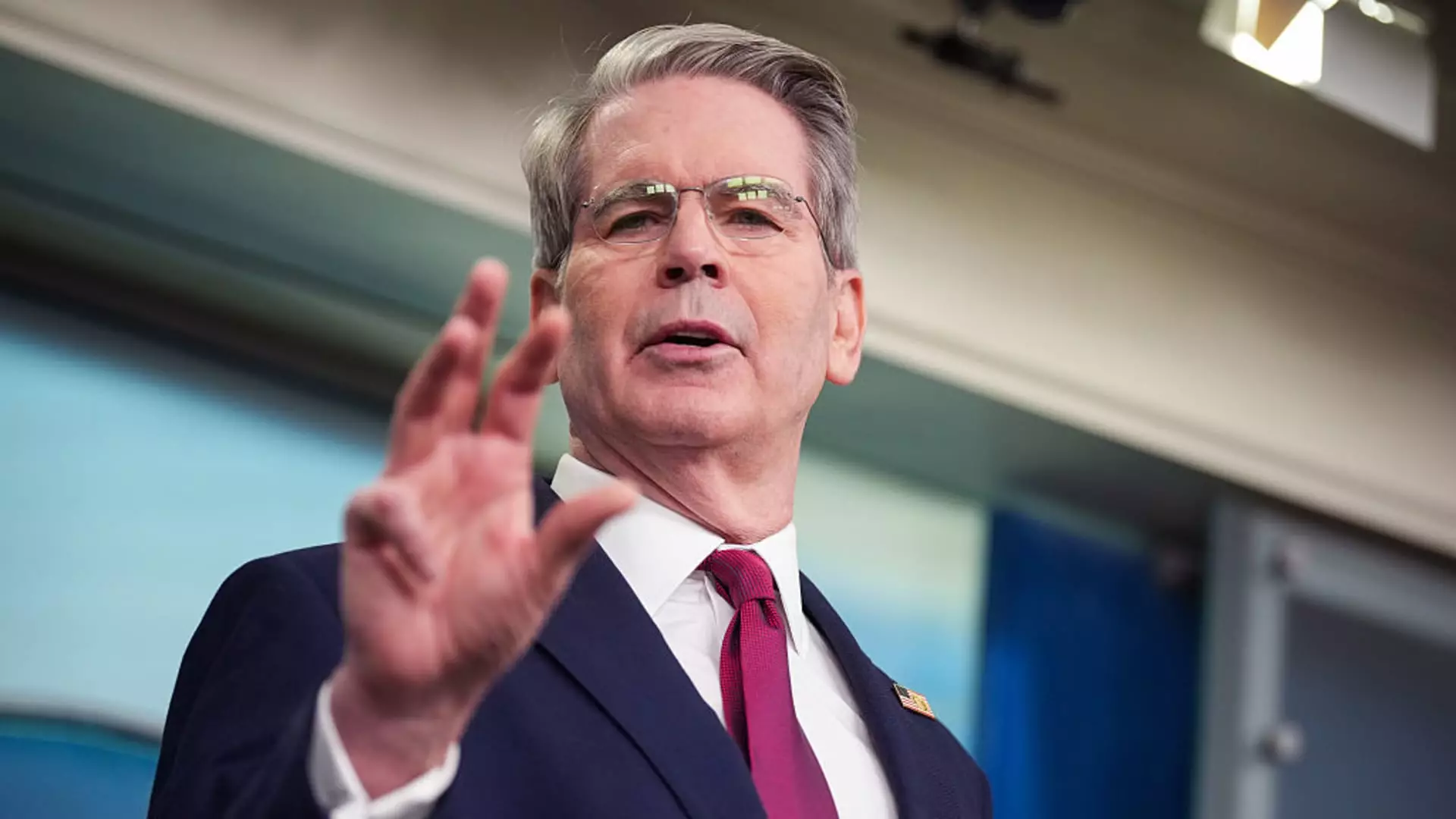

In a surprising revelation, Treasury Secretary Scott Bessent asserts that individual investors are displaying remarkable staunchness amidst market chaos, drawing an ambitious line of confidence in President Donald Trump’s controversial tariff strategy. This staunch loyalty stands in stark contrast to the palpable anxiety radiating from institutional investors, who are seemingly prepared to abandon ship in the face of looming economic pressures. Bessent’s assertion that “individual investors trust President Trump” suggests a disconnect between the average investor’s sentiment and the high-stakes motives of larger financial entities. With 97% of Americans reportedly refraining from trading over the past 100 days, as stated by Vanguard, the question arises: Are these retail investors exercising prudent patience, or are they stuck in the grip of misguided optimism?

The Dangers of Complacency amid Turmoil

With Trump’s aggressive tariff policies leading to the most significant sell-off of equities since the pandemic’s inception, alarm bells are ringing on Wall Street. The S&P 500, having flirted with a bear market territory, paints a troubling picture of an economy at risk. Yet, despite the dismal statistics, retail investors seem undeterred, diving headlong into the market as they seize opportunities presented by declining stock prices. But one must wonder whether this bold strategy mirrors genuine belief or is merely an expression of a delayed reaction to economic reality.

Bessent’s commentary, juxtaposed with insights from hedge fund executives, indicates an unsettling schism in how economic indicators are perceived. While individual investors appear to wear blinders, clinging respectably but perhaps naively to Trump’s assurances, institutional players have turned bearish, foreseeing troubling repercussions. As consumers begin to experience the tangible fallout from steep tariffs—such as price increases and availability issues—will that previous trust in leadership withstand the impending strain on their pocketbooks?

Potential Recession and Its Repercussions

The worry doesn’t end with civil attitudes toward presidential policy. Renowned economist Torsten Slok warns of impending recessionary shadows as the summer looms ahead. His forecast hinges on the notion that trade-related shortages will soon permeate grocery aisles, straining the economic fabric of everyday Americans. Detractors of the tariff strategy argue that it may not only dampen consumer spirit but also substantially tarnish the U.S.’s economy and its international standing.

Ken Griffin, Citadel’s head honcho, remarkably echoes these concerns, emphasizing that Trump’s combative approach to global trade might detract from the historical allure of U.S. Treasury securities. The potential branding crisis that could emerge under this administration raises urgent questions about the long-term ramifications of such a strategy. As the once-stalwart individual investors cling to their beliefs, they may soon find themselves facing the harsh realities of market-driven changes, perhaps learning that blind fealty to leadership can cloud judgment.

The Balance of Belief and Reality

The collective psychology of individual investors, characterized by unwavering support for Trump, showcases both the strength and fragility of American faith in leadership. This steadfastness raises critical considerations about the nature of investor confidence—does it stem from realistic economic analysis or blind hope masked as belief? The interplay between individual investor behavior and institutional response reveals a landscape where perceptions might soon clash with economic realities, leading to potential repercussions far beyond Wall Street. As the sentiment evolves, the looming question remains: how long can this bubble of optimism persist in the face of encroaching economic adversity?