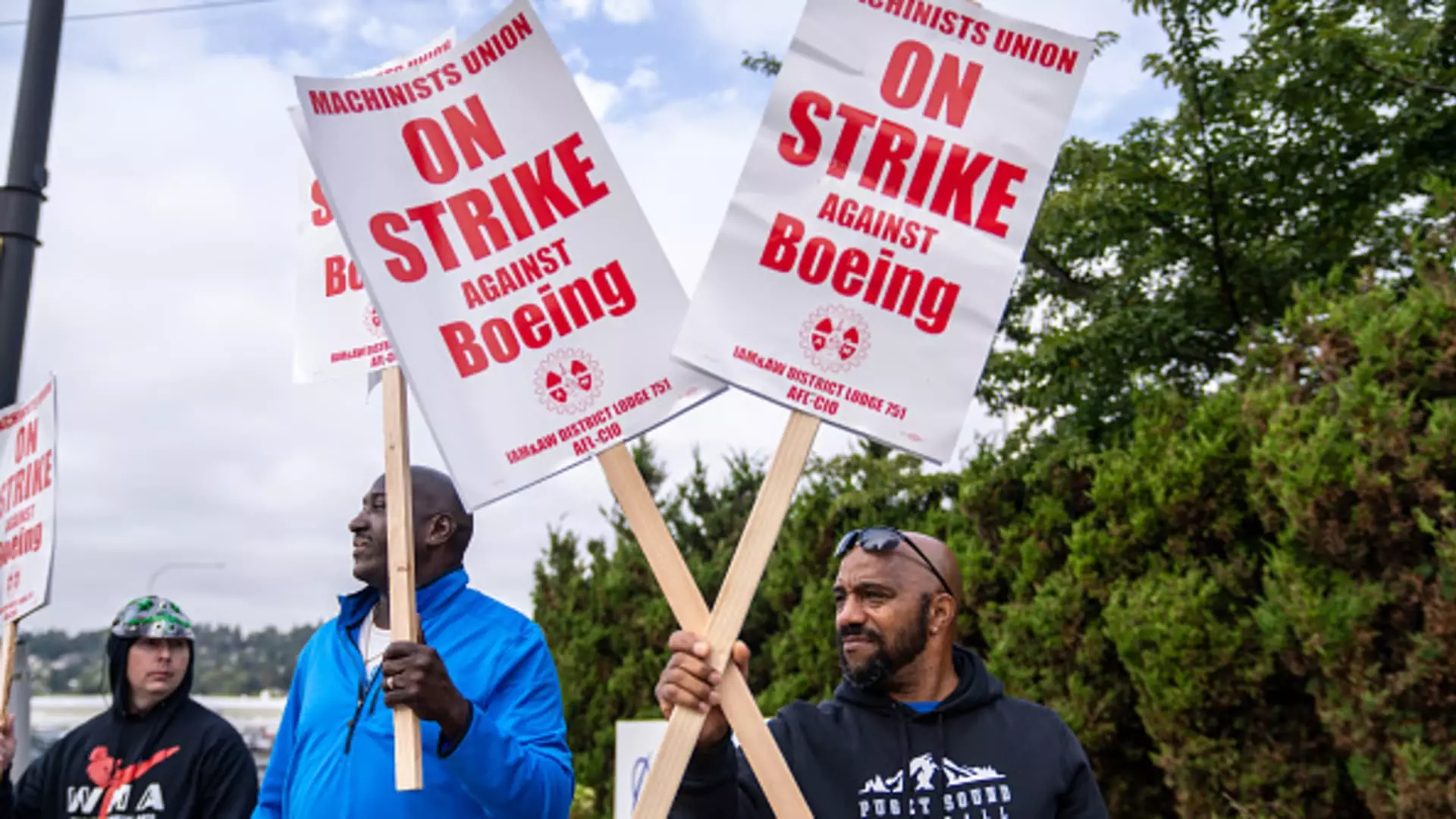

Just over a month has passed since Boeing machinists, numbering more than 30,000, initiated a strike that was sparked by an overwhelmingly negative response to a proposed contract. The resultant work stoppage has exacerbated existing pressures on Boeing, especially for its new CEO, Kelly Ortberg. He took the reins during a tumultuous time, charged with addressing a myriad of challenges that the aircraft manufacturing giant has faced in recent years. The current labor disruption is not just a strike; it symbolizes a deeper crisis that has been boiling over since the first of two devastating crashes involving the 737 Max, which have ensnared Boeing in a web of reputational damage.

