As Nvidia prepares to deliver its fiscal third-quarter earnings report, due Wednesday after market hours, industry stakeholders are brimming with anticipation. According to consensus estimates from LSEG, analysts predict Nvidia will report revenues of approximately $33.16 billion and earnings per share (EPS) of 75 cents, adjusted. However, these figures represent just the tip of the iceberg regarding investor focus; the true crux lies in Nvidia’s outlook for the future.

Investors are scrutinizing this earnings call not merely for numbers but for a glimpse into Nvidia’s capacity to sustain its incredible growth trajectory amid the ongoing AI revolution that is now in its third year. The bar is set even higher, with Wall Street forecasting an EPS of 82 cents alongside projected sales of $37.08 billion for the upcoming quarter. The heartbeat of this optimistic outlook is Nvidia’s newly launched AI chip, Blackwell, which is central to the company’s strategy for maintaining its competitive edge in an increasingly crowded market.

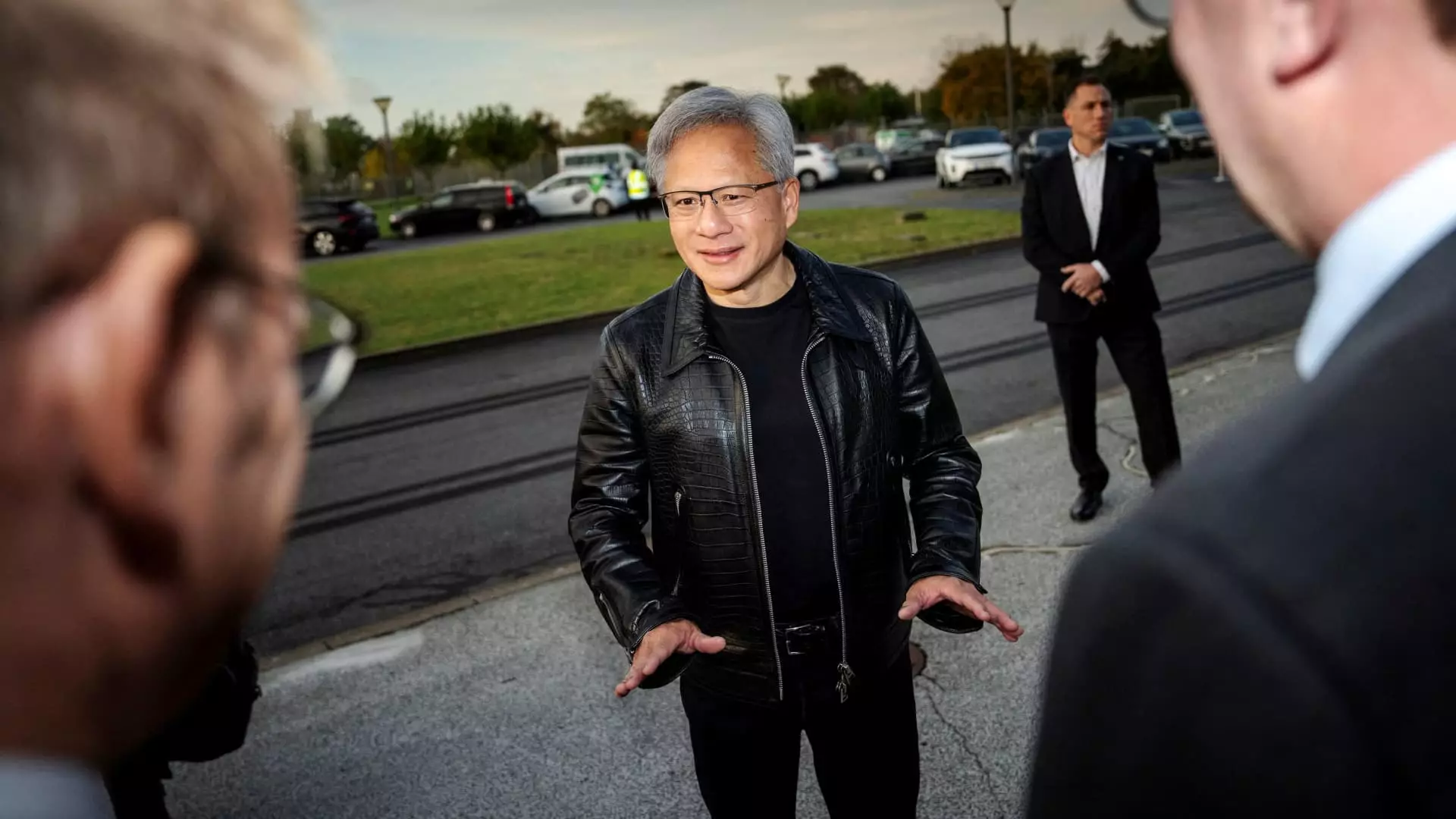

The Blackwell chip is touted as a game-changer for data centers and is already being shipped to major tech giants like Microsoft, Google, and Oracle. Given the intense demand for AI technologies, analysts are particularly keen to hear from Nvidia’s CEO, Jensen Huang, about the demand trends related to this next-generation chip. His statements during the earnings call could provide critical insights into whether Nvidia’s growth can truly withstand the pressures of increasing competition and potential technical setbacks.

Interestingly, Nvidia also faces challenges regarding the performance of the Blackwell systems, notably overheating issues that some clients have reported. Transparency on these matters will be essential in building and maintaining investor confidence. It’s crucial for the company to reassure stakeholders that it can not only resolve these technical issues but also capitalize on the burgeoning demand for AI solutions in data centers.

The company’s prior performance showcases impressive yet fluctuating growth rates. While Nvidia recorded a staggering 122% year-over-year sales growth in the most recent quarter, this does mark a decline compared to the remarkable 262% growth reported earlier in the year. The slowdown may prompt skepticism around whether the company can sustain its rapid expansion or if the market for its products is merely experiencing a temporary phase of adjustment.

Despite these fluctuations, Nvidia’s stock performance has been enviable, having nearly tripled since the beginning of 2024. This bullish trend can largely be attributed to the rising consensus that large-scale AI implementations are here to stay. Nevertheless, investors must remain vigilant, balancing optimism with caution as they digest the implications of Nvidia’s upcoming earnings report and forecasts.

In summation, as Nvidia steps into this critical earnings report, the stakes are higher than ever. The dichotomy of robust revenue potential against the backdrop of challenges surrounding product performance creates a complex narrative. Investors will be keenly watching not just for the numbers but for the broader context within which Nvidia operates. With the future of AI and data centers under the spotlight, all eyes will be on Nvidia to see if it can maintain its position as a leader in the industry.