the $800,000 hybrid supercar, Valhalla, is also on the horizon, with deliveries scheduled for the end of this year or early 2025.

Aston Martin is not only focusing on new models but also banking on continued growth through its personalization program. With the success of the “Q New York” showroom, where customers can customize their cars with unique paint colors, fabrics, and details, the company plans to open additional Q locations in London, Miami, and California. Customers are willing to pay premium prices for specialized personalization, with some even requesting fur in the interior. This customization trend has led to a 35% increase in the average sale price of an Aston Martin over the past two years, demonstrating the program’s success in attracting buyers.

Aston Martin’s presence in Formula 1, owned by Lawrence Stroll, has helped the company attract a younger demographic, with the average age of a customer now at 42 compared to 55 four years ago. The revitalization of the brand through Formula 1 and a new product portfolio has sparked renewed interest among consumers, reflecting positively on Aston Martin’s image and appeal to a broader audience.

Despite facing challenges such as production disruptions and increased losses, Aston Martin remains optimistic about the future. With a strong lineup of new models, a successful personalization program, and a growing customer base, the company is on track to achieve positive cash flow and drive profitability. As it continues to innovate and adapt to evolving consumer preferences, Aston Martin is poised for a successful transformation in the competitive luxury automotive market.