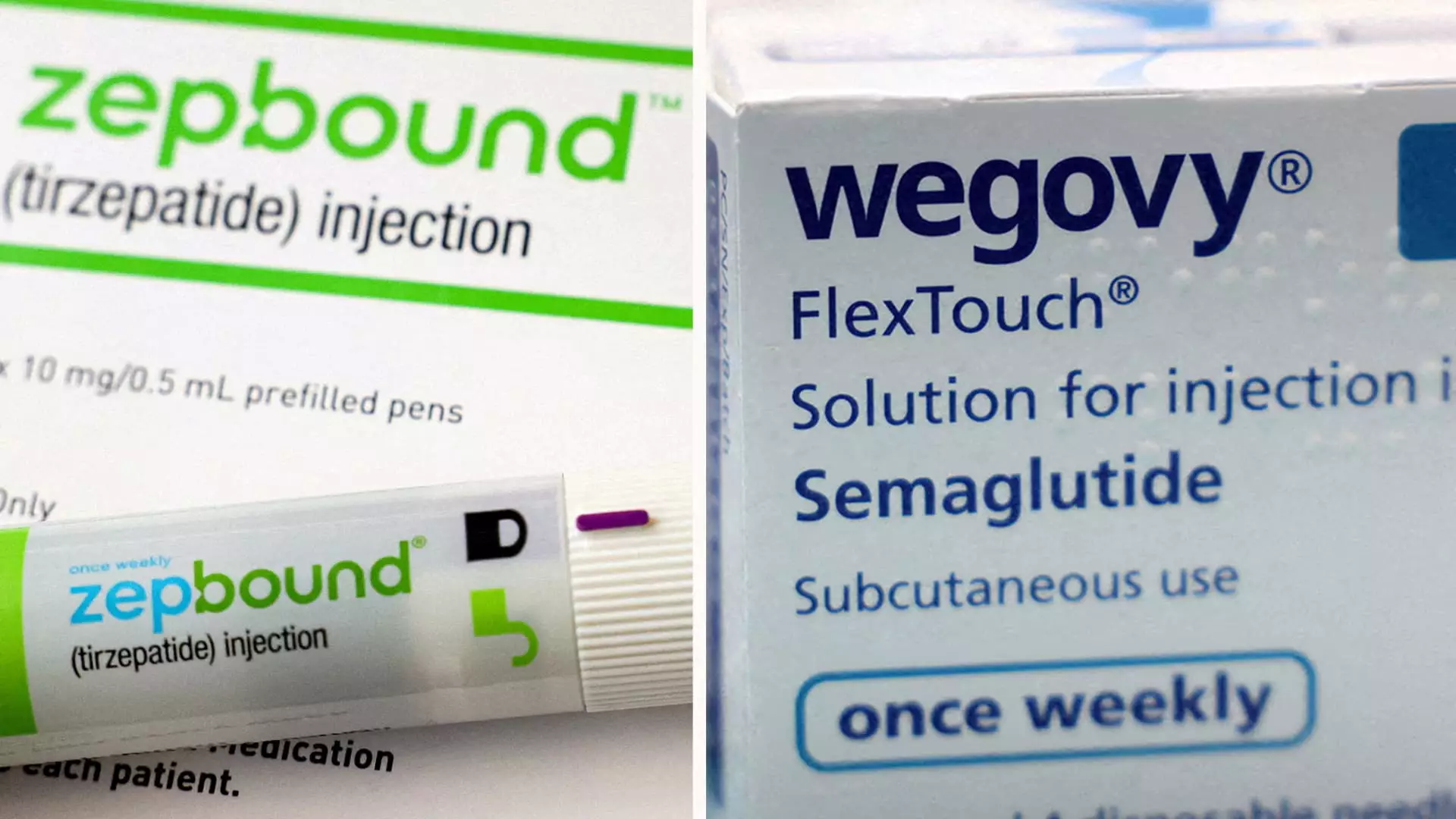

Weight management has been a significant health concern for countless individuals facing issues of obesity or simply wanting to lose excess weight. As the demand for effective obesity treatments continues to rise, Eli Lilly has introduced a game-changer in the form of Zepbound. As outlined in a recent unveiling, Zepbound has demonstrated remarkable efficacy in weight loss, surpassing its closest competitor, Novo Nordisk’s Wegovy, in head-to-head clinical trials. This article explores the implications of these findings within a broader healthcare context and examines how Zepbound could reshape the landscape for weight management therapies.

Eli Lilly’s announcement regarding the results of its initial phase three clinical trial is noteworthy. According to the data, patients treated with Zepbound experienced an average weight loss of 20.2% over 72 weeks, translating to about 50 pounds. In contrast, those treated with Wegovy lost an average of only 13.7% of their body weight, or around 33 pounds. This disparity suggests that Zepbound is not merely a marginal improvement over Wegovy; it could potentially redefine standards for effectiveness in obesity treatment.

The trial involved 751 participants who were randomly assigned to receive either drug, making its findings robust and statistically significant. Impressively, over 31% of the Zepbound group achieved a weight loss of at least 25% of their body weight, while this figure stood at a mere 16% for Wegovy users. Such performance metrics present Zepbound as a potentially more desirable option for individuals struggling to achieve meaningful weight loss, especially in the face of various obesity-related complications.

Both Zepbound and Wegovy operate on similar biological pathways but differ in their mechanisms. Zepbound interacts with two hormones linked to appetite and blood sugar regulation—GIP and GLP-1—enhancing its effectiveness. This dual approach could provide a more comprehensive metabolic impact compared to Wegovy, which primarily focuses on GLP-1 alone. Researchers and healthcare providers are increasingly intrigued by this mechanism, as it may offer better outcomes for patients who are unresponsive to existing treatments.

The market for weight-loss drugs is poised for significant growth, expected to reach valuations around $150 billion annually by the early 2030s. Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy are at the forefront of this burgeoning sector, yet they are not without competitors. PwC’s forecasts suggest that while Wegovy has carved out a sizeable share of the market since its debut two years earlier, Zepbound could eclipse it in annual sales, with projections estimating Zepbound could generate $27.2 billion in revenue by 2030 compared to Wegovy’s $18.7 billion.

Despite the promising commercial potential, challenges remain. The recent surge in demand for these obesity treatments has strained production capacities, leading both companies to invest heavily in their manufacturing capabilities. Although recent updates from the FDA have proclaimed a stabilization of supply for both medications, the issue of insurance coverage for these treatments continues to pose a significant barrier to access for many patients who need them.

The advent of Zepbound, with its promising weight loss results, offers a renewed sense of hope for millions battling obesity and associated health conditions. As Eli Lilly continues to analyze and publish their findings, the broader healthcare community is watching closely to see how this new treatment can be integrated into patient care. With obesity prevalence rising globally, the significance of having effective treatment options cannot be overstated. Zepbound not only provides a potential advantage for Eli Lilly in securing a greater market share but could also become a vital tool in the fight against obesity, ultimately improving health outcomes for countless individuals.

In this new arena of weight management therapies, Zepbound has emerged not just as a contender, but as a potential leader, promising to change lives one injection at a time.