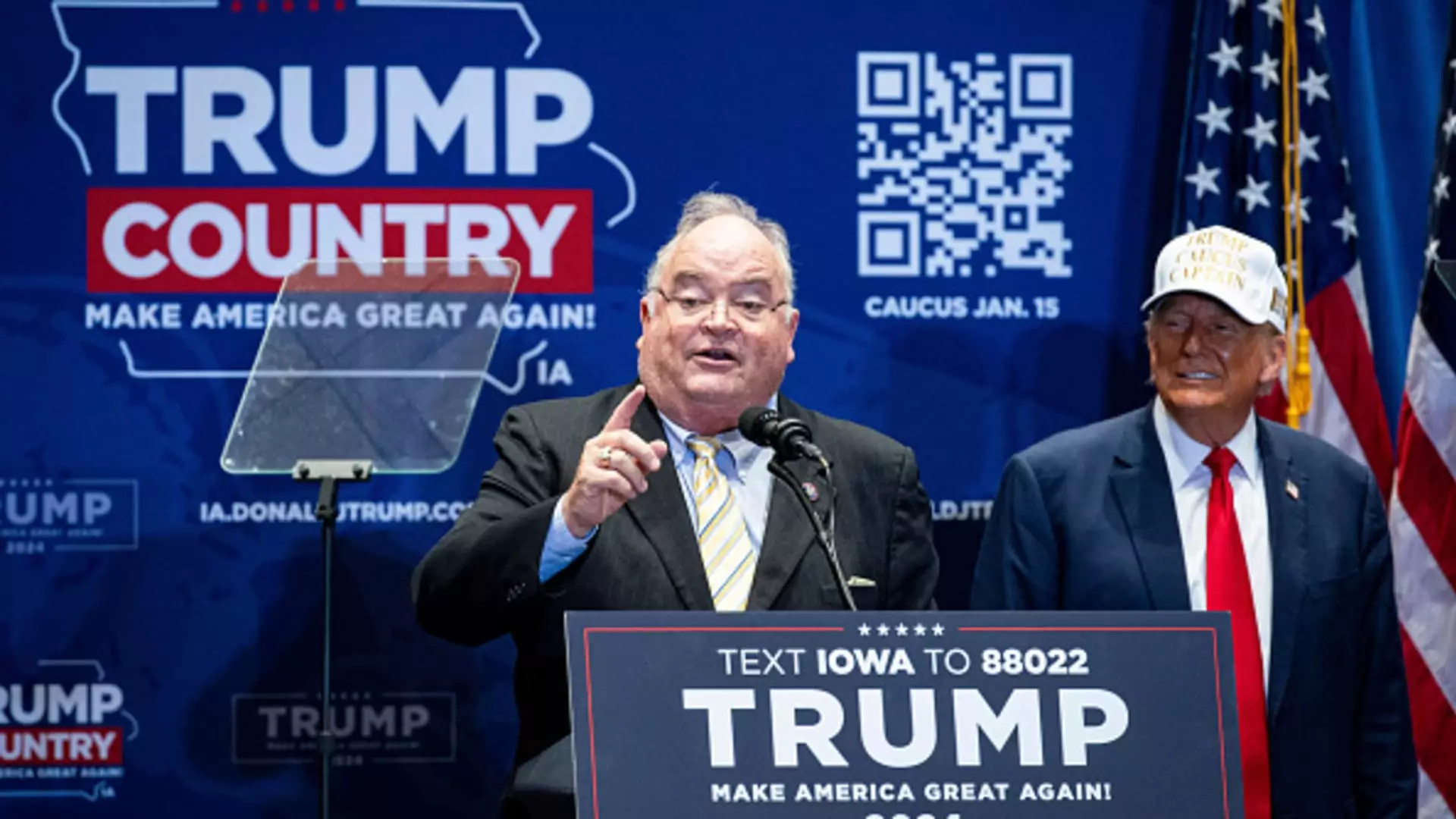

The announcement of Billy Long as President-elect Donald Trump’s nominee to lead the Internal Revenue Service (IRS) has ignited significant debate across political and professional circles. As the agency continues its ambitious overhaul supported by substantial congressional funding, Long’s potential influence on policy and strategy raises questions about the direction of the IRS during a transformative period.

Donald Trump’s appointment of Billy Long, a former congressman from Missouri, comes at a crucial juncture for the IRS. In recent years, the agency has been allocated nearly $80 billion for modernization, aimed at improving technology, customer service, and taxpayer compliance. This funding was a response to the growing complexities of tax compliance and enforcement. With a plan to enhance efficiency and expand oversight on wealthy taxpayers and corporations, the choice of Long is particularly striking given his limited traditional background in tax policy.

Long, who has shifted from a congressional role to working as a business and tax advisor, has been vocal about helping small businesses navigate IRS requirements. While this experience may lend him some credibility among taxpayers and business owners, it could also reflect a potential bias toward a segment of taxpayers that has its own set of concerns regarding IRS operations.

The potential ousting of current IRS Commissioner Daniel Werfel, appointed under President Joe Biden, signals a shift not only in leadership but in the ideological direction of the agency. Long’s appointment is seen as a significant move away from the previous administration’s strategies, particularly concerning enforcement initiatives aimed at high-income earners and complex corporate structures.

However, critics like Senate Finance Committee Chair Ron Wyden raise alarms about Long’s credentials. Wyden points to Long’s post-congressional career, specifically his involvement in the controversial Employee Retention Tax Credit (ERTC) claims, which have come under scrutiny for fraudulent applications. These accusations could undermine Long’s credibility and effectiveness at the IRS, especially as the agency seeks to restore public trust and enhance compliance.

The response to Long’s nomination has been predictably mixed along party lines. Republican senators, including Mike Crapo, express hopes that Long can address long-standing issues within the agency, such as security, taxpayer privacy, and operational inefficiencies. They talk of an “oversized emphasis” on enforcement that, according to them, detracts from the agency’s primary purpose of assisting taxpayers. This sentiment reflects a broader Republican skepticism of federal agencies perceived to be overreaching in their regulatory scope.

On the contrary, Democrats are cautious about the implications of Long’s past decisions and affiliations. Critics see his nomination as indicative of a troubling shift toward prioritizing the interests of certain business sectors over equitable tax enforcement. This reflects a growing concern that the IRS could become a tool for political agendas rather than a fair arbiter of tax compliance.

The implications of Long’s potential confirmation as IRS Commissioner are vast, particularly as the agency undertakes its multibillion-dollar reform initiative. If confirmed, Long will be tasked with not only navigating the complicated landscape of tax regulations but also restoring faith in an agency that some see as plagued by inefficiencies and biases.

His congressional experience might provide valuable insights into legislative negotiations; however, the challenge will be to balance this with a clear commitment to fairness and transparency. Ultimately, the effectiveness of Long’s leadership will hinge on his ability to forge alliances within Washington and rebuild trust with the public.

While there are supporters who view Billy Long’s nomination as an opportunity for meaningful change at the IRS, there are just as many who warn of the potential pitfalls. The future of the IRS hangs in the balance as the confirmation process unfolds, revealing much about the administration’s priorities regarding tax policy and governance.