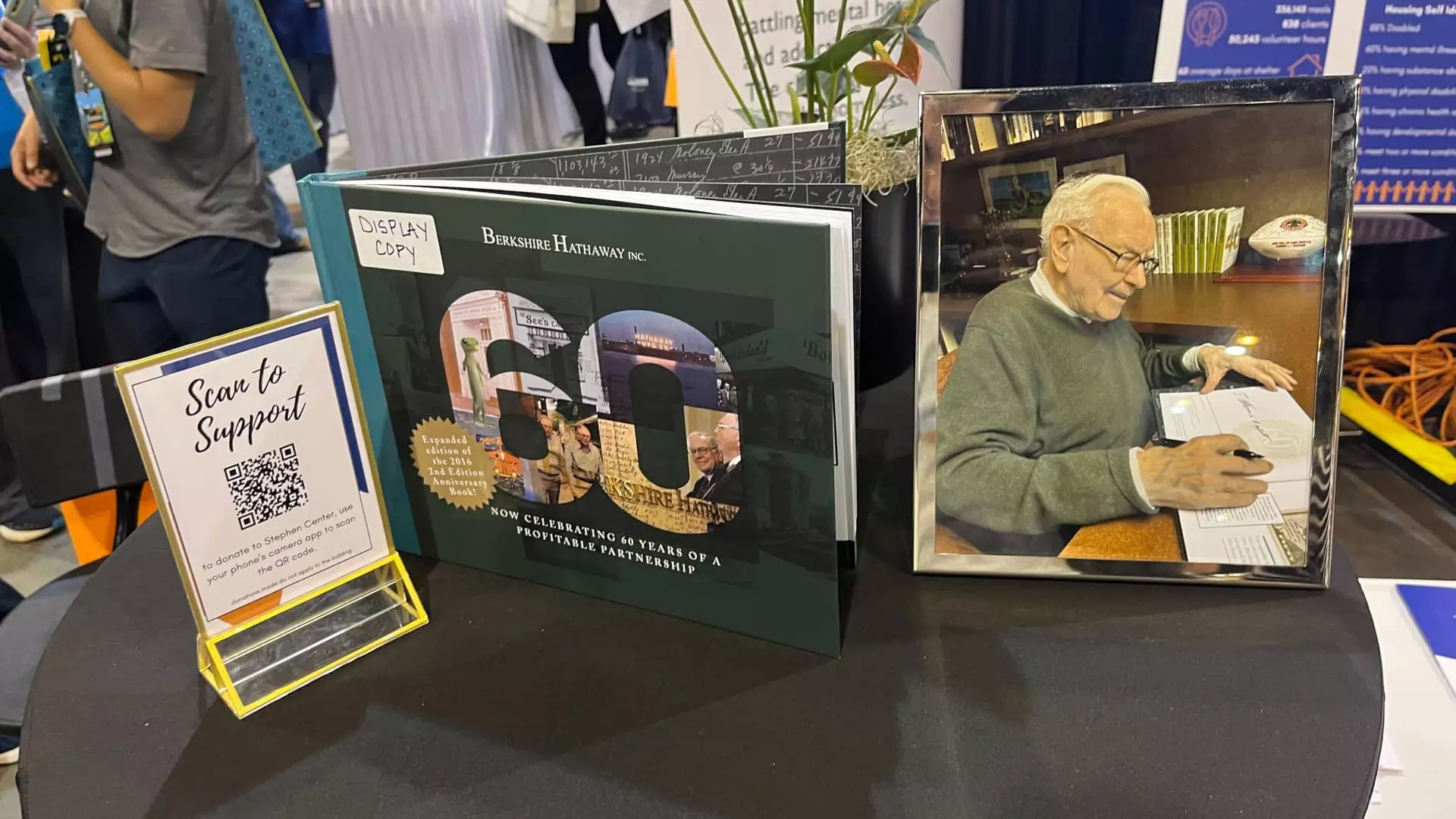

In a remarkable display of compassion and community spirit, the recent Berkshire Hathaway annual meeting revealed the profound impact of Warren Buffett’s philanthropic endeavors. Omaha, Nebraska, witnessed an extraordinary convergence of shareholders and philanthropists eager to capitalize on memorabilia from Buffett himself, raising a phenomenal total of over $1.3 million for local charity. This annual occasion, which combines financial acumen and selflessness, was driven by the rare opportunity to bid on signed copies of a special anniversary book, “60 Years of Berkshire Hathaway.” But what made this gathering even more significant were the unexpected turns and revelations that underscored the billionaire’s commitment to charitable causes.

