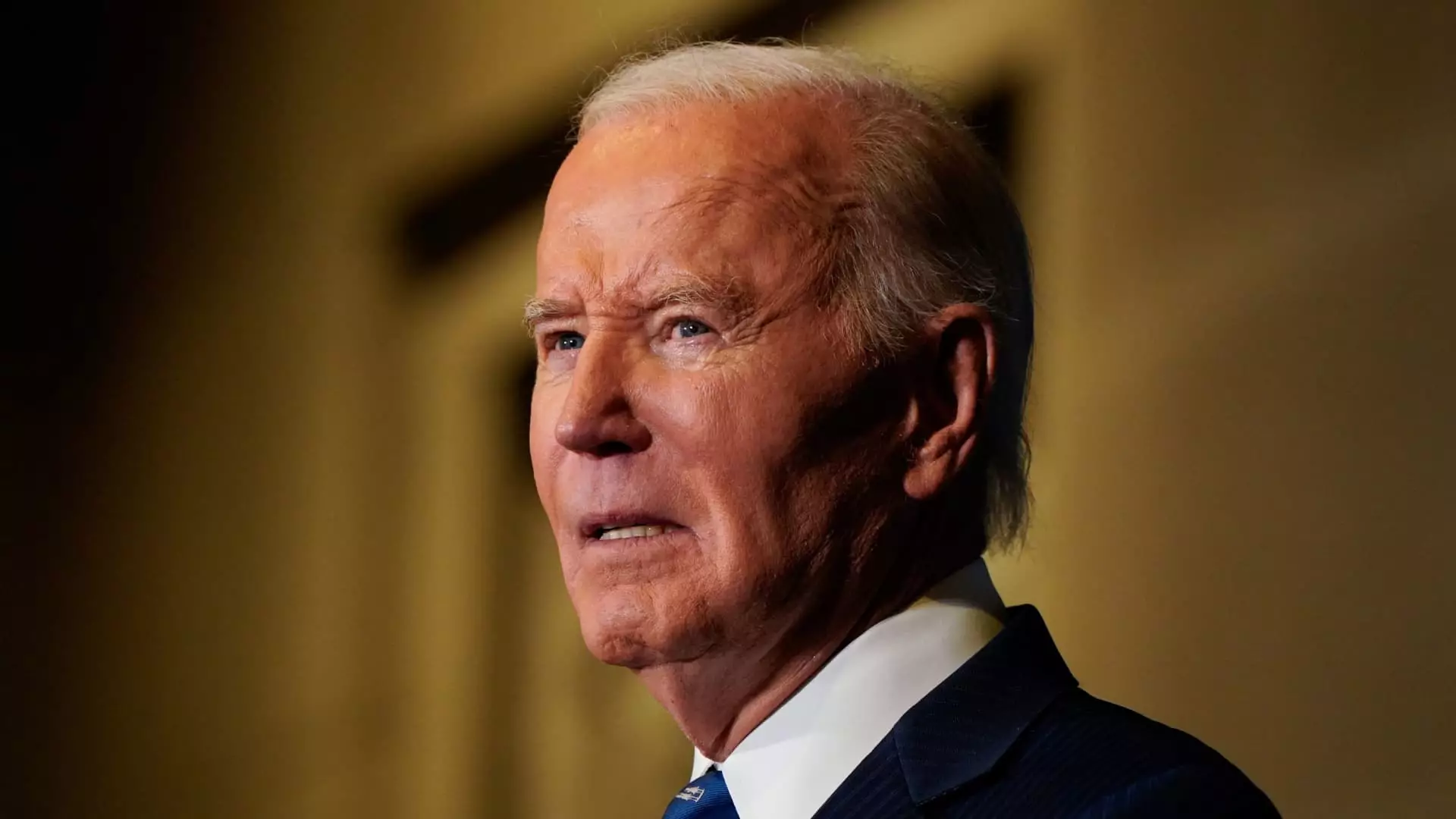

The Biden administration recently made headlines by withdrawing significant plans aimed at providing student loan forgiveness. These proposed regulations had the potential to ease the financial burdens of numerous borrowers who have been struggling with student loan debt for years. The plans would have authorized the Secretary of the U.S. Department of Education to cancel loans for various borrower groups, particularly for those in long-term repayment or facing substantial financial difficulties. The aim was ambitious: to alleviate the education debts affecting millions of Americans while addressing an ongoing student debt crisis.

As part of the withdrawal process, the Education Department announced its decision in the Federal Register just weeks before the transition of power to President-elect Donald Trump. The rationale behind halting the rulemaking was couched in terms of “operational challenges,” indicating that the administration felt it could not effectively implement the proposed policies in the limited time remaining. Instead, the Department of Education stated it would allocate its resources to assist borrowers who are at risk of falling behind on repayments.

The Implications of Policy Changes

The decision to scrap these forgiveness plans has significant implications for borrowers and the broader economy. Mark Kantrowitz, a recognized expert in higher education finance, argued that the Biden administration was aware its proposals would likely face opposition under Trump’s leadership—Trump himself having publicly denounced student loan forgiveness attempts, labeling them as “vile” and questioning their legality. Amidst this political backdrop, Biden’s plans emerged as a “Plan B” after the Supreme Court invalidated his initial approach to student loan relief earlier in 2023.

Consumer advocates voiced their discontent following the recent policy reversal. Persis Yu, a deputy executive director at the Student Borrower Protection Center, articulated the sentiments of many by stating that Biden’s proposals had the potential to liberate millions from the burdens of student debt. The ability to access debt relief would not only have provided immediate financial support but also offered a pathway for economic mobility among affected borrowers.

Furthermore, anxiety surrounding the future of educational debt continues to grow, amplified by the changing political climate. Elaine Rubin, director of corporate communications at Edvisors, highlighted the concerns regarding how the incoming administration’s policies might influence current and future borrowers. Many remain unsure about the prospective fate of their loans, living under the constant pressure of financial uncertainty.

Alternatives Still Available

Despite the withdrawal of the proposed regulations, the Education Department still maintains several loan forgiveness programs in place designed for specific borrower populations. Programs such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) continue to be available. PSLF, for instance, empowers eligible not-for-profit and government employees to erase their federal student loans after consistently making payments for a decade. Meanwhile, TLF offers loan relief up to $17,500 for educators who work in low-income schools over a designated period.

Moreover, the Biden administration recently announced a new initiative to forgive an additional $4.28 billion in student loan debt for approximately 54,900 public service workers through the PSLF program, showcasing that some relief is still being provided, albeit in a more limited capacity compared to the previously announced proposals.

For borrowers navigating the complexities of educational debt, the shifting political landscape adds layers of uncertainty. While immediate plans for sweeping loan forgiveness have been abandoned, various existing programs remain active. Organizations such as Studentaid.gov and the Institute of Student Loan Advisors continue to offer vital information and resources that can empower borrowers to explore available relief options.

As the narrative evolves around student loan policies, it becomes clear that the challenges of student debt will require persistent advocacy and a collaborative approach among policymakers, borrowers, and consumer advocates to ensure that effective solutions are realized moving forward. The road ahead may be fraught with obstacles, but the ongoing dialogue surrounding educational financial aid remains vital in shaping a more equitable future for borrowers.