The ongoing strike is costing Boeing an estimated $1 billion per month, a staggering figure that highlights the financial ramifications of the dispute. As production at critical Seattle-area facilities has come to a halt, the striking machinists have not only impacted Boeing’s bottom line but also increased the already mounting tensions between labor and management. The company’s recent decision to withdraw a revised contract offer, previously rejected by union leaders, showcases a decline in communication and negotiation efficacy.

Harry Katz, a labor relations expert, foresees that in order to settle the impasse, Boeing will have to enhance its offer significantly. Yet, complications arise from the union’s demands, among which is a significant push for a reinstatement of pension plans. This particular demand may not easily see resolution, yet it acts as a banner for the workers’ broader grievances regarding employment terms and conditions. Recent negotiations have seen a downturn; mediators intended to facilitate discussions have faltered, leaving both sides at an arduous stalemate.

As tensions heat up, Boeing has taken a combative stance, filing a charge with the National Labor Relations Board claiming the union is engaging in bad faith negotiations. This accusation represents a drastic shift in Boeing’s approach, reflecting deeper issues in labor relations culture at the company. The union’s president, Jon Holden, openly called for a return to dialogue, signaling that the key to resolving the conflict lies in constructive negotiations rather than threats or stratagems aimed at intimidation.

Impacts on Employees

The labor dispute has not only created financial strain for the company but has also drastically affected the lives of thousands of workers who have lost their paychecks and the crucial company-backed health insurance since late September. However, unlike past strikes, the job market in the Seattle area includes a variety of contract work opportunities that could help alleviate some of the financial burdens faced by the striking employees.

The ambiance surrounding the current situation starkly contrasts the events of the 2008 strike, where workers found themselves with fewer job alternatives. As workers explore temporary job opportunities posted on union boards ranging from food delivery to warehouse positions, the resilience of the workforce reflects a commitment not just to their jobs at Boeing, but to their financial futures amid uncertainty.

Boeing’s Response to Financial Pressures

In the face of shrinking revenues, Ortberg has announced an impending workforce reduction of roughly 10%, targeting various levels of the company’s hierarchy, from executives to line workers. This decision, combined with the halting of production on several aircraft models, represents Boeing’s bleak financial landscape. The delay of the 777X and the impending cessation of commercial 767 freighter production highlight the severity of the operational difficulties the company now faces.

Furthermore, with recent projections indicating a significant per-share loss for the third quarter and added charges amounting to $5 billion for both commercial and defense segments, Ortberg’s leadership is under scrutiny. Investors are notably restless; the company has not seen annual profits since 2018, and the forecast of a steep 42% decline in shares this year underscores a worrying trend.

Analysts express skepticism toward Boeing’s claims that stabilizing 737 production will rectify financial woes. Richard Aboulafia suggests that, ironically, the strategy of laying off personnel—who could be vital for achieving production equilibrium—is counterproductive. The pressure on Ortberg to improve Boeing’s financial outlook and operational status is immense, as he faces an inevitable earnings call that will illuminate the company’s current distress.

As Boeing grapples with the dual challenges of labor unrest and financial instability, the future remains uncertain. With S&P Global Ratings cautioning that the company’s credit is at risk of being downgraded, a potential equity raise may loom for Boeing. The ongoing labor strike adds another layer of complexity to a situation already rife with challenges, posing critical questions about the company’s ability to recover from this fallout and return to innovation and productivity in a fiercely competitive market.