When attendees gathered, the atmosphere was electric. It wasn’t merely a financial conference; it served as an emotional catalyst igniting goodwill among shareholders. Owning a piece of history, especially when it comes with Buffett’s signature, ignited a fervor that had individuals bidding tens of thousands of dollars just for the chance to possess such a treasure. The stakes? Beyond mere acquisition, they symbolized an investment in a local organization, the Stephen Center, which provides shelter and addiction recovery services. Buffett’s match of every dollar raised intensified the bidding frenzy, turning traditional auction dynamics into a robust fundraiser aimed at addressing homelessness and addiction in the community.

The Art of Bidding: A Community Engaged

The auction unfolded in two phases, both online and on-site at the meeting. Attendees were treated to a thrilling competition to secure the limited signed editions of the book. The online auction saw bids climbing as high as $100,000, a testament to Buffett’s cult-like following. But the in-person auction proved even more competitive. With multiple bidders jostling for the prized editions, the gathering turned the act of bidding into a shared experience of unity, creating a collective enthusiasm that went beyond mere monetary transactions.

Matthew Rodriguez, a 43-year-old local real estate professional and self-proclaimed “fan boy” of Buffett, exemplified the spirit of the auction. His $50,000 bid was not just a financial transaction—it represented a personal commitment to an organization that provides critical support to vulnerable populations. Rodriguez’s excitement wasn’t solely about owning a piece of Buffalo-related memorabilia; it also reflected a deep sense of belonging and connection to Omaha and its community-focused initiatives. Interestingly, this local engagement highlighted Buffett’s influence not only as a business titan but also as a community leader who inspires his shareholders to give back.

Philanthropy—A Core Berkshire Value

The importance of philanthropy at the Berkshire Hathaway annual meeting is emblematic of Buffett’s lifetime commitment to charitable giving. For over two decades, he has engaged in auctions to support various causes, generating enormous sums for those in need. With his heart firmly rooted in the welfare of those less fortunate, Buffett does not just speak about giving; he acts. His recent engagement further proves that charitable giving is not a side endeavor for Bradford but rather a core tenet of Berkshire’s identity.

Buffett’s reverence for simplicity, paired with substantial financial literacy, allows his philanthropic impact to resonate deeply in the communities he cares about. By orchestrating fundraising initiatives, such as those benefiting the Stephen Center, Buffett emphasizes that wealth can be a means for greater social good, steering the discussion away from accumulating family wealth dynasties to advocating for direct communal benefits.

Moreover, the revelations during the meeting—most notably Buffett’s announcement of his upcoming retirement—added an emotional layer to the events. A legacy built over sixty years was not just a corporate milestone but also a potent reminder of the moral responsibility that accompanies great fortune. For attendees, it invoked reflection about what these two moments—the auction and the retirement—entail for both Buffett and Berkshire Hathaway moving forward.

A Call for Social Responsibility

The funds raised will directly impact crucial initiatives, such as renovating addiction recovery facilities and developing a women’s and children’s shelter. These funds reflect a pressing need, especially as Omaha faces an increasing homeless population, which has risen nearly 10% according to reported statistics. As the socio-economic climate grows more tumultuous, initiatives like these are vital for those who may feel forgotten.

The engagement of shareholders, like Jay Ji—who experienced hardship first-hand—illustrated a reawakening of social responsibility amongst the wealthiest. Winning a bid at around $20,150 to support the Stephen Center wasn’t merely about the acquisition for Ji; instead, it manifested as a rallying cry to prevent other families from enduring the same struggles he faced in childhood. This empathy is what Buffett has inspired over decades—a collective consciousness that wealth is a tool for change rather than an endpoint for personal gain.

Buffett’s actions serve as a beacon for those in positions of influence. His message rings clear: lasting wealth should come with a moral obligation to uplift those in need. This philosophy should reverberate throughout the world of finance and business, steering future generations towards embracing a culture of giving, ultimately enriching the very fabric of society.